As a sole trader, solely in charge of your business, you may have some questions around profit. Like, for example, what is it? How important is it? And how do you grow it?

Companies and businesses often have teams of people working on analysing processes and growing revenue. But many sole traders can’t afford the same level of support. More than this, sole traders are unique in that they are their business – and most of the information out there doesn’t take this into account.

To help our community of sole traders kick start their business growth, we’re creating a series of articles focused on how to get to that next level. Starting with perhaps the most burning question of all – as a sole trader, how do you measure and grow business profit?

We’re so glad you asked. Let’s go!

- What is profit?

- The three types of profit

- What does profit mean for sole traders?

- How to measure profit

- How to increase profit (in real terms)

- Hnry’s got your back

What is profit?

Not to be a drag, but it’s kinda simple, and kinda complicated at the same time.

Profit is essentially money leftover in your business once you subtract all the costs associated with business activities. In other words, your revenue (money made by your business) minus expenses (all the costs associated with running your business).

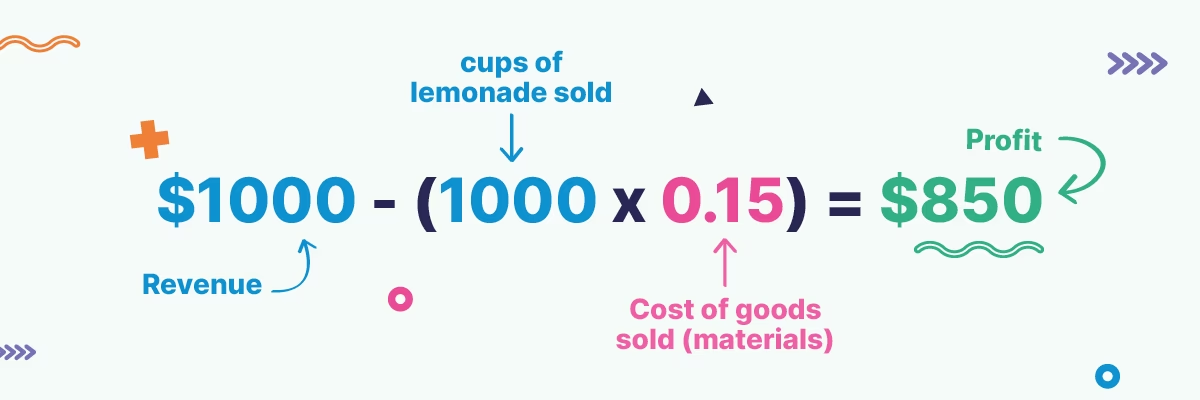

For example, say you’re a nine-year-old girl running a lemonade stand in Mooloolaba. Your mum has a huge lemon tree in her backyard, so you get your lemons for free. The water you use to make your lemonade is also free. But you have to pay for the cups and the sugar, which averages out to $0.15 per drink sold.

If you sell your lemonade for $1 a cup, and you sold 1,000 cups across two days (the Mooloolaba Triathlon was on!), your profit would be your revenue ($1,000), minus the cost to make your product ($0.15 a cup).

Sweet!

The three types of profit

While the above example works as a quick explainer for what profit is, it doesn’t take into account the full picture.

That’s because there are technically three different types of business profit, and each is calculated slightly differently.

- Gross profit

- Operating profit

- Net profit

Let’s use our lemonade stand example to look at each one.

1. Gross profit

Gross profit is calculated by taking your total revenue (money made through your business activity) and subtracting the costs directly associated with creating your products/services. These are known as your cost of goods sold (COGS).

It basically shows that you aren’t spending more to create goods/services than you make in selling them.

With the lemonade example, we took into account the materials involved in making and selling lemonade (lemons, water, sugar, cups). But we didn’t think about the labour costs involved, which must be included in a gross profit calculation.

Let’s say the hourly wage of a self-employed nine-year-old is $15. Not bad!

If you spend four hours brewing and packing your lemonade, and then another 10 hours selling it at your stall, the cost of your labour is $210.

So the equation to calculate your gross profit becomes: $1,000 - (1,000 x $0.15) - $210 = $640.

2. Operating profit

Operating profit is like gross profit, but including all other costs incurred in running your business, like rent, power, and internet, as well as depreciation on business assets. It’s calculated pre-tax, and excludes any interest you may owe.

You use operating profit to show that your business can run at a profit, excluding the things you don’t have control over (tax and interest rates). That’s why operating profit is sometimes called EBIT (earnings before interest and tax).

To calculate your operating profit, you take your gross profit, and subtract your operating costs (also called overhead or fixed costs).

Going back to your lemonade stand, operating costs might include the cost of the equipment used to make the lemonade, the stand itself, and the fuel for transport. To keep things simple, let’s say all this costs you about $100.

3. Net profit

Finally, net profit is operating profit, minus tax and interest. In real terms, net profit is a business’ take home pay.

So, a nine year old with a lemonade stand generally won’t owe tax to the ATO. But let’s say your parents decided they wanted to teach you about business by funding your enterprise with a loan of $250 (covering all upfront costs), at a rate of 2%.

Your net profit is calculated after interest, meaning you’ll have to include it in your costs calculation:

What does “profit” mean for sole traders?

With all three of those definitions in mind, which one should sole traders use to measure their business growth?

Honestly, it depends – on your situation, what you want to know, and what you plan to do with that information. There are two key ways to think about it.

For starters, you’ll need to consider your take-home pay. Are you making enough to cover your living expenses? What’s the minimum you need to make each week/month, taking into account your business expenditure? You’ll need to factor living costs into your calculations.

Secondly, what are your goals? Do you need more funds to grow your business? Are you wanting to increase your earnings? Or even introduce a new product/service into the market? Measuring and growing profit can play into all of these.

As a general starting point, if you’re interested in figuring out the cost of creating your products/services, without factoring overheads and fixed costs, take a look at your gross profit.

If you want to see if your business can run at a profit, you might want to consider your operating profit.

And finally, if you’re looking to increase your take-home pay, it could be beneficial to calculate your net profit.

Of course, you don’t have to stick to just one – you can use all three as a roadmap to get to where you want to go. Speaking of which –

How to increase your profit

Increasing your profit is simultaneously simple, and difficult. It’s simple because when it comes down to it, there are only three things ways to do it:

- Make more money (eg. increase your revenue)

- Spend less (eg. decrease your expenses)

- Both of the above

While that’s pretty straightforward, the difficult bit is figuring out how you’re going to do it. That will depend on your business, and how it operates. So while we can’t give you a detailed list of actions to take, we can give you a few things to think about.

1. Claim all your business expenses (spend less)

We’re Hnry – of course we’re going to start with this one!

This doesn’t directly relate to profit calculations – it’s more about lowering your tax bill. But seriously, if you’re not claiming all the expenses you’re entitled to, you could be paying way more tax than you really need to. Our research shows that sole traders miss out on claiming an average of $5,600 a year in expenses they’re eligible for!

💡 For more on claiming expenses, check out the Hnry guide to tax deductions for sole traders.

2. Charge more (make more)

Are you undervaluing your own time? Are you sure? If you find that your margins are quite tight, it might be worth double checking your pricing structure.

Luckily, we have a guide for that. It is technically for freelancers, but the fundamentals discussed apply for almost everyone.

3. Bulk purchase (spend less)

Can you negotiate with your suppliers to buy in bulk, and pay less per unit? If so, this is a great way to increase your profit margin.

4. Find cheaper suppliers (spend less)

You might be able to find a better price for your materials, without sacrificing quality. Why not shop around?

5. Bundle/unbundle your services (make more)

This goes back to your pricing structure again. Basically, if you bundle certain things together, could you charge more than they’re worth individually?

For example, if you’re a freelance writer, could you throw in a quick landing page optimisation alongside your copywriting service, and increase your price without putting in much more time?

Conversely, do you have services/products that are currently bundled together, that might be more valuable separately?

6. Lower your prices (make more)

This probably feels counterintuitive, but if your cost is prohibitive for your customers, lowering it might increase demand.

If this happens, you might make less per unit/job, but sell more in the long run.

Be very careful with this strategy – it could really work, but it could also backfire!

7. Offer new products/services

It may not be what you set out to do when you started your business, but if there’s something you’re not doing that you think will be profitable, why not give it a try?

For example, if you make macrame plant holders, why not host a class?

Or if you busk on the weekends, why not try gigging at your local bar? (Ask them about it, what do you have to lose?)

Or if you’re a freelance horse therapist, why not start selling fertiliser? Ok, we’re running out of ideas here, but you get the gist.

Basically, the sky’s the limit when it comes to your creativity and ingenuity. You already know you’re a self-starter – that’s why you started your business in the first place. Look at you go.

Hnry’s got your back

Whatever it is you’re trying to do, whether it’s increasing your earnings, or growing your business, Hnry can help. We’re an award-winning tax service that takes the “sole” out of “sole trader taxes”.

For just 1% + GST of your self-employed income, capped at $1,500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

We also lodge your tax return every year, all as part of the service. Oh, and we chase-up late paying clients on your behalf. And we review and claim your expenses for you, so you get all the tax-savings you’re entitled to in real time.

Basically, we make it so that you never have to think about taxes again.

Save time, save money, join Hnry today.

Share on: