As a sole trader, you are your business – meaning that your business finances are an extension of sorts of your personal finances.

Because of this, your hard-earned dollars need to cover everything, from your business’ overheads and expenses to your personal, everyday essentials.

So bearing in mind that you need to keep both you and your business running, how do you decide how much to pay yourself in good times and bad? What about putting some money aside for sick leave, or savings, or even a well-earned holiday?

This is where budgeting comes in.

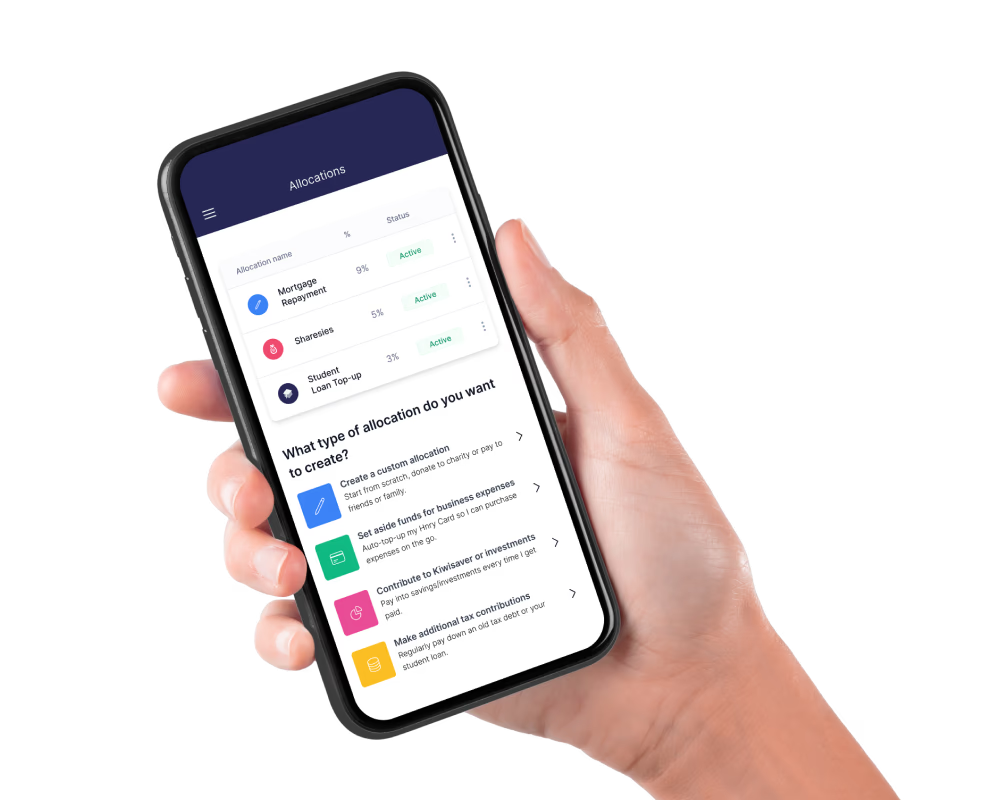

A good budget is a plan that will help keep you and your business funded. Let’s take a look at how to budget as a sole trader – including how Hnry’s Allocation feature makes it easy to set money aside so you don’t accidentally spend what you actually mean to save.

- Why budget?

- Budgeting as a sole trader

- Balancing your two budgets

- Creating a budget

- Adjusting your budget

- Budgeting apps

- Tips and tricks

- Budgeting FAQs

- How Hnry helps

What is a budget?

A good budget is essentially a spending plan that will get you to your goals. It’s all about taking charge of how and when you intend to use your money.

Unlike a cash flow forecast, where you predict the timing of future income and outgoings, budgeting is telling every dollar you have – and will have – exactly what to do. Whether it’s paying yourself or the bills, building up your savings, or putting some cash back into your business, budgeting makes sure your money is always pulling its weight.

By budgeting smartly, you’re less likely to be blindsided by unexpected expenses, and you can jump on opportunities when they pop up. Nice, right?

How to budget as a sole trader

Like we said earlier, when it comes to your finances, you and your business are pretty much one and the same. Budget-wise, it’s like having a dual personality. Essentially, you’ve got two budgets to manage:

A budget for yourself

Firstly, you need to cover the basics, such as your rent or mortgage, groceries, utility bills, and other everyday essentials.

Don’t forget the potential need-to-haves, like funds for sick leave, taking a break, or going on a holiday. Even sole traders need downtime!

Then there’s the nice-to-haves – this is your ‘fun’ money for little treats and outings that make life enjoyable without breaking the bank.

Finally, let’s not skip investments and savings! It’s always smart to stash some cash for the future, whether it’s a rainy day fund or a retirement fund that could grow over time.

A budget for your business

What do you need to set aside to hit your business goals? This might include funds for supplies, marketing efforts, or expansion plans. For example, if you want to bring a new product to market, you may need to spend more upfront, so you’ll need to set aside extra in your budget for that.

Consider the overheads too, such as rent for an office space, utility bills, or any software subscriptions that keep your business running smoothly.

If your business has seasonal highs and lows, budgeting is even more important. For example, a landscaping business often sees an increase in demand during the spring and summer months when people are eager to spruce up their gardens. During these busy periods, income is typically higher, so it’s crucial to budget wisely. You can set aside a portion of those earnings to cover quieter months, like winter, when demand might drop off.

By having these dual budgets, you’ll have a clear picture of where your money needs to go, keeping both your personal life and business ambitions ticking along nicely.

What’s the right balance between business and personal?

Finding the right balance between your personal budget and your business budget is all about setting priorities and being flexible as your circumstances change.

Imagine your finances as a seesaw, where both personal and business needs must be weighed carefully. On one side, you’ll need to make sure your personal essentials are covered – eg. housing, food, and health – because you can’t run a business sustainably if your personal life isn’t stable. On the business side, you may want to prioritise investments in areas that drive growth or stability, such as inventory, marketing, or necessary overheads.

Striking the right balance means regularly reviewing and adjusting your budgets as needed. Keep an eye on both the short-term necessities and long-term goals, allowing room for savings and unexpected expenses in both areas. This helps you create a stable financial foundation that supports both your personal wellbeing and business success.

How to create a budget

Creating a budget might sound a bit intimidating, but it’s really just a few simple steps.

You can get started using an Excel sheet (or a notebook, or scrap piece of paper – anything really). From there:

1. List all your income

Record how much money is coming in, where it comes from and when it arrives (eg. weekly, monthly, annually). If your income varies, calculate an average amount.

Remember to include all income, including anything you receive outside your sole trader business, like PAYG income, government benefits, or earnings from investments.

Create two columns, one for estimated income (take this from your cash flow statement) and one for actual income.

2. List all your expenses

Make sure to include your regular, essential costs – those things you need to pay in your personal life and business to keep everything ticking along smoothly.

Fixed expenses can include rent or mortgage payments, utility bills, council and water rates, household needs (yes, coffee is included!), transport, and insurance.

Debts must be included, such as any personal loans, your student loan, and credit card repayments.

Don’t forget those sneaky unexpected expenses, such as car repairs, surprise medical or vet bills, or fees for school trips.

An easy way to make sure you don’t miss any expenses is to take a peek at your recent bills or bank statements. Note down what each expense you’ve had was for, how much it cost, and when it was due. You can use this info as a basis for what expenses you may have in the future.

Again, include two columns in your Excel sheet – one for estimated expenses and one for actual expenses.

3. Allocate funds to each expense

Now, divide up your funds into different expense categories. Remember to prioritise expenses based on what’s most important for your business and personal goals.

For example, if your goal is to improve your online presence as a sole trader, you might want to allocate more money to creating a glamorous website or boosting your social media marketing. Or, if you’re looking to expand your service offerings, you might choose to invest in training courses or new tools for your trade.

Analyse your budget regularly and make adjustments

Your budget is like a well-tailored suit – it should fit you perfectly, so make sure to adjust it as life throws its curveballs.

Say, for example, your expenses suddenly skyrocket (maybe those daily lattes are adding up?). You might have to rein in your spending a bit, or rethink your savings target.

On the flip side, if you finally clear that credit card debt, you might find yourself with some extra cash to allocate for a summer holiday (hello Bali!). It’s all about making the numbers work for you.

💡 Don’t want to create an Excel sheet from scratch? You can download a small business budgeting template from the Australian government’s business website.

Budgeting apps

Not a fan of spreadsheets? We hear you.

Budgeting apps can help you skip the manual entry faff. They’re designed to make it easy to track your spending, set financial goals, and keep your budget on target – all from the palm of your hand. The options are almost endless.

Remember to do your research; any budgeting app you invest in should fit you and your needs!

Other things to consider

Take your own approach

When it comes to budgeting, there’s no one-size-fits-all solution – everyone’s financial journey is as unique as their fingerprint.

What works wonders for your sole trader mate may not suit your lifestyle or goals, and that’s okay. The key is to find an approach that matches your circumstances and dreams, so you can manage money your way.

Separate your money into different accounts

With so many different expenses, both personal and business, it can be tricky keeping on top of everything. You may be tempted to spend money you’ve mentally set aside for specific purposes. This is why it can be a good idea to use separate bank accounts for different purposes.

As well as having separate business and personal accounts, you can also set up specific accounts for things like everyday shopping, regular bills, health stuff, holidays and fun, and more. Bonus points if you store funds for long-term goals in a high-interest savings account.

You can also use automation to hit your goals faster, like setting up routine transfers to your savings account or direct debits for when it’s time to tackle those bills. Hnry makes this process hassle-free with our Allocations feature, keeping your money management practically on autopilot.

Budgeting FAQs

What is a budget?

A budget is a spending plan for your money that helps you make sure you’re able to cover all your expenses.

Basically, you’re divvying your earnings into different categories according to your priorities, so you’re not overspending (or underspending!) in any given area.

How do I budget?

Budgeting means creating a spending plan that assigns every dollar you earn to different spending categories, helping you manage your money.

It doesn’t take much to get started! You can create a budget using an Excel sheet, go old school with pen and paper, or even find a budgeting app to fit your needs.

How do I create a budget?

Create a document with two columns.

In the first column, write down how much you expect to earn over the next month (or the time period you’re creating this budget for).

In the second column, write down how much you expect to spend, split by category (business overheads and expenses, personal bills, coffee fund etc). Ideally, your expenditure shouldn’t exceed your income.

How do I use a budget to save money?

You can use a budget to save money by making sure you have money left over once all your expenses are covered.

If your budget allocates all your income towards your various bills and expenses, you’ll have nothing left over to put towards savings. In this case, you’ll need to rethink how much you’re spending on certain expenses, and where you might have room to reduce your expenditure.

Bonus points if you use a high-interest savings account to grow your savings!

How do I budget for a holiday?

Great question! One way to save up is by including a monthly savings target in your budget.

Simply divide how much you’d like to have saved for your trip by the number of months you have left before you head off. Add the resulting figure to your monthly budget, and make sure you set aside the budgeted amount in a separate savings account, so you don’t accidentally spend it.

Stick to it, and you should meet your holiday savings goal!

Also, Hnry does your taxes

As well as allocating your money however you choose, Hnry also takes care of all your tax admin. It’s an app designed specifically for sole traders, handling every aspect of your tax obligations and letting you focus on what you do best – running your business and living your life.

For just 1% + GST of your sole trader income, capped at $1,500 +GST a year, we calculate, deduct, and pay all your taxes, levies, and whatnot for you, including:

… meaning you won’t have to think about any of that. Ever.

Being a sole trader is hard enough. Hnry has your back. Sign up today, and make sure a hefty tax bill is something you never have to budget for.

Share on: