If your HECS loan has been a real weight on your shoulders, well, you’re definitely not alone. As of 2024, a staggering 3 million Australians owe a combined total of $81 billion in student loan debt.

Paying back a student loan can feel like a sisyphean task, especially when the cost of living is rising at such an alarming rate. Younger Australians especially are having a hard time of it, struggling to save for traditional milestones like buying a home, while living paycheck to paycheck. 70% of student loan borrowers are under the age of 35.

In this context, the government’s recent legislation wiping out 20% of all borrowers’ debt is welcome relief. It comes amidst a range of changes aimed at addressing current economic conditions, including a rethink of how compulsory student loan repayments are calculated.

Here’s everything you need to know:

- Why student loans are difficult to pay off

- The 20% HECS forgiveness - FAQs

- Other recent changes to student loan repayments

- How Hnry can help

Why student loans are difficult to pay off

Before we get to the good stuff, some quick background information.

Part of the reason why student loans can be difficult to repay is because of the way the repayment system works. Until very recently, student loan debt was indexed to inflation, meaning that if the cost of living soared (like it did during the pandemic), so too did loan balances.

(Due to recent high indexation rates, loan balances are now indexed using either the inflation rate or the wage price index – whichever is lower.)

On top of this, student loan indexation happens before compulsory repayments are due, meaning that your loan balance effectively increases before you knock it down with your repayments.

The only way to reduce your loan balance before indexation is applied is by making voluntary repayments throughout the year. But (spoiler alert) – your voluntary repayments don’t count towards your compulsory repayments. Meaning that if you make voluntary repayments, you’re still on the hook for the full compulsory repayment due.

If this sounds complicated, that’s because it is! Unfortunately, it’s not uncommon for borrowers to get caught up in the system, making repayments for years only to discover that they’re not making much of a dent in their loan balance.

📖 Not sure how all the pieces fit together? Check out our full explainer on student loans and how they work

The 20% HECS loan reduction FAQs

As part of their 2025 campaign promises, the Albanese government announced that should they be reelected, they would reduce all outstanding HECS loan balances by 20%.

Well, they won the 2025 Australian election, and signed their promise into law. Whoo!

Here’s what that means in practice:

How does the 20% student loan reduction work?

It’s almost exactly as it says on the tin – all student loan balances will be reduced by 20%, as of 1st July 2025.

The fine print is that this loan reduction will take place before both indexation and your compulsory repayment for 2024/2025 is applied. What this means is that your loan balance will be reduced by 20%, before increasing by this year’s indexation rate (3.2%). Your compulsory repayment for this year will then be applied against this new total.

Who is eligible for the 20% student loan reduction?

Basically anyone with a student loan balance (known as a HECS or HELP loan) as of the 1st of June, 2025 is eligible for the 20% reduction.

When will I see the 20% reduction affect my loan balance?

The government has said that the debt discount will come into effect by the end of this year.

Although the reduction applies as of the 1st of June 2025, you might not actually see your balance drop straight away. Don’t worry though – the maths on all this is still accurate, and all loan balances will be tidied up in due course.

What happens if I’ve already paid my loan off?

If you’ve already paid off your student loan, even if you did it just before the 1st of June, you’re unfortunately not eligible for any reduction or repayment.

Think about it this way – if your student loan balance was $0 on the 1st of June, a 20% reduction wouldn’t help – 20% off $0 is $0!

If the 20% reduction isn’t credited to your account before your compulsory repayment is applied, and you end up paying more than required to settle your loan, you may be eligible for a refund.

Will the rest of my debt be forgiven?

Honestly, that’s up to this and future governments.

The 20% reduction is set to be a one off, at this point in time. But with economic inequality and the cost of living both set to rise over the next few years, chances are the government might step in again to offer some tangible relief for young people.

Other recent changes to student loan repayments

Repayment calculation changes (2025)

Alongside the 20% reduction, the government also introduced changes to student loan repayment calculations.

Before, once you were over the repayments threshold, compulsory repayments were calculated using a flat rate that applied to your whole income. Rates were based on your income level – the more you earned, the higher your repayment rate.

Now, repayment will be calculated based on a progressive system, not unlike how income tax works. Once you’re over the repayment threshold, your income will be split into brackets, each with a different repayment rate. You would only pay the set rate on income within that income bracket, rather than all your income.

The new repayment threshold for FY 2025/26 is $67,000, and your compulsory repayments will be calculated only on income above $67k.

You’ll owe 15% of every dollar from $67,000 to $124,999, and an additional 17% of every dollar above $125,000. Tada!

But the one caveat to all this if you earn above the top threshold of $179,286. At this point, you’ll owe 10% of all your repayment income in compulsory repayments – just like the old system.

| Income band | Repayment percentage on that income |

|---|---|

| $0 - $67,000 | 0% |

| $67,001 - $125,000 | 15% |

| $125,001 - $179,285 | 17% |

| $179,286+ | 10% of all repayment income |

📖 We cover all this in more detail in our piece on the government’s recent changes.

Indexation changes (2023)

In 2023, the government changed the way in which they index student loans.

Rather than only indexing to the Consumer Price Index (CPI – essentially the inflation rate), they changed the system so that loans would be indexed to either the CPI or the Wage Price Index (WPI – the rate of wage growth), whichever was lower.

They then backdated that change to the 2022/23 financial year. Due to high inflation, all student loan balances were set to increase by 7.1%; the CPI. Instead, under the new rules, they were indexed to WPI, a more manageable 3.2%.

📖 For more info on indexation, check out our news article from when the changes went live.

How Hnry helps

We might be biased, but we reckon the easiest way to stay on top of all these changes (and your taxes) is to just use Hnry.

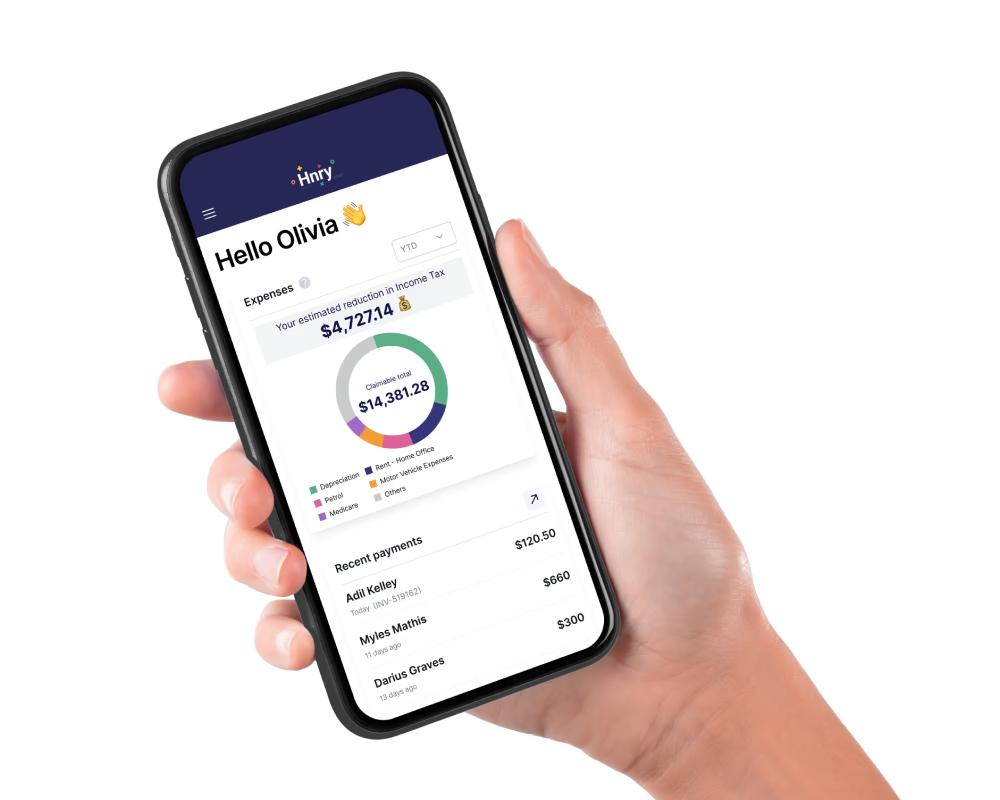

Hnry is an award-winning tax app and service designed specifically for sole traders. We calculate and pay your student loan repayments as you earn!

In fact, for just 1%+GST of your self-employed income, capped at $1,500+GST a year, we will also completely sort out all your tax and levy bits and bobs, including:

- Income tax

- GST

- Medicare Levy

- Superannuation contributions (optional)

We also lodge your annual tax return for you – it’s all part of the service.

Whether you’re just starting out, or an industry veteran, Hnry is designed for all sole traders. We make sure that you never know the horror of an unpaid tax bill – ever. And that’s a big deal, believe us.

Forget your student loan exists. Join Hnry today.

Share on: