If you’re an Aussie with a degree, you’re probably familiar with Australia’s student loan system (HECS/HELP). Essentially, you borrow a small fortune to get a degree, and then when that degree gets you work, you use your wonderfully big salary to pay that small fortune back.

The problem is that if you’re a sole trader, you’re entirely responsible for managing your own repayments. And it’s no small sum – if you earn above the repayment threshold (currently $67,000 for financial year 2025/26), you’re required to pay a set percentage of every dollar you earn towards your student loan debt. Yes, even if you’re still a student (we see you side hustling!).

Australian student loans also come with a weird quirk – they’re annually indexed to either inflation or wage growth, whichever is lower. What that means is that your loan is set to grow (maybe shrink, most probably grow) alongside the Consumer Price Index or Wage Price Index. This can make paying off the balance in full extra tricky, especially if the economy is tracking like a roller coaster.

Because of all this, we thoroughly recommend saving for your student loan repayments throughout the year, instead of leaving it until the very end. And if you have exceptionally high student loan debt (oof), there are a few things you may want to consider when planning your repayments.

Let’s crack into it!

- Student loans in Australia

- How student loans work

- Checking your student loan balance

- Repaying your student loan while overseas

- Should you pay your student loan off faster?

- Automate your student loan repayments with Hnry

Student loans in Australia

Once upon a time (1973), local students could earn a degree from Australian universities for free.

This changed in 1986 with a modest administration fee of $250, and then again in 1989, when the then government introduced the Higher Education Contribution Scheme (HECS). To help fund their university education, students were asked to contribute a whopping $1,800 a year towards their tuition (around $4,664 in today’s money).

From there, the student loan system was changed and updated regularly in order to remain cost effective. Income repayment thresholds were introduced, fees increased (understatement), different repayment incentives were implemented and then discarded. It was a confusing time for students who weren’t maths/commerce majors.

And then, as if things weren’t perplexing enough, in 2003 the government announced the introduction of a new Higher Education Loans Program (HELP).

HECS was incorporated into HELP, to become HECS-HELP. FEE-HELP was introduced to cover full fee-paying courses, taking over from older HECS-based schemes like OLDPS, PELS, and BORPLS.

(We promise we’re not making any of those acronyms up.)

This is all honestly just skimming the surface, but the bottom line is that a lot of thought and work has gone into Australia’s student loan system – meaning it’s kind of convoluted. And subject to future change, depending on the government in power.

All this brings us to the present day, where more than 3 million Australians owe roughly $80 billion in student loan debt. So really, if you still have a hefty student loan, welcome! You’re in great company.

How student loans work

Alright, we’ve (tried to, briefly) covered the history of student loans in Australia – here’s how it all works in practice.

Compulsory student loan repayments

We’re not going to lie, this is where things start getting tricky.

In Australia, student loan repayments are calculated based on your repayment income. From the 2025/26 financial year, once you earn above the repayment threshold, you’ll need to pay a percentage of every dollar you earn above the threshold towards your student loan. This percentage amount depends on your repayment income – the more you make, the higher the percentage.

The one caveat is if you earn above the top threshold – currently set at $179,286 (good for you!). At this point, you’ll owe 10% of all your repayment income in compulsory repayments.

Just like with income tax brackets, how much you’ll owe depends on how much income you earn within each repayment bracket (or if you earn above that top threshold). Luckily (unlike with income tax!), there are only four brackets for student loan repayments:

| Income band | Repayment percentage on that income |

|---|---|

| $0 - $67,000 | 0% |

| $67,001 - $125,000 | 15% |

| $125,001 - $179,285 | 17% |

| $179,286+ | 10% of all repayment income |

Compulsory repayments are calculated based on your repayment income, which includes:

- Taxable income

- Reportable fringe benefits

- Total net investment loss

- Reportable super contributions

- Any exempt foreign employment income

The amount due is calculated using your income tax return, and is payable as part of the lodgement of your tax return.

💡 Pre FY2025/26, student loans were calculated at a flat rate that applied to your entire income, depending on your earnings threshold. Previous rates can be found on the ATO website.

Compulsory repayments calculator

Voluntary student loan repayments

If you really want to knock down your loan balance, you can make voluntary repayments throughout the year.

But the important thing to remember is that voluntary repayments don’t count towards your compulsory repayment.

For example, if you have a compulsory repayment of $3,000, and you make voluntary repayments throughout the year totaling $4,000, you’ll still owe a compulsory repayment of $3,000. So all up, you’ll pay $7,000 that year towards your student loan.

What voluntary repayments do help with is reducing your balance, before your loan is indexed. Speaking of which -

Indexing to inflation or wage growth

In Australia, student loans are interest free. This means that unlike other kinds of loans, they don’t accrue interest.

But unlike other kinds of loans, student loans are indexed to inflation or wage growth. What this means is that if the Consumer Price Index (CPI) or Wage Price Index (WPI) rises or falls, your student loan balance rises or falls by the same percentage amount (whichever rate is the lowest). According to the ATO, this is to maintain the real value of the loan without it being eaten away by inflation.

In theory, this is comparable to being charged a low interest rate. Historically, the annual inflation rate in Australia has sat between 1-3%, which is lower than some interest rates charged on student loans overseas.

But in practice, student loan indexation has hit a few roadbumps. Before the 2022/23 financial year, student loans used to only be indexed to the inflation rate. Then in May 2023, inflation rose to 7.1%, meaning that if you had a student loan, you suddenly owed 7.1% more than you did before the most recent round of indexation.

To account for unstable inflation, the government at the time changed the system so that student loans would be indexed to either inflation or wage growth, whichever was lower. These changes were applied retrospectively to the 2022/23 indexation rate, offering some relief from the sky-high 7.1% increase.

📖 For more information on these changes, as well as student loan indexing, check out our HECS loans indexation explainer.

Indexing and repayments

Now we’ve covered how indexing and repayments work, let’s talk about how they work in conjunction.

The last weird quirk of the Australian student loan system is that your compulsory repayment is due after your loan is indexed for the year. What this means is that if inflation/wages have gone up, your loan balance will increase before you reduce it with your compulsory repayment.

This usually isn’t too big a deal, but if the indexation rate skyrockets, it’s definitely something to bear in mind. Making voluntary repayments before indexation could save you quite a bit down the line.

Recent changes to student loan repayments

Over the past few years, the government has made three major changes to the student loan repayment system:

- Indexation

- Marginal repayment rates

- 20% reduction

All these changes have been designed to make things a little easier for those with student loan debt – especially given the current high cost of living.

1. Indexation changes

Like we mentioned earlier, until financial year 2022/23, HECS loans were only ever indexed to inflation.

This was to stop the value of the loan from eroding over time. For example, $10,000 in the year 2000 is worth about $19,000 now. If you spent $10,000 to earn a degree in 2000, and that $10,000 wasn’t indexed, you’d only owe $10,000 today – even though the value of the degree would be worth $19,000 in today’s money.

(Fun fact – New Zealand student loans aren’t indexed, and they don’t earn interest, meaning that’s actually how it works over the ditch!)

Indexing student loans with inflation means that borrowers are always repaying the true value of the loan. But if the inflation rate skyrockets (like it did during the pandemic), so too does everyone’s balances. And if wages don’t rise at the same rate, paying off your student loan can get quite difficult.

In FY 2022/23, to help stop balances from spiraling out of control, the government decided that student loans would be indexed to either the CPI or the WPI – whichever was lower.

2. Moving to marginal repayment rates

Pre FY 2025/26, student loan repayments were calculated by applying a flat-rate repayment percentage to your entire income, once you earn over the repayment threshold.

Say you earned $60,000, and the repayment threshold was $50,000. If the rate of repayment for a $60k income was, say, 5%, this 5% would apply to all your income – not just the $10k above the repayment threshold.

So you’d be paying 5% on $60,000, which is $3,000, instead of 5% on $10,000, which is $500.

From FY 2025/26, we’re moving to a marginal rate system, where repayments are calculated based on income within a repayment bracket, rather than a flat rate applied to the whole of your income.

Going back to our earlier example, the new marginal rates system means that you would only pay 5% on $10,000, rather than the full $60k. Tada!

💡 The repayment rate isn’t actually 5%, by the way. We covered the actual threshold and rates earlier – just scroll up!

3. The one-off 20% balance reduction

As part of budget 2025/26, the government announced a one-off 20% reduction of all student loan debt. Basically, everyone with student loan debt after 1 June 2025 will have their balance reduced by 20%. Whoooo!

To get into the weeds, this reduction will apply to your balance pre-indexation – so whatever your loan balance was before the FY 2025/26 increase. It’s an automatic thing, so you don’t have to do anything, and it’ll happen before the end of the (calendar) year.

If you paid your loan balance off this year, before 1 June, we’re sorry to say this measure won’t apply to you – technically your balance was $0 at the point the discount was applied, and a 20% reduction of $0 is $0.

But if you paid your balance off after 1 June, you’ll receive the 20% reduction in the form of a credit. Presuming you don’t owe anything else to the ATO, the credit will be processed as a refund, and should hit your bank account before the year’s out. Easy!

Finally, it’s important to note that this is a one off thing – it’s not set to happen again. The government could decide to implement similar measures in the future, but that’s completely up to them.

Checking your student loan balance

You can find a full breakdown of your student loan balance, as well as how much you’ve already repaid, in your myGov account.

💡 If you’re not registered with myGov, it’s fairly straightforward to get set up!

You’ll be able to see how much indexation has added to your loan balance over the years, as well as whether or not your compulsory repayments have been making a dent or not.

But if this is the first time you’re checking your numbers, we recommend steeling yourself – there’s a chance your loan balance may be higher than you think.

If you’ve been very unlucky with the indexation rate and your working situation, you may discover that your loan balance hasn’t gone down at all, or has actually gone up since graduation. In which case, it could be a useful exercise to see if making voluntary repayments will help manage your balance.

And if it helps at all, you’re not alone.

Repaying your student loan while overseas

Now for some good news! Repaying your student loan if you live in another country is actually relatively straightforward.

If you’re heading overseas for 183 days or more in a 12-month period, you’ll need to update your contact details accordingly and submit an overseas travel notification within seven days of leaving Australia.

You’re then required to report your worldwide income to the ATO through your myGov account before the 31st of October each year. Based on this, the ATO will calculate how much you owe in student loan repayments using the same system as for local borrowers.

💡 If you don’t make the 31st October deadline, you may be charged a penalty fee. Be sure to lodge on time!

Should you pay your student loan off faster?

Outside of the compulsory repayments, should you be proactively paying off your loan?

We’re going to satisfy no one with our answer – it really does depend (sorry!). When asking yourself this question, there are a few things you need to consider for yourself and your situation.

1. Indexation and value

If the indexation rate is low and steady, your loan shouldn’t increase by much year on year (unless you owe a hefty amount).

But if you know that your loan is set to increase by a lot due to indexation, voluntary repayments can help offset this. It’s money out of pocket now, but it’ll save you potentially thousands of dollars in loan increases.

2. Applying for a mortgage

Student loans can impact the amount a bank will let you borrow when buying a house. If you plan on getting your own place soon, it may be worth seeing if you can lower your student loan balance.

We recommend talking to your bank about it first though, before you go dipping into your house deposit!

3. The % pay cut

If you earn above the repayment threshold, a set percentage of your earnings are required to go towards your student loan. Once you pay your loan off, you’ll have a few extra thousands (potentially) to play with every year.

Imagine what you could do with those extra funds?

4. Your risk tolerance

If you have a high tolerance for risk, you may be more inclined to put your money into high-reward investments that have the potential to net you significant gains (or significant losses).

But if you have a low-risk appetite, it might be more important for you to pay off your “low risk” student loan before anything else. After all, as we’ve seen over the past few years, no one can accurately predict the indexation rate!

5. Overseas admin

If you’re heading overseas for a long period of time, you’ll have a bit of extra admin to deal with, as well as handling all the local tax implications.

It’s not a big deal, but paying off your student loan means one less piece of admin to think about. Say goodbye to the ATO, and hello to the European/Asian/American sun, sand, and surf (or whatever it is you’re doing outside Australia).

6. The mental load

Many ex-students are grateful for the education they were able to undertake, but still feel burdened by the weight of their student loan. If this is the case for you, nothing can compare to the weight off your shoulders once you’re done paying it off.

Don’t forget to throw a massive shindig when that loan balance hits $0. You’ll have earned it.

Automate your student loan repayments with Hnry

Look. You’re busy. We get it. You don’t need to be reading yet another article about money you owe the ATO. Which is why we really recommend you start using Hnry.

(Yes, we’re biased; hear us out.)

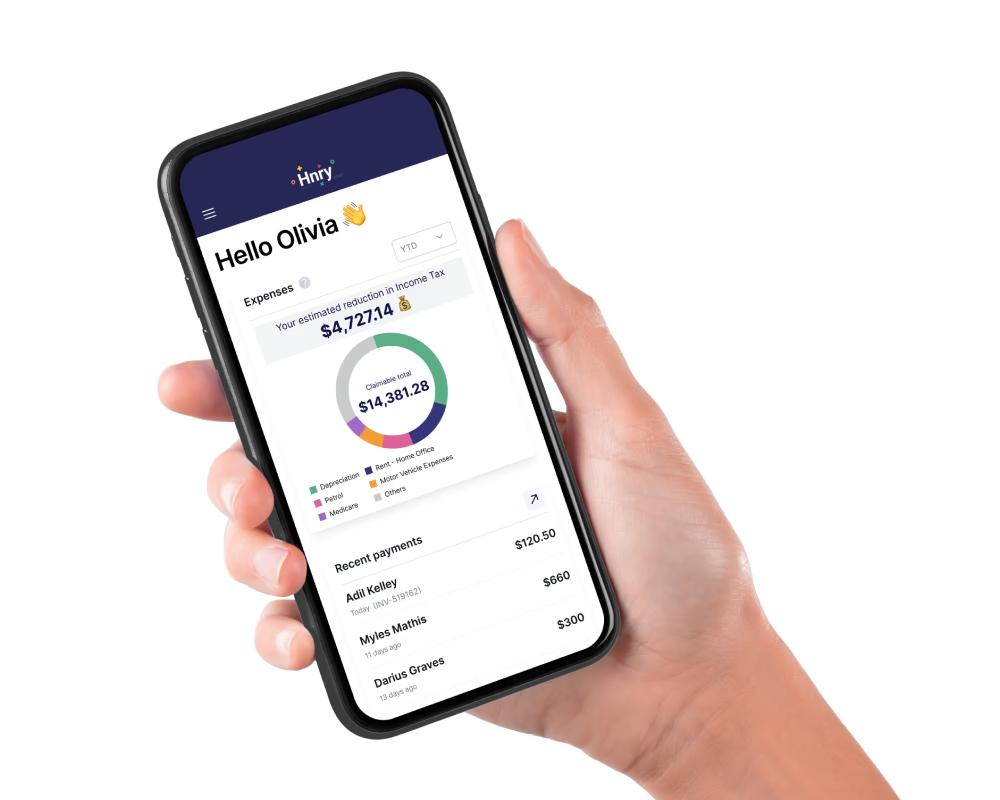

Hnry is an award-winning tax and financial administration service for sole traders. For just 1% of your self-employed income, we will completely sort out your compulsory student loan repayments, alongside your:

- Income tax

- GST (if applicable)

- Medicare Levy

- Superannuation contributions (optional)

We also lodge your annual tax returns, as part of the service.

Whether you’re just starting out, or an industry veteran, Hnry is designed for all sole traders. We make sure that you never know the horror of an unpaid tax bill – ever. And that’s a big deal, believe us.

Forget your student loan exists. Join Hnry today.