Being a sole trader has its perks: flexibility, control, better work/life balance, and the ability to scale your business up or down as needed.

But let’s face it, the process of getting a mortgage wasn’t exactly designed with you in mind. Banks often ask for documentation that may be harder for sole traders to produce, and some banks are skittish in the face of variable income.

Buying a house (congratulations!) is a big deal – and it’s hard enough without having extra hoops to jump through. On top of this, every bank, lender, and broker is different and has different requirements. So as a sole trader, what are the steps you can take to make your home loan dreams a reality? Here are a few tips and tricks we’ve seen help our users.

Let’s get stuck in!

- Why being a sole trader can make getting a mortgage trickier

- How to prepare for a home loan application

- Documents you might need

- Low-doc mortgages

- Common mistakes to avoid

- Tips for applying for a home loan

- Hnry makes it much easier

Why being a sole trader can make getting a mortgage trickier

Australia’s home loan system favours employees who receive regular income from their employer. As a sole trader, your income’s typically up and down – sometimes you’ll have quiet periods and other times business is booming.

It can also be harder for you to prove your income. A regular employee may only need a couple of payslips to apply for a mortgage, whereas the requirements on sole traders are more onerous (we’ll cover this a bit later). You don’t get any payslips and unlike if you operated a sole director company, you can’t pay yourself ‘wages’. Your business and personal income as a sole trader are the same.

In addition, since sole traders don’t get sick pay or holiday pay, this can make you less attractive as a borrower – if you get sick and can’t bring in income, lenders may think you won’t be able to make your mortgage payments.

Ultimately banks and other financial institutions don’t want to take risks, so you need to be able to prove your ability to pay your mortgage. Even if you’re in a good financial position, lenders can still be wary about self-employed home loans.

How to prepare to apply for a home loan

As a sole trader, there are a few key things you can do to improve your chances of securing a home loan before you apply:

Get your finances in order

It’s important to be across your cash flow, budgeting, expenses, and profits. The better your finances look, the higher chance you stand of getting a mortgage.

Pay off any debts you might have (if possible)

Debts can count against you when you apply for a home loan. This includes any ATO debts, including student loans, you may have, as well as credit cards.

Make sure you have a good credit rating

You can regularly check your credit score through agencies such as Equifax or Experian, or using online credit score providers. A poor credit rating could be a hurdle in securing a home loan, so it’s wise to assess and improve it well before you apply for a mortgage. Remember, a good credit rating not only enhances your chances of approval, but can also open the door to better interest rates.

Save a healthy deposit

When it comes to home loans, lenders use something called the Loan to Value Ratio (LVR) to figure out how much they’re willing to lend you.

The LVR is essentially the portion of the property’s value that you’re hoping to borrow. It’s determined by dividing the loan amount by the property’s value. A higher LVR (smaller deposit) signals more risk to the lender, whereas the larger your deposit, the lower the risk you pose, which can lead to better mortgage rates. Just remember, the property value is set by the lender and might not match the asking price.

Imagine you’ve saved up $70,000 for a deposit and you’re interested in a house priced at $600,000. To buy this property, you’ll need a mortgage of $530,000 (excluding other costs such as stamp duty, which we’ll discuss later). Providing that the lender also values the property at $600,000, your LVR would be calculated as $530,000 ÷ $600,000, resulting in approximately 0.88 or 88%.

While some lenders might be comfortable lending up to 95% of a property’s value as the LVR, smaller deposits may mean you’ll have to fork out for Lenders Mortgage Insurance (a premium you pay that protects the lender if you default on a home loan). Ouch!

It’s also worth remembering that the more you borrow up front, the more you’ll pay back in interest over time.

See if you’re eligible for any grants or schemes

If you’re a first-time homebuyer, you may benefit from the Home Guarantee Scheme. This Australian Government initiative helps those on low to middle incomes buy a home with a deposit as low as 5%.

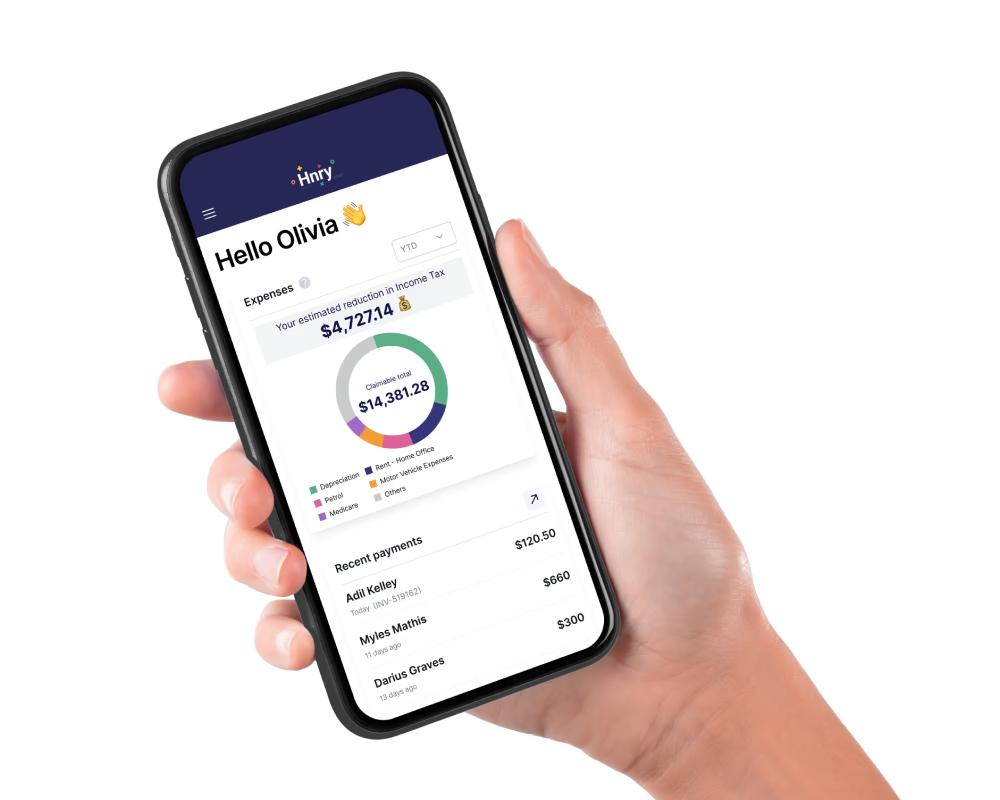

Use accounting software to create reports to back up your financial situation

If you’re a Hnry user, Hnry can provide you with financial statements, including a profit and loss statement, that backs up your financial situation. Having documentation supporting the financial viability of your business will go a long way towards getting your application approved!

The Hnry Dashboard gives you a financial overview of your business, including a month-by-month breakdown of profit earned. Using Hnry also means that you’ll have peace of mind knowing your taxes are taken care of. All i’s dotted, t’s crossed, and everything shipshape. Easy!

Documents you might need to apply for a home loan

There’s nothing worse than turning up to any appointment, only to realise you left the required documents at home!

Here’s a quick list of what you might need to take with you for a home loan application:

- ID: You’ll need to prove to the lender who you are (of course), so you’re likely to need your driving licence and/or passport, as well as utility bills showing where you live.

- Profit and Loss statement: Lenders consider your net profit as a sole trader, so having this neatly laid out and correctly calculated is essential. And yep, Hnry provides this for you!

- Accountant’s Income Letter: This can lend authority to your application. The good news is that Hnry can also create this for you but only for income that goes through our app – so if you also have a part-time job as an employee, we can’t vouch for that.

- Full copies of recent tax returns: These should be spotless if you’ve used Hnry to lodge your tax returns. You can access your tax returns through your ATO portal.

- Your two most recent ATO Notice of Assessments: These can be useful in proving exactly how much you earn, including your sole trader income.

- Copies of recent BAS lodgements: If you earn more than $75,000 you must be registered for GST and lodge BAS statements. Again, if you’re lodging these through Hnry, these will be neat and tidy and ready to go. Like your tax returns, you can also access these from your ATO portal.

Different banks might ask for different things, so make sure you’re across what your bank/lender will need ahead of time!

Low-doc mortgages

As the name suggests, you don’t have to provide as much documentation for a low-doc mortgage as you would for a standard mortgage.

To verify your income for a low-doc home loan you’ll generally need a Self Declaration of Income, and one of the following:

- Accountant’s Letter (Hnry can easily sort this out for you!)

- BAS statements lodged over the past six months (Get these from your ATO portal)

- Business bank statements over a six-month period

Keep in mind, low-doc mortgages often have maximum loan limits, and LVRs of 80%+ might only be an option in larger cities or major towns. They may also come with high interest rates attached. You’ll need to take this into consideration when deciding when and where to buy.

Common mistakes to avoid

A few common pitfalls:

Submitting incomplete or out-of-date documents: Not only does this slow the application process down, it can make you appear inefficient and possibly a higher-risk borrower, so be sure to check all the documents you submit (if you use Hnry, these will be airtight so no worries there).

Minimising profit: While it’s tempting to keep your profits down in order to lower your tax bill (after all, who enjoys paying more tax?), keep in mind that lenders look closely at your net profit when evaluating your home loan application. If your net profit seems insufficient compared to the amount you want to borrow, it could cause them to decline your application.

It’s wise to consult your accountant as soon as the thought of buying property crosses your mind. Although it might mean paying a bit more tax in the short term before applying, it could significantly enhance your chances of getting a mortgage.

Having bad credit: As we noted earlier, this makes you a risk to lenders, so take steps to improve this well before you apply for a mortgage.

Using payday loans: Also known as Small Amount Credit Contracts, or SACCs, these are short-term loans of up to $2,000 with repayment terms ranging from 16 days to a year, usually offered by non-bank lenders and typically with very high interest rates. Relying on these loans can signal financial distress to lenders, suggesting you’re having difficulty making ends meet. This perception can negatively impact your mortgage application, especially if you’ve used them within the past two years.

Tips for applying for a home loan

Do your research:

On mortgage providers: You can go direct to a bank or other financial institution to apply for a mortgage, or you could go with a mortgage broker who will shop around and find the best option for you. Look out for brokers, such as Yard, that specialise in home loans for self-employed people, freelancers and contractors.

On rates: Decide whether you want a fixed rate mortgage (you pay the same rate for a period of time, such as two years or more), or a flexible rate. A fixed rate can give you peace of mind in that regardless of interest rate fluctuations you’ll pay the same amount each month. A flexible rate means your payments can go up and down. If interest rates are cut, you’re golden. But if they go through the roof, it could cause you serious financial distress. Be sure to check the rates on offer in case you can get a better deal elsewhere.

On fees: Be sure to ask about all fees, including broker fees, hidden fees, and break fees. A break fee is a fee charged by your lender if you want to pay off some or all of your mortgage in one go, or change lenders. This can be hundreds or thousands of dollars, so check the fine print in your contract.

On legal fees and stamp duty: It’s wise to use a conveyancing lawyer to help you buy property as it can be a complex process. Stamp duty is a tax applied to certain property transactions and varies across each state or territory. It can also vary depending on if you’re buying the property as your primary residence or as an investment. It’s based on the value of the property and can be quite hefty, so make sure you have enough funds to cover this.

Hnry makes it much easier

Hnry is an award-winning tax service designed specifically for sole traders.

For just 1% (+GST) of your self-employed income, capped at $1,500 a year, Hnry will calculate and pay all your taxes, levies, and whatnot for you, including:

We also lodge your income tax and BAS returns for you, at no added cost. AND we handle all your financial admin, like:

- claiming expenses,

- sending quotes and invoices,

- and chasing up late-paying customers (politely of course.)

Because we handle all your tax and financial admin, we can provide you with the financial statements you’ll need for a mortgage application. Basically, you don’t have to go at it alone anymore. Hnry was designed by sole traders, for sole traders. We know exactly what you need to get the job done.

Join Hnry today!