If you’re based in Queensland, then you may be eligible for support payments related to the August 2021 Covid-19 outbreak.

So far the Australian government has made the following relief payments available:

For individuals:

‘Covid Disaster Payments’ have been made available to individuals who have been impacted by the August 2021 lockdown. The Australian government is responsible for these payments and more information can be found here.

For Sole Traders:

‘COVID-19 Business Support Grants’ are now open to small businesses that have seen a 30% reduction in turnover due to Covid-19. This grant is a one-off $1,000 for sole traders - to be eligible you can’t have employees.

What payments are available to individuals now

The ‘COVID-19 Disaster Payment’ is a payment from the Federal government to individuals affected by a declared lockdown. This is a lump sum payment to help when COVID-19 restrictions last for more than 7 days. Every 7 days is called an ‘event’ and payments can be claimed once for every event.

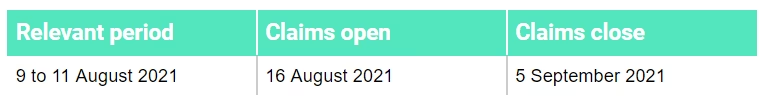

There are different dates for the ‘events’ depending on whether you are affected as part of Queensland.

The dates of each event for the South East Queensland, Cairns and Yarrabah locations are listed below:

Key dates for South East Queensland:

Key dates for Cairns and Yarrabah:

These dates will be adjusted as further lockdowns are announced. Most up to date dates can be found for Queensland here.

How much can I get

For the first and second events (1-7 August and 8 August in South East Queensland locations):

- If you have lost less than 20 hours work - you’ll get $450 per event

- If you have lost more than 20 hours work - you’ll get $750 per event

The disaster payment is a non taxable payment.

These amounts are only to individuals who do not receive any income support or have not received Pandemic Leave Disaster Payments.

How do I get the payment

Claims the ‘COVID-19 Disaster Payment’ can be made through your myGov account linked to your online Centrelink account.

What payments are available to sole traders now

‘COVID-19 Business Support Grants’ are now open to small businesses that have seen a 30% reduction in turnover due to Covid from the 31st of July in Southeast Queensland and from 8th of August for Cairns/Yarrabah. This grant is a one-off $1,000 for sole traders - to be eligible you cannot have employees. Applications are still not open but you can register your interest here.

If you’re a Hnry customer

If you’re a Hnry customer, then you’ll still need to claim the support payments through your myGov account.

If you have questions about how the support payments will affect you from a tax perspective, simply get in touch with the team to talk through your options!

*This article is up to date as of the 17th August, as Covid restrictions change so will this information.

Share on: