Thinking about launching a sole trader business and making it profitable? Awesome!

We’re here to cheer you on every step of the way.

First, a great starting point on your journey to financial success is creating a budget. This will help you see what you’re planning to earn and spend.

Next, you’ll want to get a handle on cash flow, which means keeping track of when money is coming into your business and when you need to spend it. This ensures that you have funds available when you need them.

It’s also a good idea to set aside some savings for quieter periods or emergencies, providing you with a cushion for those unexpected bumps in the road. Calculating how much you might need, and putting money aside for a rainy day, will help your business stay afloat – even in stormy weather (both metaphorical and literal).

And if, after implementing these strategies, you see your profits start to roll in – brilliant! If not, don’t worry, there’s always room for some fine-tuning. We cover it all in this article. Let’s dive in!

- 1. Begin with a budget

- Business vs. Personal budgets

- 2. Map out your cash flow

- 3. Savings and investments

- 4. Calculating profit

- … And Hnry is here to help

1. Begin with a budget

Very simply, a budget is a plan stating how you intend to earn and spend your money. It’s important because it provides you with a clear overview of your financial situation, allowing you to make informed decisions and adjustments as needed.

For example, if you make huge amounts of money during the end-of-year holiday period, you could plan to purchase extra equipment that’ll help increase profit margins during the slower winter months. By knowing what resources you have and how you’re using them, you can steer your business towards your goals with confidence.

We’ll chat more about profit in a bit. But first –

Business vs. Personal budgets

As a sole trader, you and your business are intertwined. This means you’re managing two budgets: one for the business and another for your personal life.

Business budget

A business budget outlines the money you plan to spend to keep your business running smoothly. It’s essential for achieving your business goals by making sure you have enough funds set aside to cover all costs. This may include:

Overheads: Regular indirect expenses like office rent, utility bills, and essential software subscriptions.

Cost of goods sold: Funds needed for supplies and production costs.

Marketing and growth: Resources for marketing campaigns, or planning for expansion.

Keep an eye on your spending, and be ready to adjust as your business evolves. If a new product launch is on the horizon, for example, you might need more cash on hand to pay the startup costs. You’ll need to adjust your budget accordingly.

Personal budget

A personal budget helps you manage the funds you need for your everyday life. Make sure to cover:

Basics: Essentials like your rent or mortgage, electricity, groceries etc.

Downtime needs: Set aside money for breaks or holidays, because even solo entrepreneurs need a breather!

Fun money: Reserve a bit of cash for those small indulgences that add joy to your life without breaking the bank.

Savings and investments: It’s wise to allocate funds for future security, such as an emergency reserve or investments that offer growth potential over time (stay tuned for more on this later).

🙋♀️ Remember – you’ve also got to put aside enough to pay your taxes. Or you could make it super simple, and just use Hnry – we sort it all for you, so you don’t even have to think about it.

Balancing the budgets

Finding the right balance between your personal budget and your business budget is all about your personal priorities.

If you’re growing your business, this might mean a little less take home pay for a while. In contrast, if you’re growing your family (congratulations!), you might opt to scale back what you spend on your business.

In any case, it’s recommended that you:

- Regularly check in with your incomings and outgoings

- Adjust your budget on the fly (if needed)

- Make sure you’re covering both immediate needs and long-term growth, with a cushion for surprise expenses.

Consider your budget a trusty map leading you to success, helping you navigate around potential roadblocks.

📖 For a more detailed look on how to balance a budget, check out our article on budgeting.

🙋 Struggling to set money aside? Hnry can make budgeting easier by automatically allocating your money to different accounts.

2. Map out your cash flow

Running a business isn’t just about keeping tabs on expenses – you need to ensure there’s actually money in the coffers when it’s time to spend. That’s where cash flow comes in: it’s all about timing, and it’s the lifeblood of your sole trader business. Cash flow keeps everything ticking over, from paying bills and buying supplies to, importantly, paying yourself. After all, that’s the endgame, isn’t it?

Cash flow is essentially the timing of money in and out of your business. Incoming funds could be from selling your products or services, landing a grant, or flogging off some old equipment. On the flip side, outgoing cash might be the cost of goods, purchasing new items, or settling debts.

Imagine cash flow as a snapshot of your bank account at any given moment, capturing when money enters and exits – not just when you send out or receive an invoice.

Staying cash flow positive is the goal. This means having enough cash on hand to cover every bill, tax, and random expense that comes your way – maybe even with some to spare. Falling into cash flow negative territory means you don’t have enough money in your bank account to pay bills as they’re due, and you might have to borrow money to stay afloat. Yikes!

Managing cash flow can sound daunting, but it’s all part of business finance essentials, and trust us, it’s a worthwhile pursuit.

You can start with a cash flow statement, which is just a rundown of money flowing in and out over a designated period, such as a month.

Then, create a cash flow forecast, marking out when in the future you have bills due, and when you’ll be paid. Think of this as your business’s crystal ball – no wizardry needed! This forecast predicts your future cash situation, helps spot potential shortfalls, and lets you plan for those big expenses.

📖 Learn more in our comprehensive guide to cash flow, including how to create a cash flow statement and forecast, so you’re always on top of what’s flowing through your bank account.

3. Savings and investments

Savings

Setting aside money for your business in an emergency fund can be a lifesaver when things head south.

With inflation being on the high side in recent years, sole traders are feeling the pinch with soaring costs for fuel, supplies, and services. It’s been difficult to keep up with the burgeoning cost of living. In creative industries, rates have sometimes been stagnant, or even trending down. Oof!

But it’s not just your business that needs a buffer – life can throw curveballs too. Can you squirrel away funds for personal emergencies or perhaps a well-deserved vacation? Try to weave these into your budget planning (as mentioned earlier).

Investments

Then there’s the world of investing. Investing is a way to grow your money – but while your investment grows (hopefully), it generally shouldn’t be touched. This means money you’ve invested is usually less accessible than money you’ve squirreled away into a savings account.

Investing in superannuation is a great way to grow a nest egg for your retirement. As a sole trader, contributing to a superannuation fund isn’t mandatory, but making voluntary contributions can pave the way for a retirement filled with beachside cocktails, not pot noodles. Plus, there are a few potential tax benefits that you may be eligible for, to sweeten the deal.

Other investment paths include things like stocks and shares, ETFs, property, or cryptocurrency. Each comes with its own set of risks, so it’s crucial to research thoroughly and only invest what you’re comfortable with potentially losing. And remember, each investment type comes with unique tax implications.

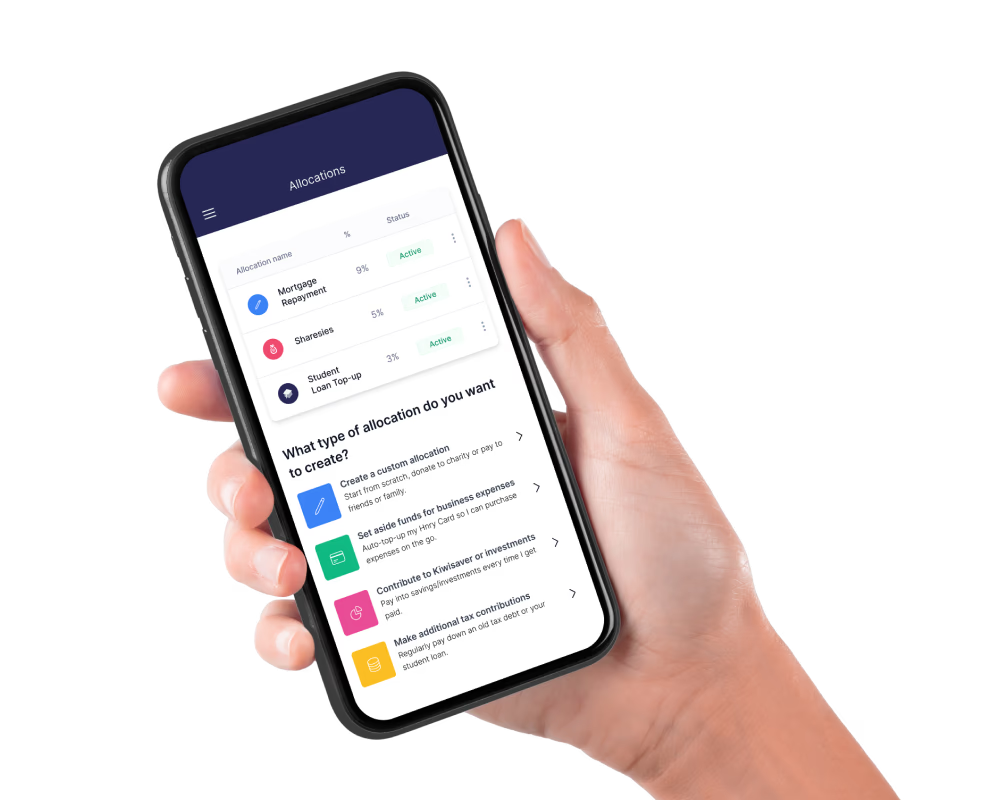

The bright side? Hnry makes saving and investing sooo much easier. Our Allocations feature lets you earmark portions of your income to funnel into different accounts every time you’re paid. You choose where your money flows, making it quick, easy, and automatic!

📖 Learn more about investing in our dedicated article on the subject.

4. Calculating profit

If you’ve made it to this point, give yourself a pat on the back! You’re getting a handle on business finance. Now comes the exciting part – calculating that sweet, sweet profit.

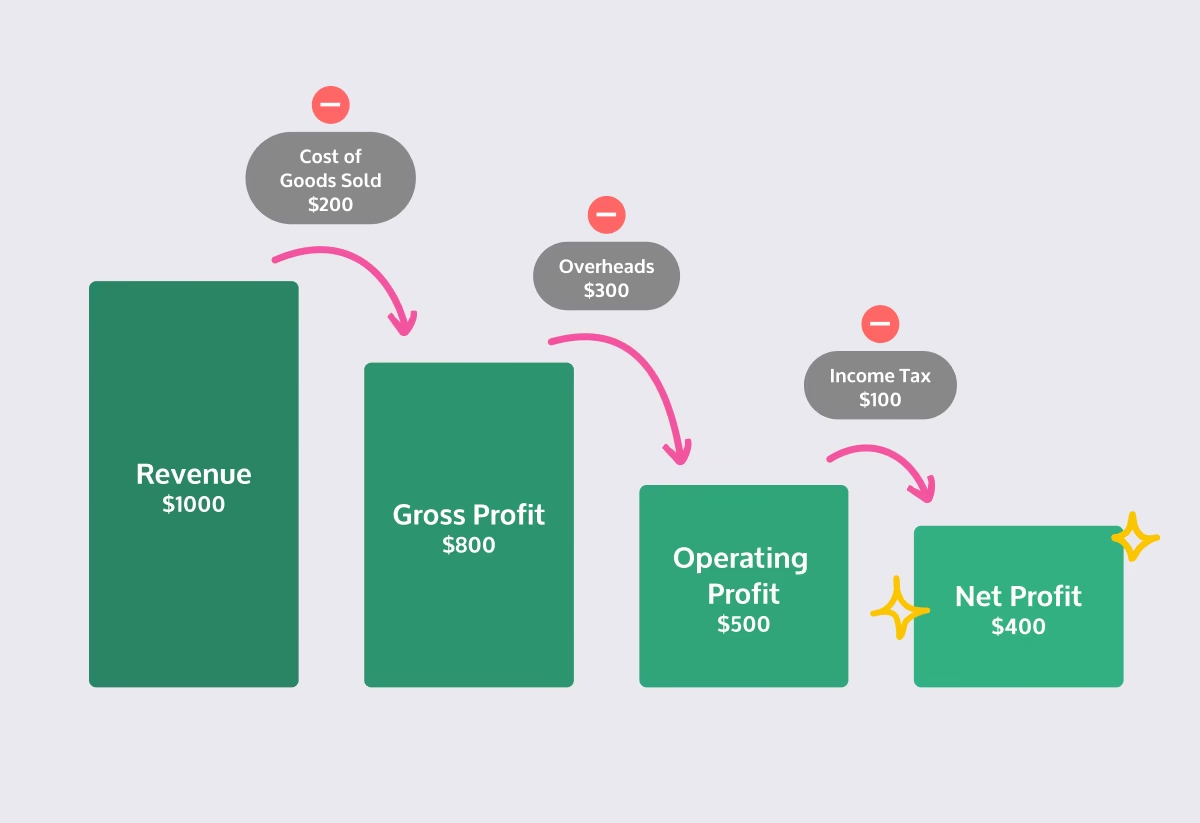

Profit calculation might be a bit more intricate than it looks at first glance. There are three types of profit to consider:

1. Gross profit:

Think of this as your business’s raw earnings. Start with all your revenue from business activities, then subtract the costs directly tied to creating your products or services, known as the cost of goods sold (COGS).

2. Operating profit:

This one’s a bit like gross profit, but with a few more variables.

Operating profit includes all the costs associated with keeping your business running (also known as overheads) – like rent, utilities, internet, equipment purchases, and motor vehicle expenses. This figure is calculated before tax and interest come into play, which is why it’s also known as EBIT (Earnings Before Interest and Tax). It helps you see how well your business can perform without those tax and interest rate variables.

3. Net profit:

This is the grand total you’re left with after you’ve accounted for taxes and interest as well. Think of net profit as your business’s take-home pay.

So which profit should you use to gauge your business’s growth? It really depends on where you stand, what insights you’re after, and your future plans. Are you aiming to boost your earnings and expand your business? Looking to launch a new product or service? Or just want reassurance that your business can provide a comfortable lifestyle from its profits?

💡 Note: Don’t overlook taxes! It’s tempting to get swept away by profit figures, but remember to factor in your tax obligations.

Once you’re clear on the profit metrics that matter to you, it’s time to fine-tune your business for better profitability. Could you offer your products or services at a lower cost to get more sales, or conversely, up your prices to service premium clients? Save by purchasing supplies in bulk? Perhaps bundle offerings together to drive up sales or profit margins? Are you claiming all the business expenses you’re eligible to claim?

📖 Check out our indepth guide to profits for sole traders.

… And Hnry is here to help

No matter your goal – whether it’s boosting your income or expanding your business – Hnry’s here to lend a hand and help you get on top of business finance. As an award-winning accounting service, we make the taxing (ha!) aspects of being a sole trader a breeze.

For just 1% +GST of your self-employed income, capped at $1,500 +GST a year, we sort all your taxes, levies, and whatnots for you. That includes:

We also take care of lodging your tax return and Activity Statements each year. Plus, we’ll even chase up clients who are a bit slow in settling their invoices. And we manage your expenses for you, ensuring you snag every tax-saving opportunity in real time.

Essentially, we make it so you can wave goodbye to tax worries forever.

Save your time, keep more money in your pocket, and focus on what you love doing. Let us handle the rest.

Join Hnry today!

Share on: