Note: From 1st July 2020 to the 30th of June 2023, the ATO allowed businesses to claim the full cost of an asset in the year it was purchased. Learn more about temporary full expensing.

Let’s get straight to business: depreciation is confusing. Not just because it can involve a lot of spreadsheets and schedules and maths, but also because there are a few different ways to do it, depending on your needs.

On top of this, the Australian Taxation Office (bless their hearts) have changed depreciation rules more than a few times over the past decade. This was done to help businesses save time and money, especially during the pandemic – but now there’s more to know, and more to stay on top of.

The good news is that for sole traders and small businesses (who have an aggregated turnover of less than $10million), the ATO has created an easy-ish way to depreciate assets, using “simplified depreciation rules”.

So without further ado, let’s crack on. Here is everything you need to know about assets, depreciation, and claiming depreciation as a sole trader.

What are assets?

In financial accounting, an asset is a resource owned or controlled by a business that should provide future benefits. This includes physical things like laptops, vehicles, furniture, and the coffee machine that fuels you through mind-numbing client meetings. But it also includes intangible things like intellectual property, logos, licences, and films.

If you’re a sole trader, and you buy an asset for less than $20,000, it can be claimed as an expense. If it’s over $20k, it can no longer be claimed as an expense – instead, the ATO will (usually) only allow you to claim the asset’s depreciation.

💡 Like with all expenses, if your asset is purchased for both business and personal use, you can only claim the business portion of the depreciation.

📖 For more on how business expenses and tax deductions work, check out our monster guide to tax deductions.

What is depreciation?

Depreciation is the reduction in value of an asset over its effective life, usually due to wear and tear. For example, if you buy a brand-new car for $40k and then use it for a few years before selling it, it will usually only be worth a chunk of what you originally paid for it. This drop in price is the depreciation.

Why depreciate assets?

Hang on, we hear you say. If full expensing is possible (like under the temporary full expensing rules), why is depreciating assets even a thing?

For the ATO

From the ATO’s point of view, it’s a no-brainer – without depreciation rules, they’d soon run out of money.

To explain why, let’s say that one year, every Aussie tradie decides to buy a brand-new electric ute (and they potentially should). If they all claimed the full expense of their vehicles in their tax returns, the ATO would lose millions in potential revenue due to the sheer size of the resulting tax deductions.

For you

From a business perspective, depreciation is mostly about accuracy.

Assets held by a business (or a sole trader!) can be quite costly to acquire. By claiming the depreciation of an asset over a series of years, you spread out the tax benefit across the asset’s working life. Doing it this way is more reflective of the way you’d use a costly asset.

Say you buy a ute as part of your plumbing business. You wouldn’t just use that ute for one year, and then get rid of it! Instead, you’d use it for several years – and claiming the depreciation reflects the value the ute has as part of your business.

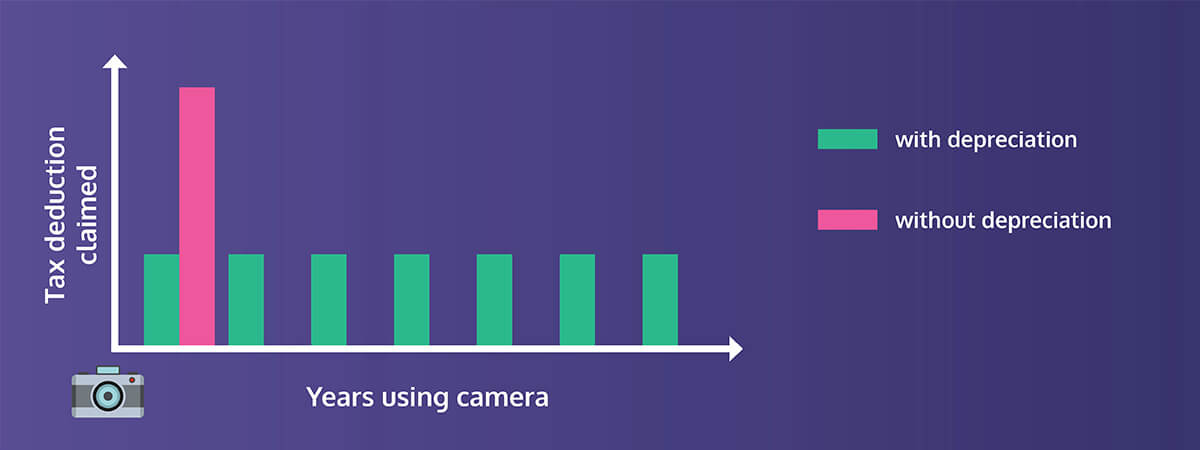

If Keith claims the full cost of his new camera in a single year, his taxable income for that year would be lowered by the full $22,650. But the next year, he would have nothing left to claim, leaving him with a heftier tax bill than the year before.

If Keith claims depreciation at $2000 a year over 11ish years, he gets a steady tax deduction every year, instead of all in one go. His tax bill will be lower for 11 years – and he’ll still be using the camera by the time all the depreciation is claimed.

How to calculate asset depreciation

So, you’ve decided you have to depreciate your assets. Great! Most sole traders use the ATO’s simplified depreciation rules to claim depreciation.

Simplified depreciation

As its name suggests, simplified depreciation is an easy way for sole traders and small businesses to calculate and claim depreciation. You can use this method if your business has an annual turnover of less than $10 million (from 2016 onwards). Here’s how it works:

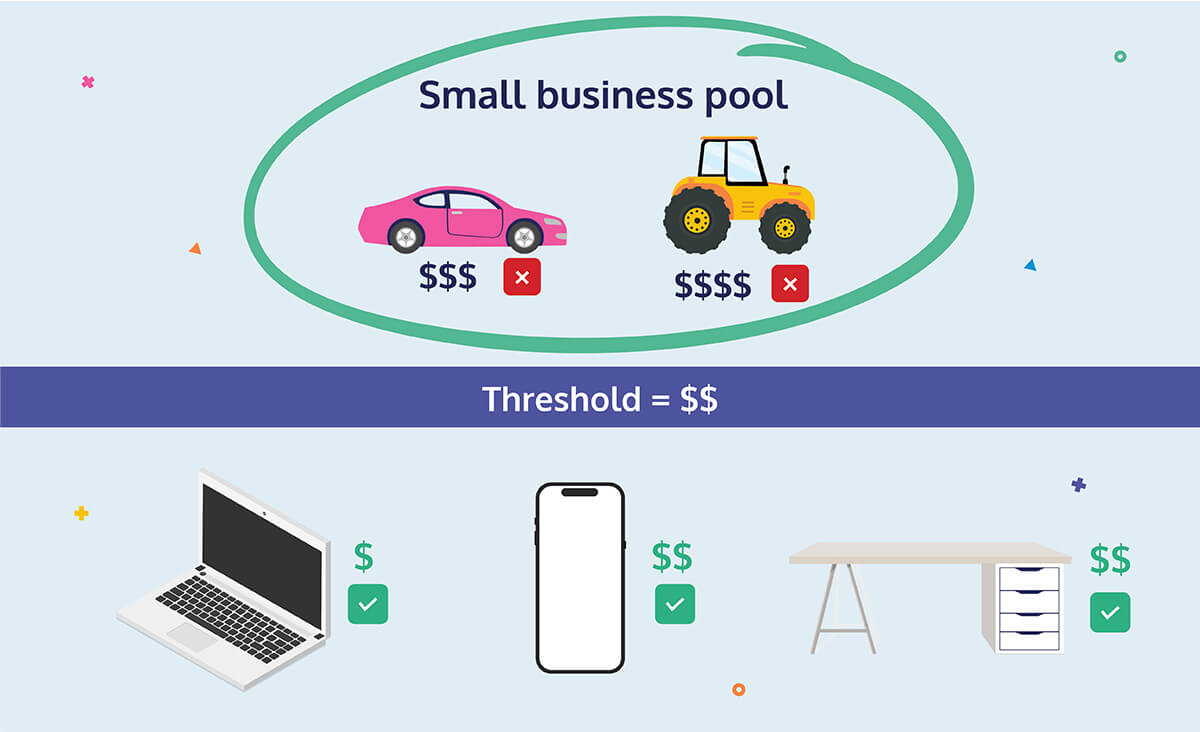

1. Under simplified depreciation, your assets are split into two categories: those worth more than the instant write-off threshold (set by the ATO, currently $20,000 for the 2024/25 financial year), and those worth less.

2. The cost of all assets under the threshold can be claimed immediately and in full.

3. The cost of all assets above the threshold are pooled together into an aptly-named small business pool.

4. You can then claim depreciation on this small business pool at a rate of 15% for the first year, and 30% for every year after that.

5. Once the value of your small business pool drops lower than the instant write-off threshold, it can be claimed in full.

Of course, like a lot of tax concepts, it is a bit more complicated than that.

Firstly, like all other business expenses, you can only claim the business usage of an asset. This is fairly straightforward for assets under the cost threshold, but for those in the pool, it gets a little tricky – especially if your business usage changes year on year.

You can get the party started yourself though. For every asset you add to the pool, you’ll need to calculate your business usage of that asset, and add the business use percentage of the asset to the pool.

But if your business usage of your pooled assets changes the next year, we recommend getting in touch with your tax agent (like the Hnry team!). They’ll be able to help you calculate the change in usage, and the right amount to claim in depreciation.

In November 2023, she bought a Dodge Dart limousine for a bargain $65k, along with a 2011 Mercedes-Benz CLC-class for $29,990.

The Dodge limo was for 100% business use, so the full $65k is added to Samera’s small business pool.

But she likes driving the Mercedes-Benz so much that she decides to use it 50% for work, 50% as her own personal vehicle. Because of this, she adds half the value of the Merc – $14,995 – to her business pool.

For a few years, the business/personal usage of her vehicles doesn’t change. But one year, three of Samera’s cousins get married (not to each other). Samera decides to let them use the limo to drive to all their various wedding-related events.

That year, Samera’s business usage for her limo changed from 100% business to 75% business, 25% personal. She now needs to change the depreciation amount of the limo in her small business pool.

Samera enlists the Hnry team to help her make the calculations, and the resulting changes. As a thank you, she sends them some of the wedding cake.

Temporary full expensing (no longer valid for assets purchased after 30th June, 2023)

If you bought an asset between 7 October 2020, and 30 June 2023, you may be eligible for temporary full expensing.

Temporary full expensing does exactly what it says on the tin: As a response to the financial pressures of the pandemic, the ATO temporarily let sole traders and small businesses claim the full expense of a business asset in the year it was purchased.

To be eligible for temporary full expensing, you needed to:

- have bought, first held, or installed your asset between 7 October 2020 and 30 June 2023,

- have a business turnover of less than 5 billion (oh my),

- or less than 50 million in the case of second-hand assets.

In July 2021, business is booming – so much so that Carly decides to invest in a larger, more fit-to-purpose van. It cost $8,000 all up, including the installation of sections to keep quieter dogs separated from the more boisterous ones during the van ride.

When Carly lodged her 2021-22 tax return, she claimed the full cost of the van under temporary full expensing.

Ditch the maths by using Hnry

We know we just taught you how to DIY depreciation – but we still think you should just use Hnry instead.

Hnry is an award-winning service designed specifically for sole traders. For just 1%+GST of your self-employed income (capped at $1,500+GST annually), we will become your tax agent. This means we will:

- Do all the depreciation stuff for you automatically (!!).

- Calculate, deduct, and pay all your taxes every time you get paid

- Lodge your tax return at the end of the year

- Claim expenses in real time, so you can immediately pay less in taxes

- Chase late-paying clients (politely!), so you get paid faster

Basically, we’re an accountant in an app. And we’re on a mission to free up sole traders from the heavy burden of tax and financial admin.

If this sounds good to you, join Hnry today! And you’ll never have to read another article like this one again.

Share on: