If you’re a sole trader running your own show, there’s a good chance superannuation is sitting at the bottom of your to-do list.

That’s probably because you’re wearing all the hats in your business and doing all the things. You’re too busy managing the day-to-day to think about the faraway future you.

But what’s going to happen when you actually retire?

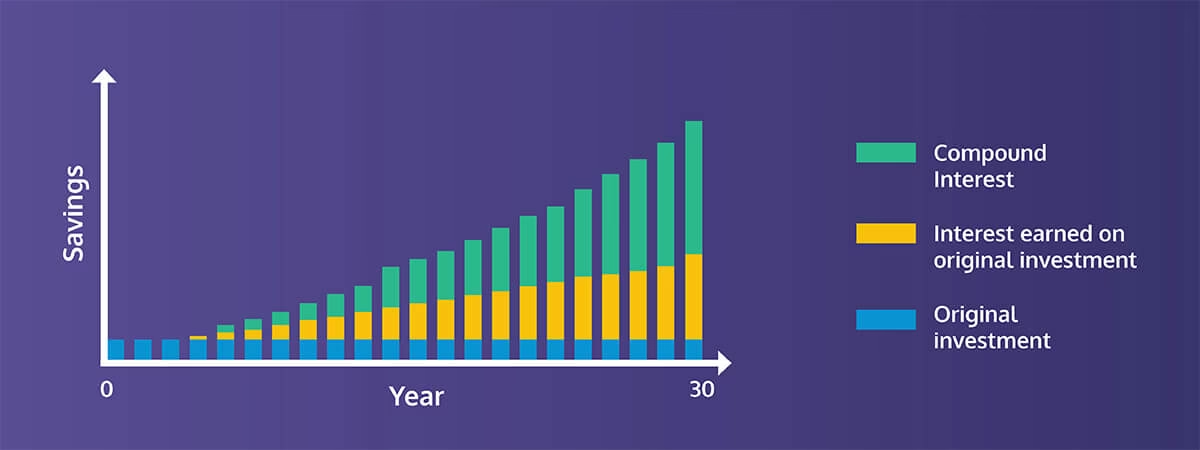

We all know that saving for retirement is important – but what you might not know is that putting it off can cost you a lot of money in the long run. That’s why starting now When the money you’ve invested generates interest, that interest is then reinvested again as part of your original investment, and generates interest of its own. Which is then reinvested. can make a big difference to your ultimate retirement savings balance. Putting in a wee bit of effort today can pay huge dividends (potentially literally) down the line.

But how do you get started? How much should you be putting away? And how can you balance saving for retirement – which may be a long way away – with investing and growing your business right now? What excellent questions. You’re a sharp cookie. Let’s go.

- What is superannuation

- How superannuation works – employees vs sole traders

- The benefits of paying superannuation

- How to pay yourself superannuation

- Automate your superannuation with Hnry

What is superannuation

The word superannuation comes from the Medieval Latin superannuari meaning “to be too old”. Basically, the government doesn’t want to offend the older generation by telling them they’re past it in plain English. Ouch!

Anyway, nowadays, superannuation is the name given to the Australian superannuation or pension system. It’s a government policy designed to encourage people to save money during their working life to fund their retirement. This money is invested in a superannuation fund which, unlike a normal savings fund, is locked away until you reach retirement age (except in exceptional circumstances).

There are actually three key pillars in Australia’s retirement system:

- Age Pension – means-tested and publicly funded income support for Australians of Age Pension age

- The Superannuation Guarantee – A mandatory employer-funded superannuation contribution

- Voluntary retirement savings – Additional savings from an individual that may also be supported by tax concessions and government support.

The Australian government made contributing to a superannuation fund mandatory in the 1990s – and for good reason. On average, Australians are getting older and enjoying a higher standard of living than previous generations. This means people will need more money in retirement and, thanks to the declining birth rate, there will be fewer tax dollars to fund it.

Superannuation requires people to save for their golden years. If you have dreams of an endless vacay in your golden years, you’ll have to contribute more than the minimum to your super to fund it.

How superannuation works – employees vs sole traders

For most Australians, superannuation is money contributed by their employer into their superannuation account. It’s calculated as a percentage of their pre-tax salary at the current superannuation rate, also known as the Superannuation Guarantee (SG). This compulsory payment currently sits at 11%.

But there are 1.5 million self-employed Australians with no employer to contribute to their retirement? What about them?

Well, if you’re a sole trader, you’re not required to make your own super contributions. If you’re an independent contractor, some companies might offer to pay SG as an added perk, or be required to due to the nature of your work with them.

But if you’ve incorporated a company and are legally an employee, your company will need to pay your SG.

| Business structure | Do you have a superannuation obligation? |

|---|---|

| Sole trader or freelancer who runs and owns a sole proprietorship | No, you don’t have to pay SG. |

| Independent contractor | No, but depending on your contract, the company you’re contracting to may need to pay you SG. Check out the rules for contractorsfrom the ATO for more information. |

| Business owner employed by your own company | Yes, your company will need to pay your SG. |

So I don’t have to pay superannuation as a sole trader?

The bottom line is that whether you choose to pay superannuation or not, you are responsible for funding your retirement. And if you skip paying superannuation, you could be missing out on growing your savings for retirement. Research shows that self-employed Australians have, on average, lower superannuation balances than wage and salary earners across every age. And around 20% of self-employed people have no superannuation at all

The benefits of paying superannuation

As a sole trader, you know that business expenses add up fast. And when you’re faced with cash flow pressures and rising inflation – do you really need to add another expense to the list?

While the answer’s probably no, there can be some major upsides to regularly contributing to your superannuation account.

Funding your retirement

Do you know how much you need when you retire? If not, there’s a good chance it’s more than you think. The Association of Superannuation Funds of Australia (ASFA) estimates Australians will need a superannuation balance of $545,000 as a single or $640,000 as a couple to achieve a comfortable retirement.

(This is assuming you own your own home. It also doesn’t account for personal lifestyle preferences – your version of ‘comfortable’ might be more than they’ve budgeted for.)

Accumulating compound interest

You know how small habits performed daily lead to big wins in the long run? Good news: when it comes to investing, it’s the exact same story.

This kind of interest is called compound interest, and it’s magic. Compound interest can net you returns far beyond what you can save on your own.

To make the most of compound interest, you need to be investing regularly. More of your own savings = more interest = even more compound interest.

Take advantage of the financial magic and blow your savings goals out of the water.

Potential tax benefits

Contributing to your superannuation comes with a few potential tax benefits. They can vary depending on the type of contributions you make, the amount, your income level, and your age – but are still a definite bonus.

Concessional contributions

Concessional contributions are superannuation payments that are tax deductible. Generally, these contributions are made from pre-tax income, and are capped at a maximum of $27,500 per year.

For PAYG employees, their employer’s SG contributions count towards their $27,500 cap. So if, say, an employer contributes $20k to an employee’s super fund in an annual year, that employee can only make $7.5k in concessional contributions.

But for sole traders who don’t have an employer paying SG, you’re free to pay the full $27.5k in concessional contributions, which you can then claim as a tax deduction.

On top of this, you can carry forward any unused contribution cap amounts for up to five years, which is handy if you’re playing catch up – just make sure that you’re eligible to do so.

Because concessional contributions come from your pre-tax income, they’re not taxed at your income tax rate. Instead, they’re taxed at a flat rate of 15% in your superannuation fund (score!).

By claiming a tax deduction for super contributions you’ve made, you can reduce the amount of tax you pay in your individual tax return.

💡 If you’re a high-income earner with a pre-tax income of over $250,000 per annum, your superannuation contributions may incur an additional tax (Division 293) of 15%, making the total rate 30%.

If you want your superannuation contributions to count as concessional contributions, you’ll need to complete a Notice of Intent form with your super fund at the end of the financial year. On their end, they’ll confirm that you’re eligible to claim your contributions as a tax deductible concessional contribution, before forwarding the information to the ATO.

Non-concessional contributions

If you’ve maxed out your concessional contribution limit, or if you’d prefer not to make contributions from your pre-tax income, you can still contribute to your super from your after-tax income. These are called non-concessional contributions.

Non-concessional contributions aren’t taxed in your superannuation fund, and are generally capped at $110,000 per financial year.

You can contribute more than the limit if you’re eligible for the bring-forward rule, which allows you to contribute up to two years of the annual cap amount.

The superannuation government co-contribution

For those on the lower end of the earnings scale, you may be able to get the government to boost your superannuation – for free!

If you meet the eligibility requirements, you could receive a bonus of $500 in your superannuation account from the government if you contribute $1,000 to your superfund this year. It’s the closest thing to free money that there is.

💡 Note: the government co-contribution will only be made based on non-concessional contributions (meaning you can’t claim a tax deduction for your contribution if you want to receive the government co-contribution).

Age-based restrictions

Different contribution rules may apply once you’re in your 60s and 70s. It’s a good idea to contact your accountant or financial advisor (or the friendly Hnry team!) for guidance.

How to pay yourself superannuation

Sold on the benefits of paying superannuation and keen to get started? Here’s what you need to do:

1. Find the right superannuation fund

If you already have a superannuation account, great stuff! Skip to the next step.

For those who haven’t, fair warning: it is a bit of an involved process.

First, you’ll need to decide what you want in a superannuation fund. A few questions to ask yourself:

- What’s my risk profile?

- If you’re ok with serious ups and downs, a higher risk fund could suit you

- If you tend to panic when your savings take a hit, you may want to look at a more conservative fund

- What’re my values?

- Some people want the highest returns in the shortest amount of time – a completely valid approach

- But if you feel strongly about, say, saving the whales, you may want to double check that the fund you’re looking at doesn’t invest in an unethical fishing company.

- What fees am I willing to pay?

- Different funds charge different fees at different amounts. It’s always a good idea to read the fine print of any contract!

- What are my insurance needs?

- Superfunds generally offer different types of insurance for their members. Remember to:

- read through terms and conditions,

- make a note of the premiums, and

- check if any of the cover exclusions apply to your situation.

- Superfunds generally offer different types of insurance for their members. Remember to:

It’s a good idea to review the performance of your fund from time to time, especially if your situation changes. If you decide it’s in your best interests to switch funds, remember to consider the potential costs and implications – things like exit fees, loss of insurance coverage, etc. As always, seek professional advice if needed!

You can use a superannuation comparisontool to help you compare the different features across different products to help you decide.

2. Decide how you’ll contribute

If you have regular, consistent profit, you could pay yourself super as you would if you were an employee. For example, you could set up an Allocation in Hnry to automatically contribute 11% of your pre-tax pay to your superannuation fund.

If your profit fluctuates, you could pay your superannuation contributions out of your business revenue. This means sending lump sum payments to your superannuation account when your cash flow allows.

💡 Did you know the superannuation rate is going up? As legislated by the Australian government, the SG will rise by 0.5% each year until it reaches 12% in July 2025. So if you’re looking to pay yourself superannuation at the same rate you would as an employee, it’s time to budget for the increase.

3. Set up payments

Make sure you stay on track for retirement by setting up an automatic super payment. And don’t forget to give your superannuation fund your tax file number.

Without it, your fund won’t be able to accept personal contributions and you’ll be taxed at the much higher rate of 47%.

Automate your superannuation with Hnry

Being a sole trader is hard enough, without having to actively contribute to your own retirement fund. That’s why we’ve made saving simple with our Allocations feature.

Set up an allocation to your superannuation account, and we’ll automatically squirrel away a percentage of your earnings for you every time you get paid. Whatever you receive in your personal bank account is yours to spend – you won’t even have to think about it!

Alongside your automatic super allocation, we’ll also:

- Calculate, deduct, and pay ALL your taxes, including your Income tax, GST and Medicare levy, every time you get paid

- Lodge your tax and GST returns whenever they’re due

- Manage and claim your business expenses

- Chase up late-paying clients (politely!)

- … and more!

For just 1% of your self-employed income, Hnry will make it so you never have to think about taxes, ATO lodgements, and saving for retirement ever again. Join Hnry today.

Share on: