DISCLAIMER: The information on this page is intended to be general in nature and is not personal financial product advice. It does not take into account your objectives, financial situation, or needs.

As a sole trader, you’re the business (whooo!). This means your business earnings need to cover your personal expenses – and your future finances. Savings and investments are a key part of managing your money in both the short and long term.

People sometimes lump savings and investments together, but they’re slightly different things, with different purposes, depending on your goals. Knowing how to save money is essential. But where do you start? And what’s the difference between the two?

To help you get a headstart on your financial goals, we’ve put together this guide on money-saving tips and investment options for sole traders.

While we’re here, we’ll also cover how Hnry’s Allocation feature can make both saving and investing automatic. What’s not to love?

How to save money

First things first: What are savings?

Your savings are cash you’ve set aside that you can access quickly. This could be for something you’re saving for specifically, or in case of emergencies.

Say your car broke down (bad luck). You’d want cash on hand to pay for the repairs, right?

In this scenario, you wouldn’t want to rely on investments, where your money might be tied up and difficult to access!

How to save money

The (hopefully) million-dollar question!

Very basically, you save money when you spend less than you earn. So if you’re currently not saving money, but you’d like to, you could either:

- Spend less

- Earn more

- Both of the above (the high-powered option)

Obviously, this is easier said than done.

Spend less

A good starting point would be to create a basic budget. Map out all your business and personal expenses for the next month, as well as everything you expect to earn. If your earnings cover your expenses, fantastic!

If not, you might need to go through your expenditure category by category and see where you could cut back.

📖 For more information on budgeting as a sole trader, check out our in-depth guide to budgeting.

Earn more

Growing your profits could mean recalculating your margins, switching suppliers, or even launching a new line of homeopathic dog treats (you could make a killing!).

If you sell your services, for example your writing or design skills, you could consider raising your hourly or project rates – especially if your expertise has increased since you first started trading.

If you sell a product, can you source the same supplies for less? Charge more per item? Or introduce a new orange-chocolate-scented candle to your scented candle range?

📖 Ready to boost your earnings? We have a guide for measuring and growing your sole trader profits.

Things you could save for

There are a few different things you could consider saving for:

Sick leave: As a sole trader, if you’re ill and can’t work, you don’t get paid. Having money on hand for times when you’re under the weather can take the pressure off and help you get better faster.

Holiday pay: Unlike an employee, no one’s paying you while you’re off on vacation. You’ll need enough cash to cover both the holiday and your regular business and personal expenses while you’re soaking up the sun or camping in the wilderness. After all, you won’t enjoy the time away if you’re worrying about money!

Paying down debt: If you’ve got credit card bills or other loans, it’s a good idea to pay off the outstanding balance before interest gets added. You can end up wasting hundreds or thousands of dollars on interest payments alone – you may as well flush your hard-earned cash down the toilet.

Medium-term goals: Say your business is doing well (go you!), but in order to grow, you need to invest in additional training or buy new equipment or stock. Putting money aside regularly can help you reach these kinds of goals faster.

Upcoming business and personal expenses: Medical bills, car repairs, new contact lenses – they all pile up. Be ready for them.

Emergencies: Unexpected costs (like your pet needing urgent surgery) can strain your business and mental health. A ‘rainy day’ fund can be a lifesaver (literally).

Where to keep your savings

Savings should be easily accessible but also safe – so maybe not cash stuffed under your mattress!

You could opt for a bank account that allows you to access funds instantly. You might face lower interest rates compared with something like a term deposit but instant access could be worth it. Just remember to check the Ts and Cs and make sure you’re across any associated fees.

To help keep things straight, you could also open multiple accounts named for specific purposes, like ‘Holiday Fund’ or ‘Sick Leave’. That way, you’re less likely to spend money set aside for one purpose on something else.

Top trick: Hnry’s Allocation feature (more on that later) makes this super easy.

How to calculate savings

To set a savings goal, figure out how much you want to set aside and break this down into a weekly or monthly target.

Alternatively, you can multiply the amount you can afford to set aside to see how much you could save in the future.

For example:

- “If I set aside X amount each month, in three years I will have Y.” Or:

- “To save X amount by Y date, I need to set aside Z amount.”

Factor in inflation and rising living costs to ensure you save enough.

You can also commit to putting aside a certain amount of your income indefinitely. Although once you hit your financial goals, you might want to start investing instead.

Speaking of which–

What about investments?

Investments are like savings, but with the specific goal of growing your money – in other words, getting out more than you put in. Who doesn’t want that, right?

Unlike savings, money you invest generally shouldn’t be money you need immediately because investment growth can take time – often years. And it’s harder to access money that’s tied up.

There are all sorts of things you can invest in, from property and assets, to shares and superannuation. Some investments are riskier than others.

Things you could invest in

Superannuation fund

As a sole trader, compulsory super isn’t a requirement, but voluntary contributions can set you up for a comfy retirement. Super works by reinvesting your earnings, which then generates more earnings – a beautiful cycle that can grow your nest egg significantly over time. While your senior years may be a way off, you want to make sure you enjoy them – think beachside cocktails, not instant noodles.

There are many different super funds you can choose from. If you work in the health sector, there are super funds specifically for health professionals that may offer you additional benefits or perks. Or maybe you’re ethically-minded and don’t want your hard-earned money going to corporations you don’t support. There’s at least one super fund that has ethics at the forefront and many mainstream super funds have an ethical or eco-package.

You can also choose the type of investments you want your money to go to, and the risk factor. Many super funds have ‘high’, ‘medium’ and ‘low’ risk packages you can choose. The higher the risk, typically the higher the reward – but you can also lose money this way, so choose wisely.

📖 For more information, check out our complete guide to superannuation.

Shares

When you buy shares in a company, you own a part of it. As such you may be eligible to receive dividends (not all companies pay them though). This is handy if you’re looking for regular income from your share investment. Or you can choose to sell your shares for more than you paid for them. This is known as capital growth or capital gain.

Investing in shares is risky, so you need to do your homework. Research companies listed on the Australian Securities Exchange (also known as the stock exchange) and keep an eye on their financial performance. Also consider what sectors are likely to do well in the future (early Apple shareholders, for example, are likely to have hit the jackpot with their initial investment).

To buy and sell shares, you need to use either an online trading platform or hire a broker who can advise you on what to buy and sell as well as do the trade for you. Both these options have risks. If you’re trading yourself, you need to be well informed about the markets. And if you hire a broker, you need to make sure they’re knowledgeable and trustworthy.

Exchange Traded Funds (ETFs)

So, what is ETF investment? ETFs diversify your investments into other assets including commodities (such as gold or silver), foreign currencies, international shares, or bonds. They’re easy to trade with relatively low management fees.

Again you can find specialist ETFs to suit your needs – there’s even a vegan one! As with all investments, ETFs carry risk, so make sure you do your research or consult a qualified professional to advise you.

Property

There’s a difference between buying a property to live in as your home and an investment property. The former is actually a liability, not an asset, as it’s not bringing in any income.

There are a couple of ways to make money from property investing:

- Buy one or more investment properties and rent them out to tenants: This brings in regular income. You can choose to sell the property down the track after it’s gone up in value.

- Flipping: This is where you buy a property at a lower market value, renovate it, then immediately sell or ‘flip’ it for a profit. You can repeat this process as often as you like.

If you hold an investment property for a while, make sure you can cover all the expenses. This includes strata fees (if it’s an apartment), council rates, water rates, real estate rental management fees, and mortgage payments. Oh, and be sure to have a contingency fund for repairs.

While property is often considered a more reliable way of investing, it’s still risky and you must do your research on where, when and how to buy to maximise your returns.

Cryptocurrency

Crypto is the latest player in the investment game – and it’s arguably the riskiest one. Early Bitcoin investors might be lounging in luxury now, but many people find themselves facing substantial losses, shivering through multiple ‘crypto winters’.

Crypto is an unpredictable and highly volatile market. So, again, educate yourself thoroughly, and only invest what you can afford to lose.

💡 Note: each of these investment opportunities has different tax implications you need to consider. The good news is that if you’re a sole trader Hnry can help with all your tax obligations.

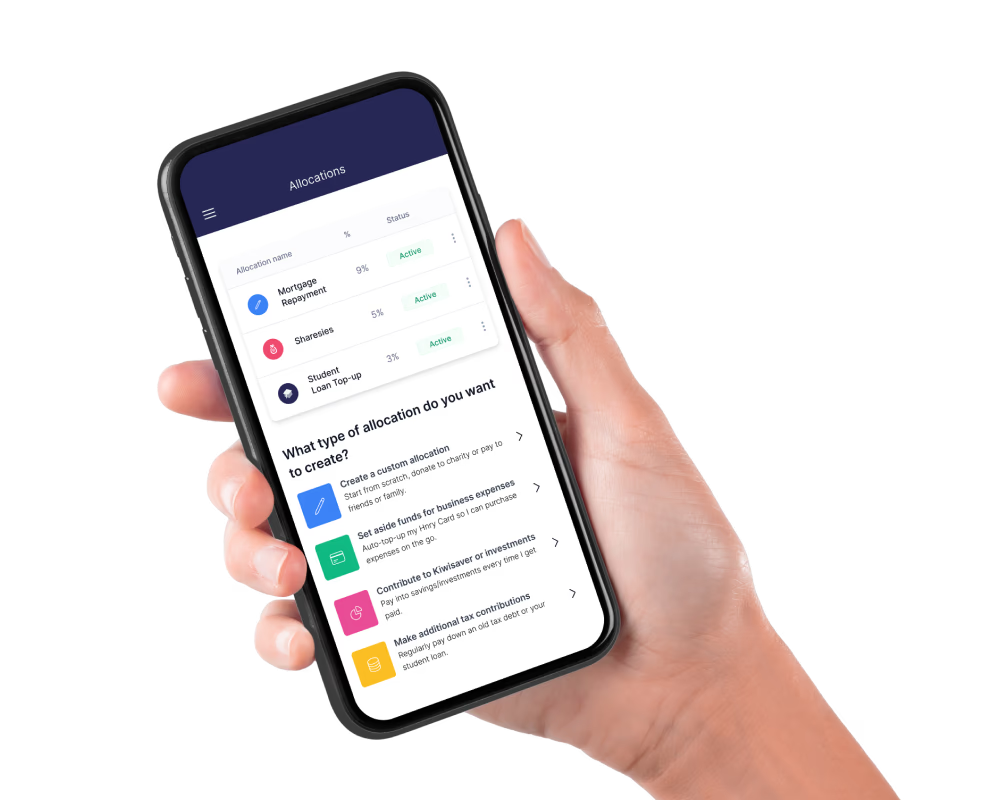

Hnry’s Allocation feature

Thinking all this sounds great, but complicated? Well, Hnry’s Allocation feature is here to save the day!

You can now automatically have money set aside from your income and transferred into different accounts. Nominate percentages of your income to go into various funds every time you’re paid. You control where your money goes. It’s quick, hassle-free – and free!

Bonus: Hnry also handles your taxes

We’re not just about Allocations. Hnry also takes care of all your tax needs.

We’re an award-winning app created solely (ha!) for sole traders like you. We understand the challenges of running a business and let you focus on what you’re good at while we take care of the boring tax stuff – at a fraction of the cost of a traditional accountant.

Join Hnry today!

Share on: