We’re not going to sugarcoat it; inflation has been especially hard on sole traders.

If you’ve been feeling the cost-of-living pinch, you’re not alone. In October 2022, during the height of inflation, 61% of sole traders said they were paying more for fuel, and a whopping 76% were paying more for their supplies and services.

Things haven’t necessarily been getting better. At this point in time, 14% of sole traders reported poor financial security. That number has now increased to 22%, as of October 2025.

With general costs running so high, it can be difficult to raise your prices as a sole trader to cover your own expenses. We aren’t going to suggest that there’s a silver lining to all of this – it’s been a rough few years, and you don’t need to hear any more empty cliches/platitudes.

What we have instead are five practical suggestions to help ease the strain of inflation on your sole trader business.

1. Automate everything you can

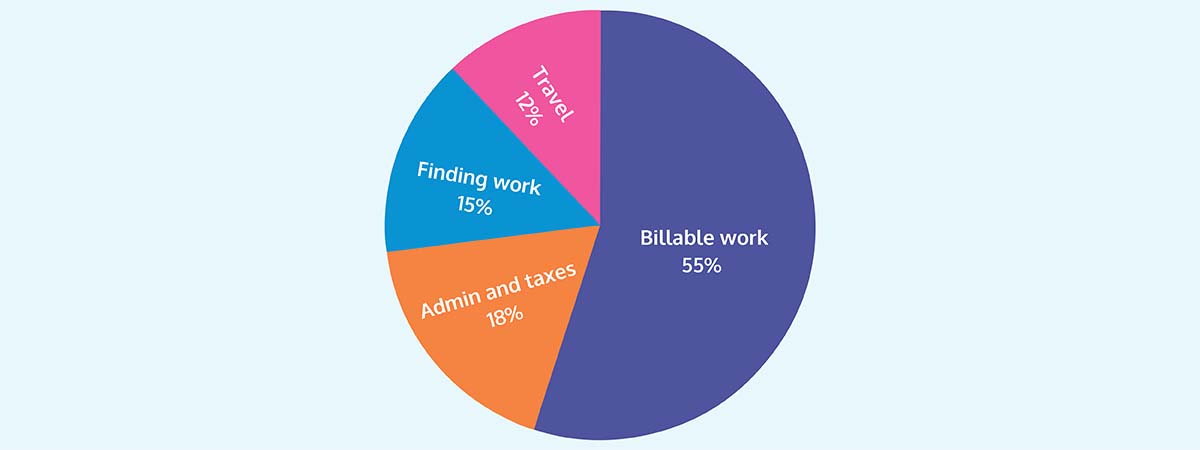

Research shows that sole traders are only spending around half of their working week (55%) on actual work - the rest gets taken up with admin and taxes (18%), finding work (15%), and things like travel (12%). Freeing up some of this time could mean taking on more projects, or working bigger contracts, resulting in a boost to your bottom line.

Breakdown of sole trader work week

Start by identifying the boring, repetitive tasks that drain your soul. For example, is chasing invoices taking up a lot of your time? Are you struggling to find new clients? At the risk of sounding like an infomercial, are taxes getting you down? Good news - there’ll be a way to either streamline that task, or automate it completely!

Once you know what you don’t want to deal with anymore, you can start finding the right solutions for your needs. That could mean anything from creating a booking form on your website, to building an automatic sales pipeline in excel, to using AI to draft social media posts, to letting Hnry automatically chase clients who are late paying their invoices (politely, of course).

Automating now can mean huge time savings down the line. If you can free up just two extra hours a week, you’ll save 104 hours a year – that’s the equivalent of creating an extra two and a half working weeks a year. What could you do with that extra time?

Hnry customers save around 5 hours a week on financial admin. Here’s how:

- No more reconciling transactions – we do it all for you every time you’re paid into your Hnry Account

- No more chasing invoices – if a client is late paying, we’ll send them a reminder email. People who use this feature get paid an average of 5x faster!

- No more saving expense receipts – simply take a photo, upload it to the app, and we’ll manage all of your expenses and store your receipts for you

- No more calculating and deducting your own taxes - we calculate, deduct, and pay all your taxes every time you get paid.

2. Claim all the deductions you’re entitled to

We can’t stress this one enough: Claiming tax deductions can save you thousands of dollars each year. If you’re not claiming everything you’re entitled to, that’s significant savings left on the table.

The ATO has three rules to help you figure out what is and isn’t claimable:

1. You must have spent the money yourself and weren’t reimbursed.

2. The expenses must directly relate to earning your income.

3. You must have a record to prove it (usually a receipt).

This, however, is just a starting point. You should also know that:

- Not every business expense will be a valid tax deduction

- Not every tax deduction is a business expense

- If an expense is partly private and partly for business, you can only claim the business portion

- Some tax deductions are industry specific. A tradie won’t be able to claim everything a clown can for example, and vice versa.

We know, it’s as clear as mud. So how do you know that you’re claiming everything you should claim?

- The ATO’s industry-specific guidelines are a good place to start

- Beyond that, it’s always a good idea to talk through your expenses with an accountant (or Hnry tax specialist in the chat box below!). They might spot something you’ve missed.

💡Confused about what expenses are, what tax deductions are, and how to make the most of both? Check out our mammoth guide to tax deductions.

3. Review your cash flow

If you haven’t come across this term before, it does what it says on the tin: cash flow refers to the flow of cash through your business.

Unlike profit, which is a single number calculated at the end of the financial year (usually), cash flow factors in the timing of incoming and outgoing funds. Very simply, positive cash flow means you have more coming into your bank account than going out at any given time; negative cash flow means the opposite.

On the first of the month, Cole makes his usual $1,000 purchase, and starts baking bread. Unfortunately, his biggest client can't pay him immediately, and instead asks to pay him one lump sum for all their bread in six months' time. For fear of losing the contract, Cole agrees.

Three months later, Cole runs out of money to purchase supplies. Even though his business is profitable, because of the delay in payment, it's cash flow negative. Cole is forced to close up shop.

Take a look at your business’ income and expenditure for a single month. Do the numbers balance, or do you need to make some changes? Do you need to start chasing invoices earlier? Could you renegotiate payment terms with your suppliers? If you can’t avoid negative cash flow, could your business benefit from a loan?

A higher cost of living makes tight margins even tighter. Do anything and everything you can to stay cash flow positive, and give yourself some breathing room.

4. Repackage your services

As the rollercoaster that is the Australian economy rumbles on, raising your rates might continue to be difficult. Everyone is trying to get the most bang for their buck, and the fear of losing work due to high prices is a real one. So how do you maintain a fair hourly rate without scaring clients away?

One strategy is to rethink what you offer, and how you price your services.

- If you’re an efficient freelancer writer who charges by the hour, your hourly rate could go up if you charge per project.

- If you’re a tradie, you could bundle small services together into a more cost-effective package.

- If you bake intricate cakes, you could subsidise larger, time-intensive orders with quicker and higher-profit cupcake runs.

- If you’re a makeup artist, you could do drunk glow-up classes at bachelorette parties (we’d book one).

- If you’re a clown at kids parties… uh… what about retirement homes…? (Sorry, we’re not fully up on the industry, but we’re rooting for you!)

The point is, all business strategies need tweaking from time to time. Now could be a good moment to introduce something new.

5. Take care of your mental health

We know that there’s already a lot out there on mental health, so we’re going to keep this short and sweet.

1. You are your business. Your business is you. If your mental health tanks, your business will struggle. From this perspective, taking care of your mental health isn’t just essential, it’s good business sense.

2. It’s tempting to bite off more than you can chew when times get tough, but it’s not a good long term strategy. If you have to put in extra hours, do your best to create time and space to recharge. Pay attention to your own warning signs; don’t push past your limits.

3. Being a sole trader can be hard, especially when you’re just starting out. Don’t be afraid to lean on your networks, and ask for help if you need it. There are a lot of kind people out there who will gladly give you a hand, and one day you’ll be able to do the same for someone else.

4. If possible, don’t neglect the basics. Good food, enough rest, fun exercise, time with friends and family. These four things are the pillars of good mental health, and can keep you steady when things get rough.

Despite all the challenges, being a sole trader is intensely rewarding. The autonomy, freedom, satisfaction, balance – there are so many reasons why more and more people go at it alone, making it one of the fastest growing segments of the Australian economy.

If you’re struggling right now, know that it won’t last, and you’re definitely not alone. We hope these suggestions have helped in some way, and we’re here to support you in whatever way we can.

🦋 Visit healthdirect.gov.au for more information on ways to take care of your mental health.

🦋 For free mental health articles, apps, and more, you can visit Black Dog Institute.

🦋 If you need immediate help, Beyond Blue offer free 24/7 online and telephone counselling services for anyone in Australia.

About Hnry

Hnry is an award-winning app and service designed to help sole traders manage their tax and financial admin. For just 1% +GST of your self-employed income (capped at $1,500 +GST annually), we’ll sort all your tax bits and bobs, including:

- Income tax

- GST (if applicable)

- Medicare levy

- Student Loan repayments

- Superannuation contributions (optional)

We’ll also:

- Lodge all your tax returns and BAS

- Manage your business expenses

- Chase up late-paying clients (politely of course!)

- Help automate your savings to support your financial goals

- .. and so much more!

We know how valuable your time is, and we want you to spend less time on financial admin, and more time on the important stuff. Save time, money, and energy with Hnry, and never think about tax again.