If you’re based in Victoria, then you may be eligible for support payments related to the June/July 2021 Covid-19 outbreak.

So far the Australian government has made the following relief payments available:

For individuals:

‘Covid Disaster Payments’ have been made available to individuals who have been impacted by the July 2021 lockdown. The Australian government is responsible for these payments and more information can be found here.

‘Small businesses COVID Hardship Fund’ provides $10,000 grants for small businesses that have experienced a reduction in turnover of over 70%.

What payments are available to individuals now

The ‘COVID-19 Disaster Payment’ is a payment from the Federal government to individuals affected by a declared lockdown. This is a lump sum payment to help when COVID-19 restrictions last for more than 7 days. Every 7 days is called an ‘event’ and payments can be claimed once for every event.

There are different dates for the ‘events’ depending on whether you are affected as part of Victoria.

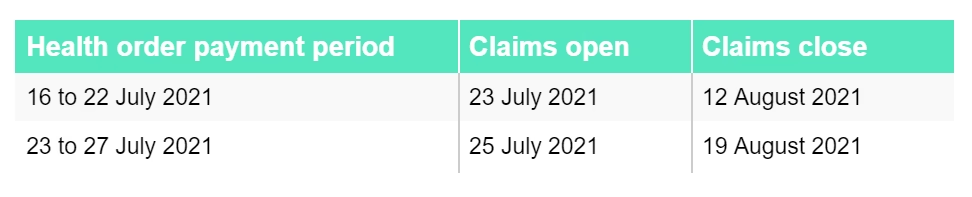

The dates of each event are listed below:

Key dates for Victoria July 2021

Key dates for Victoria August 2021

These dates will be adjusted as further lockdowns are announced. Most up to date dates can be found for Victoria here.

How much can I get

For the first and second events (16-22 July and 23-27 July in Victoria):

- If you have lost less than 20 hours work - you’ll get $375 per event

- If you have lost more than 20 hours work - you’ll get $600 per event

For the third event onwards (6 August - 2 September in Victoria):

- If you have lost less than 20 hours work - you’ll get $450 per event

- If you have lost more than 20 hours work - you’ll get $750 per event

The disaster payment is a non-taxable payment - it will not be included in your 2021/22 tax return.

How do I get the payment

Claims can be made through your myGov account linked to your online Centrelink account.

Small businesses COVID Hardship Fund

‘Small businesses COVID Hardship Fund’ provides $10,000 grants for small businesses that have experienced a reduction in turnover of over 70%.You will have to show that as a direct consequence of COVID restrictions you have experienced this reduction for at least two weeks comparable to a benchmark period in 2019. You must also be GST registered and ABN registered from 28 July 2021. Finally you must not have received any funding from the Victorian government after 27th of May 2021. A full list of eligibility requirements can be found here.

If you’re a Hnry customer

If you’re a Hnry customer, then you’ll still need to claim the support payments through your myGov account.

If you have questions about how the support payments will affect you from a tax perspective, simply get in touch with the team to talk through your options!

* This article is up to date as of the 23 August 2021, as Covid restrictions change so will this information.

Share on: