Ever wondered why you’re paying different amounts of tax on income from your self-employed side gig and your main PAYG job? Or whether you’re supposed to be paying tax on the handmade clay pots you sell to your mum’s workmates? Seriously, what’s the difference between a business and a hobby?

Navigating the maze of taxes on secondary income (or even what counts as secondary income!) can be a tad confusing. But don’t fret! We’re here to break it down for you.

- What is “secondary income”?

- Progressive tax rates: What’s the deal?

- How to claim the tax-free threshold

- Am I being penalised for having a second job?

- Other sources of income

- How to calculate the tax on secondary income

- … or you can let Hnry do it all for you!

What is ‘secondary income’?

For the purposes of this article, think of secondary income as the B-side to your main PAYG employee income track. It’s those extra dollars from part-time jobs, or perhaps a side hustle that’s separate from your primary source of income. It also includes other income sources like property investments, dividends, shares, and interest.

Don’t worry; we’ll dive deeper into these in a bit. But to understand why your second job gets taxed at a different rate to your primary income, we need to talk about how income tax is calculated overall.

Progressive tax rates: What’s the deal?

Australia uses a progressive income tax rate, which is why you pay different tax rates or amounts for different income. It’s a bit like a ladder. The space between rungs represents a different portion of your income, and each has its own tax rate.

These income tax brackets are the same for everyone, whether you’re an employee or a sole trader. Typically, the more you make, the higher percentage of tax you’ll pay on the higher income you receive.

One very cool thing to note is that there’s a tax-free threshold, which means you don’t pay any tax on the first $18,200 you earn. Nice, right?

Here’s a list of the latest tax rates for each income bracket:

Australian Resident Income Tax Rates (2022-23)

| Income Bracket | Tax Rate % |

|---|---|

| 0 to $18,200 | Nil |

| $18,201 to $45,000 | 19% |

| $45,001 to $120,000 | 32.5% |

| $120,001 to $180,000 | 37% |

| $180,001 and over | 45% |

Source: ATO

How progressive tax rates work

Income tax is calculated based on all your taxable income, however you earn it. But not every dollar you earn gets the same tax treatment.

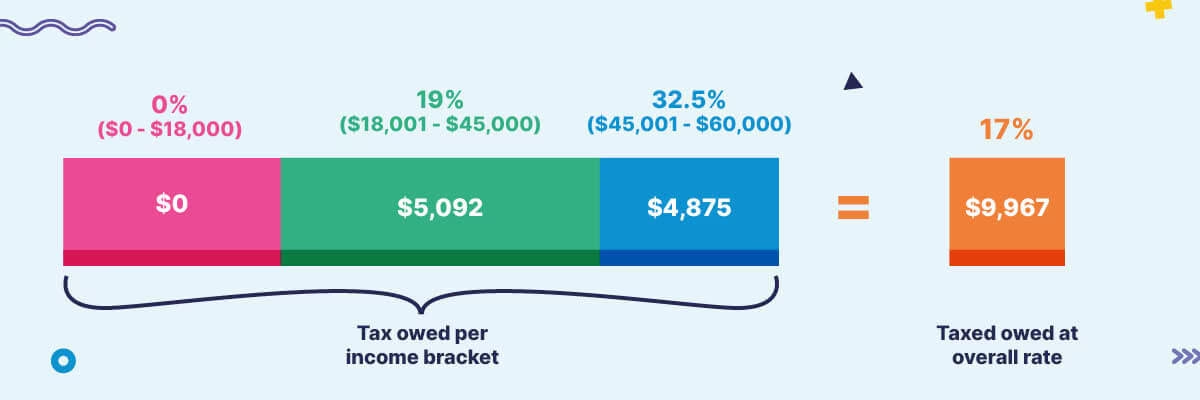

If you earn $60,000 a year, for example, you fall into the 32.5% tax bracket but you don’t pay 32.5% on the whole shebang

Because of the progressive tax rate system, you pay no tax on the first $18,200 you earn, 19% on your earnings from $18,201 to $45,000, and 32.5% on anything over $45,001 (and under $120,000).

So your income tax bill would be $9,967, making your overall tax rate 17% (as opposed to $19,500 if you had to pay 32.5% on the whole $60,000).

Remember though, as a sole trader, you can claim tax deductions on eligible expenses needed to run your business. This can help bring your taxable income down.

💡 For more on how to lower your taxable income and pay less income tax (legally!), check out our monster guide to tax deductions.

Claiming the tax-free threshold

The reason secondary income is taxed at a higher rate at source is because of the tax-free threshold.

Employers include the tax-free bracket in their income tax calculations for their employees. But if more than one employer factors this bracket into their calculations for the same person, that person wouldn’t be having enough tax withheld to cover their tax bill.

If you’re getting income from two or more employers at the same time, you only claim the tax-free threshold from one of them – typically the one that pays you the highest salary or wage. You’ll need to advise the other payers to withhold higher rates of tax from your income – known as the ‘no tax-free threshold’. As much as it sucks, doing this reduces the risk of incurring a nasty tax bill at the end of the financial year.

Similarly, if you have a self-employed business and a full-time or part-time job with an employer, you’d claim the tax-free threshold from your employer. You’re then responsible for calculating the rest of the income tax you owe from your self-employed gig.

If you’re earning income solely from self-employed sources – say you have a freelance copywriting business and you also sell handmade clay pots to your mum’s workmates – you don’t need to ‘claim’ the tax-free threshold. The ATO will simply look at your combined income when you lodge your tax return and automatically apply the tax-free threshold. Easy!

Am I being penalised for having a second gig?

Feeling like your second job is getting the short end of the tax stick? Say you’re already claiming the tax-free threshold from your main PAYG job, and you take on a part-time gig at a local cafe as an employee. Your cafe employer will withhold a higher rate of tax from the first dollar you earn with them. This is why it can feel like you’re paying more tax on your second job.

But don’t stress: you pay the same amount of tax whether you earn $2,000 a week through a combination of your sole trader business and one or more jobs. When you do your tax return, the ATO combines all your earnings and works out the tax based on the total. No penalties, just maths. Whew!

Claiming the tax-free threshold from more than one payer

If you’re confident that your combined income from all your employers will be $18,200 or less, you can claim the tax-free threshold from all of them.

But if things change and you end up earning more than you thought you would (look at you go!), you can provide one or more of your payers (except the one you want to continue to claim the tax-free threshold from) with a withholding declaration.

Other sources of income

As mentioned earlier, your taxable income consists of several different sources.

It can include the following:

Additional employment income

As well as income from your sole trader business and wages from any jobs you have, you may also need to pay tax on:

- Allowances

- Lump sum payments

- Cash and tips

- Reportable fringe benefits

- Superannuation

- Foreign and worldwide income

Side hustle or one-off transactions

Got a side hustle brewing? Whether it’s a tiny venture or a one-off gig, or even if you’re rocking the digital world as a content creator or influencer, the ATO wants to know.

But here’s the silver lining: You can claim tax deductions for eligible expenses related to your side hustle, which can bring your taxable income down.💡Note: If you’re occasionally making money through a hobby, rather than a hustle, you may not need to pay tax on it. This also means you can’t claim deductions for it. For more information on the difference between the two, check out this resource from business.gov.au.

Investment income

You may need to pay tax on interest payments (including interest you earn from your savings account), dividends, or other capital gains.

This is quite complex and you can find out more on theATO’s website.

Rental income

Got a property (or properties) you’re renting out? Cha-ching! But all that rental income, including those initial rental bonds, needs to be declared.

The sharing economy

Whether you’re cruising the streets as an Uber driver, offering your graphic design skills on Airtasker, or renting out all or part of your home via Airbnb, you’re part of the bustling sharing economy.

Basically, if you’re leveraging digital platforms to share assets or services for some extra cash, you need to add this income to your tax return.

Other income sources (with varying tax requirements) to declare are:

- Government payments and allowances

- Superannuation pensions and annuities

- Compensation and insurance payments

- Scholarships, prizes and awards

- Crowdfunding

But seriously, just use Hnry

Let’s be real. Juggling taxes from various gigs can feel like trying to solve a jigsaw puzzle with pieces from three different boxes.

But you can breathe easy. Hnry’s here to ensure you’re paying just the right amount on all those jobs and side hustles. An award-winning accounting app for sole traders, we work out everything from your tax-free threshold to what tax deductions you can claim and everything in between.

For just 1% + GST of your self-employed income, capped at $1,500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

Easy! Basically, we make it so you never have to think about tax again. Join Hnry today.

Share on: