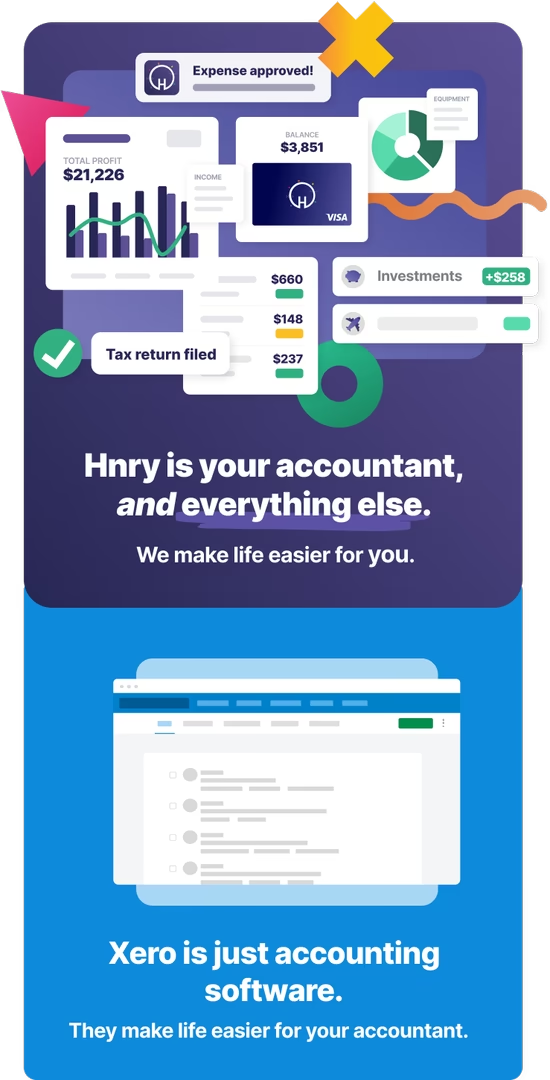

Why choose Hnry?

Your taxes and expenses automated

We automatically calculate and pay your taxes from your Hnry Account, so you’re always up-to-date and know what’s in your pocket is yours to keep. Plus the Hnry Debit Card automates all your expenses, to lower your tax rate as you spend.

An accountant with your software

We become your accountant; that means we lodge your returns (even BAS), manage your expenses as you go (to minimise your tax bill), and our team of sole trader tax experts (specialised in your industry) are there if you need a hand.

A suite of features - at no extra cost!

You get a bunch of features for all your business needs, like expenses, unlimited invoices and quotes, multiple payment options and more.

Designed for sole traders

We’re Australasia’s largest specialised sole trader accounting service and have tailored our service specifically to their needs - there’s nothing else like us.

Your taxes and expenses automated

We automatically calculate and pay your taxes from your Hnry Account, so you’re always up-to-date and know what’s in your pocket is yours to keep. Plus the Hnry Debit Card automates all your expenses, to lower your tax rate as you spend.

An accountant with your software

We become your accountant; that means we lodge your returns (even BAS), manage your expenses as you go (to minimise your tax bill), and our team of sole trader tax experts (specialised in your industry) are there if you need a hand.

A suite of features - at no extra cost!

You get a bunch of features for all your business needs, like expenses, unlimited invoices and quotes, multiple payment options and more.

Designed for sole traders

We’re Australasia’s largest specialised sole trader accounting service and have tailored our service specifically to their needs - there’s nothing else like us.