“I think I should pay more income tax,” said no sole trader ever.

If you’re self-employed, you know how hard it is to set aside a percentage of your hard-earned income to pay your taxes. Maybe you find yourself itching to use some of these funds to grow your business, or even take a well-deserved break (imagine!).

Luckily, there is a way to (legally) pay less in tax each year.

(And put more funds towards a bougie beach vacation – just a suggestion!)

To help sole traders and small businesses keep more of their money, the ATO allows some business expenses to be claimed as tax deductions. What this essentially means is that you’re rewarded for investing in your business, AND you get to keep more of your money come tax day. Woohoo!

Unfortunately, the tax deduction system isn’t as straightforward as buying an asset, paying less tax. For starters:

- only certain business expenses qualify for a deduction,

- claimable expenses differ from industry to industry, and

- some purchases are only partly claimable.

So how can you make the most of this complicated system? Buckle up team. It’s time to get fiscal. Here’s what we’ll cover:

- What is a tax deduction?

- Who can claim tax deductions?

- What expenses are tax deductible?

- Examples of deductible expenses

- Keeping records for the ATO

- 10 most common business expenses (as raised by Hnry users!)

- FAQs

- How Hnry makes claiming tax deductions easier

What is a tax deduction?

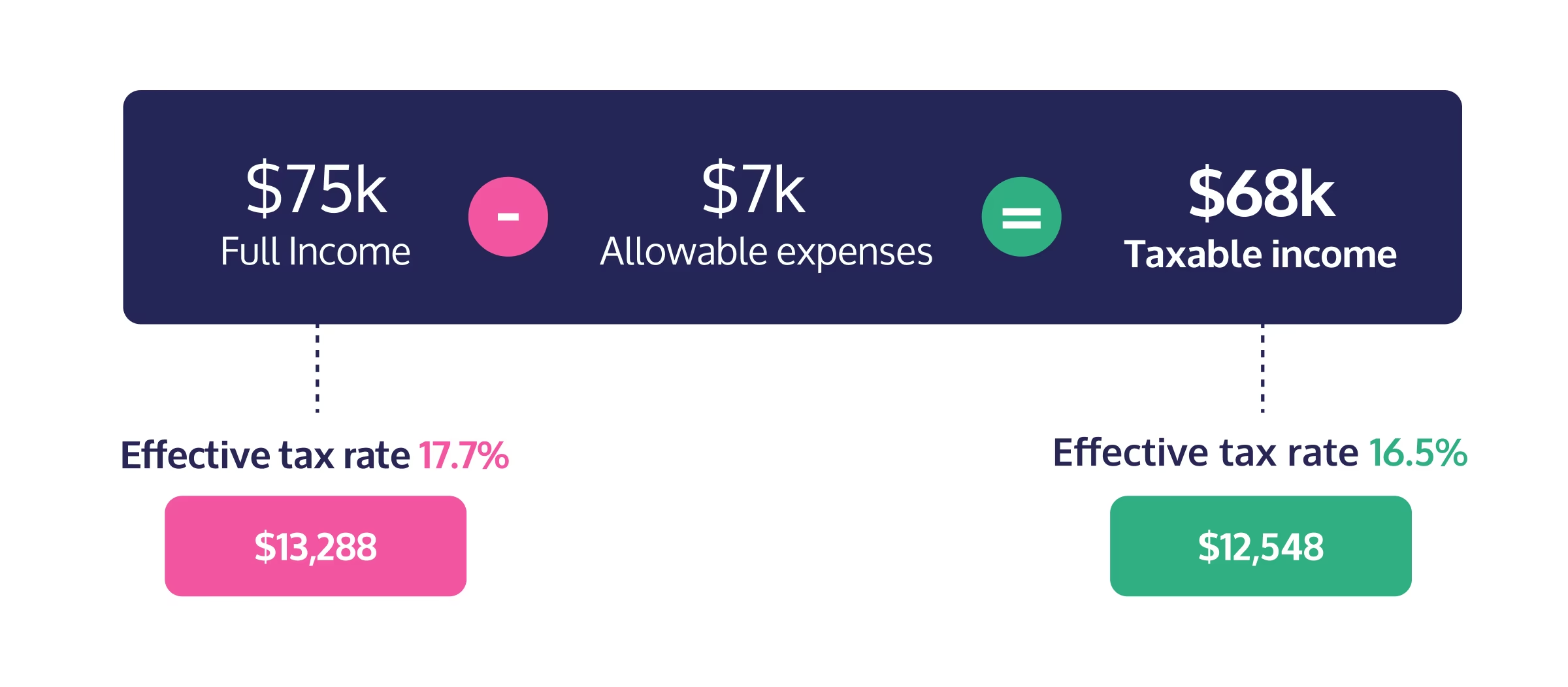

Despite having “tax” and “deduction” in its name, a tax deduction isn’t money deducted from the taxes you pay, that you then get to keep. Instead, a tax deduction reduces the amount of income you have to pay taxes on, resulting in less tax owed and a lower effective tax rate.

💡 An effective tax rate is the percentage of your total income that you pay in taxes. For more information, check out our guide to tax rates.

The ATO allows you to claim certain business expenses (or part of an expense) as tax deductions. This means that you won’t pay tax on the claimed expense, NOT that you get this amount back as a tax refund.

Sounds confusing? Let’s break it down:

💡 You can calculate your own effective tax rates before and after allowable expenses using our tax calculator. For more information about how tax rates work, see our guide to tax rates for sole traders.

💡 If you’re GST registered, claiming GST on expenses happens separately from claiming the expenses themselves. For more information, check out our guide to GST.

Who can claim tax deductions?

In Australia, anyone earning an income can claim deductions for ATO-approved expenses they incur in relation to their work. The ATO has three golden rules you must meet in deciding whether or not to make a claim:

- You must have spent the money yourself and weren’t reimbursed.

- The expenses must directly relate to earning your income.

- You must have a record to prove it (usually a receipt).

Along with their three golden rules, the ATO has industry specific guides for what you can and can’t claim as a business expense. You can find these guides on their website.

Although technically anyone can claim a work-related tax deduction, the rules differ for PAYG employees as the company they work for usually covers work-related costs. Those who try to bend the rules in creative ways can end up on the wrong end of an Australian Financial Review article - ouch.

But for sole traders, deductions are a brilliant way to pay less in taxes, while spending more money on their business. No 7-year-old personal assistant required.

What expenses are tax deductible?

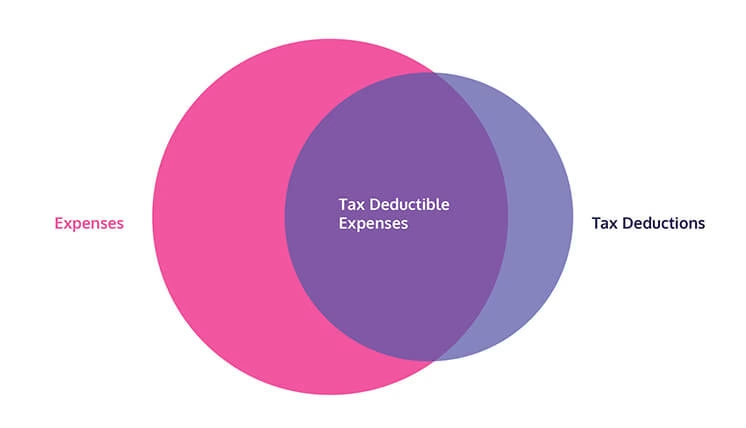

Fun fact: Not all tax deductions are business expenses, and not all expenses are tax deductible. The more you know!

Simple! Yet confusing. We hear you. Let’s dive in.

Business expenses

Business expenses are the costs you incur as part of running your business day-to-day. Basically, if you need something to help you get the job done, that purchase will be a business expense.

BUT the ATO won’t automatically accept every expense as a tax deduction. As we’ve already talked about, they have strict criteria for what is and isn’t tax deductible.

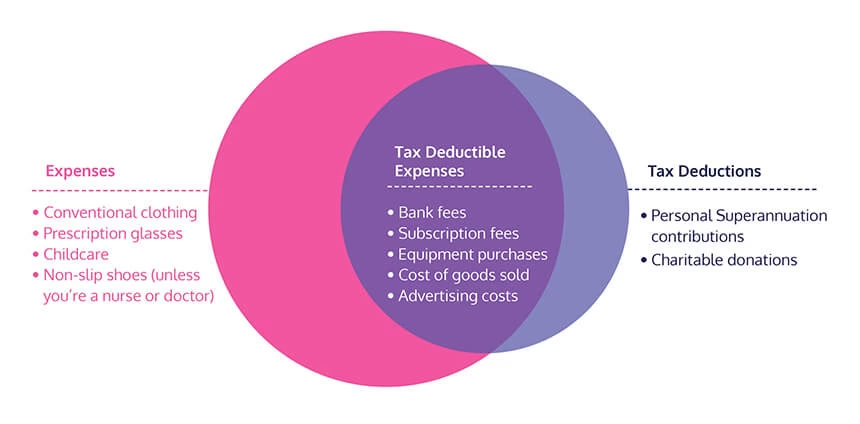

A good example is work clothes. The ATO only allows deductions for uniforms with logos, occupation-specific clothing, and protective clothing. Even if you only use certain clothes for work, if they could feasibly be worn outside of work, you’re out of luck:

Tax deductions

We’ve already covered what tax deductions are and how they work. But did you know that you can claim tax deductions for things other than business expenses?

The biggest example here is Superannuation. If you make personal contributions to your Superannuation, you may be able to claim a tax deduction for Superannuation contributions up to $30,000 (the concessional contributions cap in 2024/25). Eligibility for this deduction varies according to personal circumstances however, so it’s best to check the ATO website.

You can also claim a tax deduction for a gift or donation. In order for it to be eligible, it has to meet four conditions:

- It must be made to a deductible gift recipient (DGR: an organisation or fund that can receive tax-deductible gifts. You can check the DGR status of an organisation through the ABN website)).

- It must be a voluntary transfer of money or property without receiving, or expecting to receive, any material benefit or advantage in return, eg. no raffle ticket sales or purchases of a sausage sizzle are deductible.

- The gift or donation must be of money or property. This can include financial assets like shares.

- The gift or donation must comply with any relevant gift conditions. For some DGRs, the income tax law adds extra conditions affecting the types of deductible gifts they can receive.

With all this in mind, let’s update that snazzy venn diagram:

Examples of deductible expenses

Industry-specific deductions

The ATO’s 3 golden rules are actually just a starting point, and claimable expenses differ between industries and contexts. For example:

- Only nurses and doctors can claim non-slip shoes.

- Only actors can claim grooming costs (and that’s only if a specific role requires a specific hairstyle/colour etc).

- Only a judge can claim a judge’s robe. Why anyone would want a judge’s robe if they’re not a judge is anyone’s guess, but each to their own.

Because of this, you can’t automatically claim everything your friends and family claim – their deductions might not be applicable to your industry.

Partially-deductible expenses

Some business expenses are also only partially tax deductible. For example, you can only claim a deduction for:

- The business use of a work vehicle, not the personal.

- The percentage of your internet bill you used for business purposes

- Business calls made from a personal mobile phone.

💡 If you can’t prove that an eligible expense was partly or solely for business use, the ATO may not allow you to claim it.

Depreciating Assets

Finally, there are depreciating assets, which are claimed a little differently.

A depreciating asset is an asset that declines in value over time as it’s used. This might include cars, tools, computers, even books!

If you purchase a depreciating asset, there are few ways you can claim this as a tax deduction.

If the asset was bought/installed between 7:30pm on the 6th of October 2020 (no, really!), and 30th of June 2023, you might be able to claim the business portion of the expense in full immediately. It’s called temporary full expensing, and it was introduced by the ATO to help businesses during the pandemic.

You can learn more about the scheme in our article on temporary full expensing.

Otherwise:

- If the asset cost $20k or less (for the 2023/24 and 2024/25 financial years), you can claim an immediate deduction

- If the asset cost more than $20k (FY 2023/24 and 2024/25), you can claim a deduction for the decline in value using the simplified asset depreciation rules.

📖 Still lost? Check out our full guide to depreciating assets.

🙋♀️ Did we mention Hnry sorts depreciation for you? Simply raise the asset like a regular expense, and we’ll automatically calculate and claim the depreciation for you. See how it works.

Keeping records for the ATO

There’s nothing worse than putting hours of blood, sweat, and tears into your financial admin, only to realise at the end of the financial year that you lost the receipts!

Keeping clear, organised records of purchases and goods/products sold will help make tax time as stress-free as possible. It’s also good practice; the ATO requires you to save a record of your expenses (receipts) for five years after purchase, either physically or digitally.

Imagine five years of receipts strewn across your office floor, and you can see why a good filing system is super important!

That’s where Hnry comes in. You can raise expenses in our app, and we’ll manage them for you. We calculate your tax savings from expenses as you go, giving you immediate tax relief. Plus, we store your receipt photos for you for the required five years – no shoebox required, ever again!

For bonus points, you could also use the Hnry Debit Card. Every time you use it to make a purchase, it automatically raises an expense in the Hnry app, so nothing slips through the cracks. From there, all you need to do is upload a pic of your receipt, confirm a few details, and you’re done. Expenses sorted!

10 most common business expenses (as raised by Hnry users!)

Now we get to the fun stuff! Here are the top 10 most-raised expenses for our users in the last financial year:

- Motor vehicle expenses

This refers to maintenance expenses for car and non-car work vehicles like motorcycles, scooters, utes, and trucks. Once again, you can only claim the percentage you use the vehicle for business purposes.- For cars, you can use either the cents per kilometre method or the logbook method.

- For motor vehicles, you must use the actual costs method to claim expenses.

- 💡 Confused about the difference between a car and a motor vehicle? It’s more technical than you think! Check out our guide to claiming motor vehicle expenses to see what’s what.

- Equipment purchases

Any equipment purchased that you need in order to do your job e.g. Mobile phones software, camera equipment, tools. Remember though: If the equipment is for both business and personal use, you can only claim the business portion of the cost. - Cost of goods sold

These are the costs incurred as part of producing your work or providing your services. For example, a canvas purchased by an artist to produce a commissioned portrait. - Subscription fees

Any recurring subscription costs for business-related products e.g. recurring software costs, online magazines, newspaper magazine subscriptions, licensing fees. - Mobile phone bills

As mentioned, if the phone is for both business and personal use, you can only claim the percentage of the bill that was for business use. - Parking and transport

This one’s slightly tricky. You can’t claim the cost of transport to and parking at your regular place of work – this is considered your usual commute, and isn’t tax deductible. But if you’re required to travel elsewhere as part of your role, you can claim parking and transport costs for these trips. For more information, check the ATO website. - Advertising costs

This covers any costs of advertising your work in any way. So go ahead and commission that billboard you’ve been dreaming about forever. - Professional fees

All professional fees are claimable, including union fees, professional association fees, licensing fees, consulting fees, the cost of getting your blue card – even the 1% +GST Hnry fee. Make sure you claim them all! - Travel costs

Any travel costs incurred for certain work-related trips are tax deductible. But the trip does actually need to be for work – you can’t fly to Bora Bora, attend a seminar, drink cocktails on the beach and then expense the entire thing. That’s (unfortunately) not how it works! - Home office expenses

It does what it says on the tin. You can calculate home office expenses by calculating the actual cost of running your business from home. For more information, you can visit the ATO website.

Frequently Asked Questions

As tax experts dedicated to the sole trader cause, we’ve heard it all! Here are just a few of the more common things we get asked about:

How do I make sure I’m claiming everything I can?

To make sure you’re not forgetting anything, it’s a good idea to raise expenses as you go. So if you’re a Hnry user, you’d raise your business expense in the app as soon as you make the purchase.

But Hnry actually makes it even easier than that – have you tried our new Hnry Debit Card? It automatically raises expenses in the app for you every time you use it, so you’ll never miss another deduction again!

Do expenses have to be raised in the same year they’re purchased?

Yes they do! Expenses are claimed on a cash basis, meaning the purchase has to be made in the same financial year that you’re claiming it in order for the claim to be valid. It’s kind of like your income – you wouldn’t record income for a different financial year to the one you earned it in!

Do I have to earn a minimum amount to start claiming business expenses?

There’s no minimum – as long as you have business income, you can claim business expenses.

If your business has made a loss (eg. spent more for business expenses than you’ve made in income), this value of this loss will generally be carried forward into the next financial year.

Then next year, your business’ income for that year may be reduced by the amount of loss carried forward from the previous year.

📖 For more information on growing your sole trader business, check out our guide to profit.

Can I bulk upload expenses from before I was using Hnry?

Yes you can! For more information, visit our help centre.

Can I claim expenses for my PAYG job with Hnry?

Yeah absolutely! Raise the expense in the Hnry app the way you normally would, just make sure to select “Salary/Casual Income” in the drop-down menu for expense work type.

Do you have a list of common tax deductions?

Sure do!

We currently have individual articles on tax deductions for:

- Tradies

- NDIS Workers

- Nurses and Midwives

- Doctors

- Psychologists and Counsellors

This list will be expanding in the near future, so keep checking in on our website. Otherwise, we’ve created a list of the 10 most common expenses as claimed by our users – just scroll up.

How Hnry makes claiming tax deductions easier

We may be biased, but we believe that the best way for sole traders to maximise their tax deductions (legally) is to use Hnry.

Hnry is an award-winning service that’s helping sole traders spend less time on financial admin, and more time doing what they love (unless what they love is financial admin).

For just 1% + GST of your sole trader income, capped at $1,500 +GST a year, we calculate, deduct, and pay all your taxes, levies, and whatnot for you, including:

… meaning you won’t have to think about any of that. Ever. We’ll even lodge your tax return and Business Activity Statements for you, at no additional cost.

Raising expenses through our app is as simple as taking a photo of your receipt and inputting a few extra details. From there, our accountants will manage and claim your expenses, so you get the tax relief back in your pocket in real time (rather than having to wait until the end of the financial year). Easy as!

Get your tax ducks (and deductions) in a row by joining Hnry today!