Whether you work for an employer, or own your own business, taxes are unfortunately a fact of life.

As much as it would be nice to keep more of our hard-earned cash, we’re sorry to confirm that if you’re earning an income, you’re required to pay the tax man. Ouch.

To make matters more complicated, figuring out how much you owe the ATO can involve a fair bit of maths. That’s because Australia operates using a progressive income tax rate system with several tax brackets split by income level, rather than a single flat tax rate. This means that instead of handing over a set percentage of your taxable income every year, your personal tax rate will fluctuate depending on how much you earn.

So what does this mean, exactly? Better yet, how can you make the most of this system to (legally) pay less in taxes? Don’t worry, we’ve got you. In this article, we’ll explain:

Let’s get stuck in!

Note: this article only covers income tax rates, excluding the Medicare levy and student loan repayments which may also impact how much you’ll need to set aside for the EOFY.

What’s a tax rate?

We’re so glad you asked!

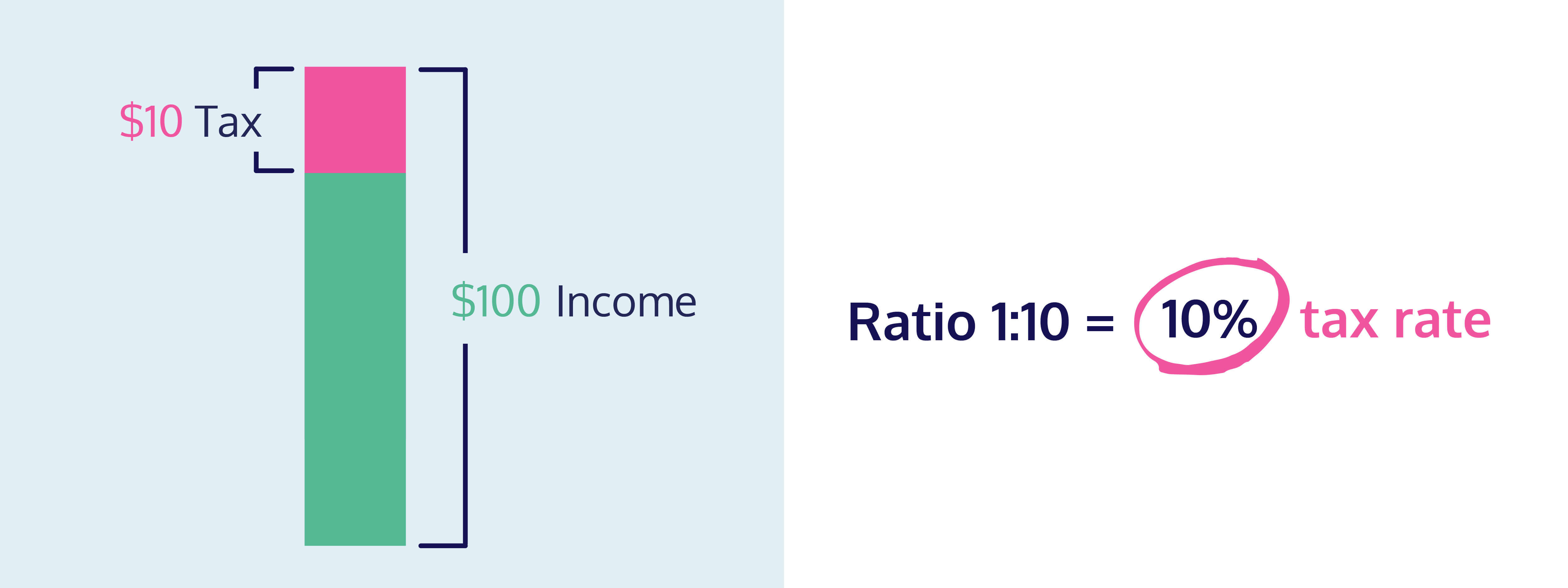

A tax rate is defined as the ratio between a sum of money and the tax owed on that money, calculated as a percentage. Don’t worry; it’s not as confusing as it sounds.

For example, if you had $100 of taxable income, and paid $10 of that in tax, the ratio between income and tax would be 10:100, simplified to 1:10. This ratio in percentage form is 10% – the tax rate.

If you wanted to simplify that even further, you could take the maths out of it and think about it like this: A tax rate is the percentage at which a person or business is taxed.

Some tax rates are easy to calculate – for example, GST (Goods and Services Tax). It’s levied at a flat rate of 10% on top of the cost of most goods and services. Fairly straightforward.

Other tax rates change depending on the circumstances. For example, income in Australia is taxed progressively, meaning that the tax rate is different for different tax brackets. Which leads us nicely to our next section:

What’s a tax bracket?

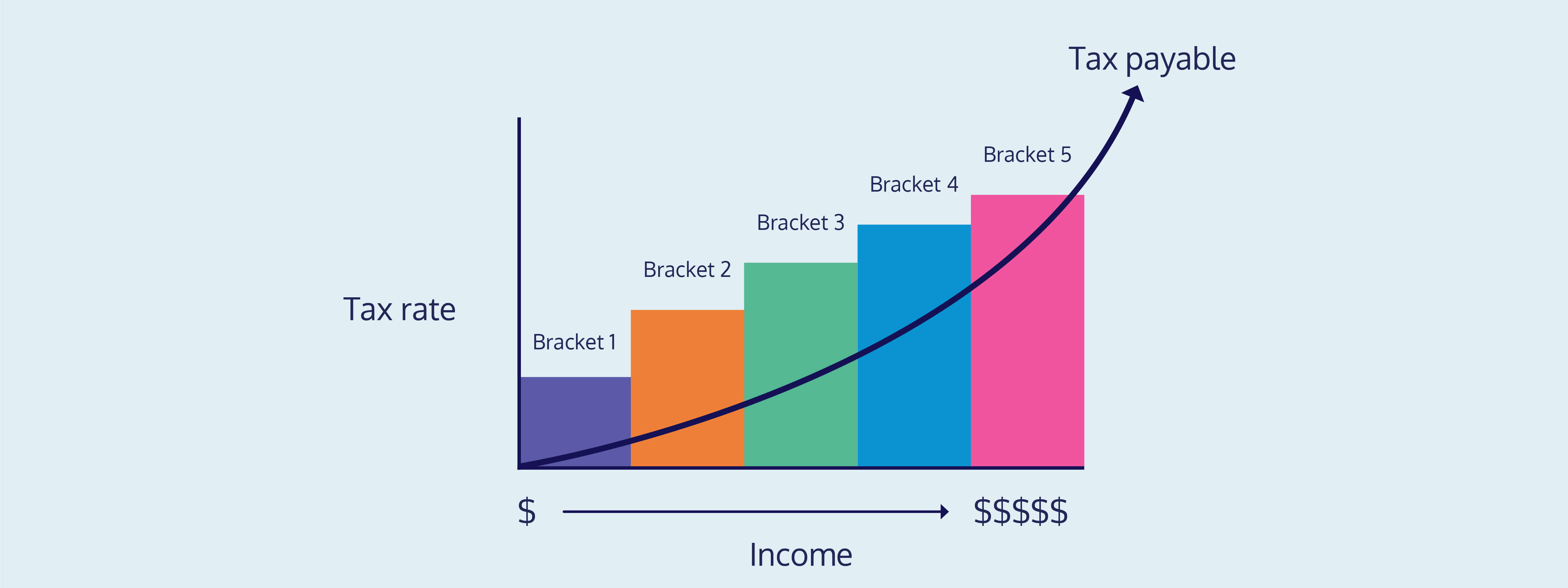

In Australia, income tax is a progressive tax, meaning that the more you make, the higher your overall tax-to-income ratio.

To this end, income levels are split into bands or brackets, each taxed at a different rate. It doesn’t matter whether you’re a PAYG employee, business owner, or sole trader – Income tax brackets are the same for everyone.

Tax brackets and their corresponding tax rates are decided on by the Australian government, meaning they’re not set in stone. Different parties have different views on what fair taxation looks like, and economic factors (like inflation) can change the value of money to the point where the system isn’t working as designed.

Although it doesn’t happen often, the government could change the bracket thresholds, the tax rates, or even add a new bracket into the mix.

📖 This happened most recently in July 2024, when the stage three tax cuts went live. For more information, check out this explainer.

💡 The government have also just proposed new tax cuts, to take effect over two future financial years – 2026/27 and 2027/28. You can read more in our 2025/26 budget digest.

Because of this, it’s a good idea to make sure you’re across the different tax rates and tax brackets each financial year – just in case.

Something important to note is that Australia has a tax free threshold, meaning the first $18,200 you earn is tax free. Sweet!

Australian Resident Income Tax Rates (2025/26)

| Income Bracket | Tax Rate % |

|---|---|

| 0 to $18,200 | Nil |

| $18,201 to $45,000 | 16% |

| $45,001 to $135,000 | 30% |

| $135,001 to $190,000 | 37% |

| $190,001 and over | 45% |

Source: ATO

How tax brackets and tax rates work

Income tax is calculated based on all your taxable income, whether you earn your income from a salary, a business, a side hustle, or any combination of all the above.

With that in mind, here’s where it gets more complicated: Not every dollar you earn will be taxed at the same rate. And that’s where tax brackets come into play.

It’s a common misconception that your entire salary is taxed at the rate of the top tax bracket you qualify for, but this actually isn’t true. Instead, you only pay that rate of tax on income that falls within that tax bracket.

For example, if you earn $60,000 a year, and fall into the 30% bracket, you may think you need to set aside 30% of your income for tax, which is $18,000. But our progressive tax rate system means that you actually pay no tax on the first $18,200 you earn, 16% on your earnings from $18,201 to $45,000, and 30% on anything over $45,001 (and under $135k):

Bracket 1: 0% of $18,200 = $0

Bracket 2: 16% of $26,800 = $4,288

Bracket 3: 30% of $15,000 = $4,500

Total income tax bill: $8,788

This makes your effective income tax rate 14.7% – far less than paying 30% across the board!

💡 An effective tax rate is exactly what it says on the tin: the actual percentage of your total income that you pay in income tax.

Your effective tax rate is unique to your situation, and is a better metric for tracking your taxation levels than the tax rates and brackets. It will vary wildly depending on where your income falls within the bracket system – the closer you are to the top end of the bracket threshold, the higher your effective tax rate will be.

📖 Curious about your own effective tax rate? Check out our tax calculator for sole traders!

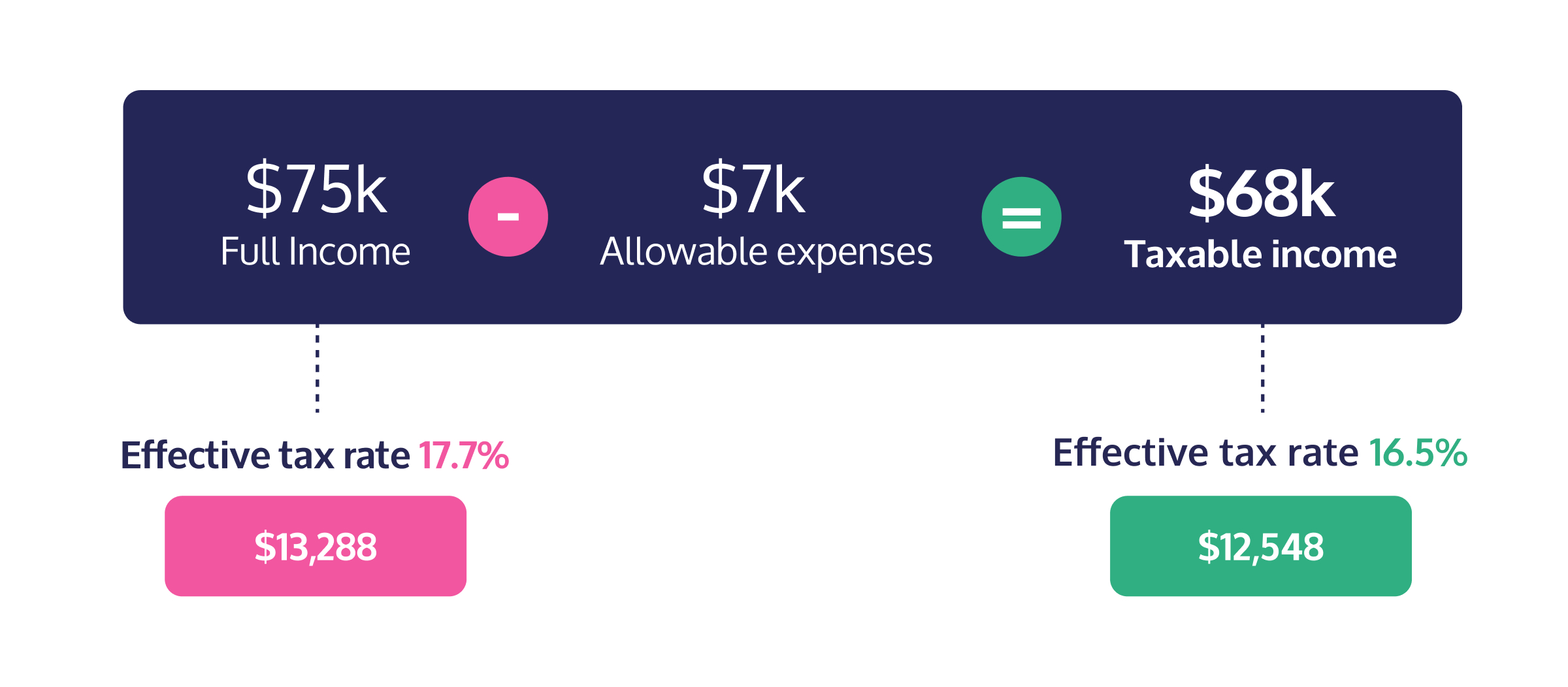

But wait! There’s actually some good news here, especially if you’re a sole trader. You can reduce your taxable income – and therefore your effective tax rate – by claiming tax deductions for approved business expenses (🎉).

How claiming business expenses affects your tax rate

To help sole traders and small businesses keep more of their money, the ATO allows some business expenses to be claimed as tax deductions. What this essentially means is that you can put money into your business, and you don’t have to pay as much income tax come the EOFY. Win win!

Here’s how it works:

- You purchase a good or a service that directly relates to earning your sole-trader income

- You claim the cost of the expense as a tax deduction

- The cost of the expense is excluded from your taxable income, which reduces the income you pay tax on and lowers your effective tax rate

- You pay less in taxes at the end of the financial year.

This is oversimplifying it – the ATO won’t accept purchases made willy-nilly – but if you’re clever about it and the stars align, you could make a real difference to your final income tax bill.

📖 Ready to get expense-y? Find out everything you need to know in our monster guide to tax deductions.

📖 You can also use our tax calculator to see how claiming expenses reduces your effective tax rate.

💡 If you’re not sure whether an expense will be accepted by the ATO, it’s always a good idea to check with a tax specialist (like the Hnry team!)

How Hnry Helps

Hnry is an award winning app and tax service, designed specifically for sole traders.

For just 1% + GST of your self-employed income, capped at $1,500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

Our app models your income throughout the year and predicts your effective tax rate based on what you earn. We only ever deduct what we estimate you’ll owe, meaning you won’t get behind (or ahead!) on tax payments. You also won’t have to set money aside yourself – in fact, you’ll barely have to think about taxes at all.

Better still, using the Hnry platform costs less than using a traditional accountant, and is entirely tax deductible.

If that sounds good to you, join Hnry today and never think about tax again!