If you’ve ever, say, accidentally dislocated your shoulder while snowboarding, you’re probably familiar with (and grateful for) Medicare.

But what you might not know is that these services are partially funded by a levy that most working Aussies pay.

For those who are newly self-employed, finding out that you need to pay a Medicare levy may come as a surprise in your first year of business. And even if you’ve been around for a while, paying an extra levy isn’t exactly a fun time.

Most people who work in Australia are subject to paying this levy. But while PAYG employees usually have their levy automatically deducted by their paycheck and paid by their employers, sole traders are responsible for calculating and paying this levy on their own as part of their tax return.

The Medicare levy is calculated at a simple flat rate, meaning how much you pay will depend on how much you earn. If you’re bringing in top dollars, you may also have to pay an additional surcharge on the levy.

The good news is that you can lessen the load by regularly putting aside money for the Medicare levy throughout the year, so you’re not hit with one huge bill you can’t cover. We’ll take you through:

- What Medicare is and does

- What the Medicare levy is all about

- How to calculate your Medicare levy

- The Medicare levy surcharge

- How Hnry can help (because we really can!)

Let’s get started!

What is Medicare?

Medicare is Australia’s universal public health system and it’s one of the best in the world.

It helps residents and some overseas visitors with the costs of seeing a doctor, getting certain medicines and accessing mental health care. It also helps fund cancer screening tests and a range of programs to help with specific healthcare needs.

Some of these costs are covered in full, while others are subsidised. A full list of eligible costs can be found on the Medicare Benefits Schedule (MBS) website. Pretty cool, right?

The Australian government pays for Medicare via the Medicare levy.

What is the Medicare levy?

The Medicare levy is a mandatory fee every working Australian (with some exceptions – see below), pays to the government to help fund the public health system.

The levy is on top of the tax you pay on your taxable income and GST.

Medicare levy surcharge

If you make above a certain amount as a single or as a family, you may be subject to the Medicare levy surcharge (see below). This is in addition to the Medicare levy, not instead of it.

💡 While Hnry will calculate and pay your Medicare levy on your behalf, we won’t be able to sort your Medicare levy surcharge. The surcharge calculation depends on things Hnry might not be aware of, like your level of Private Health Insurance cover, how much your spouse earns, and if you have any dependents.

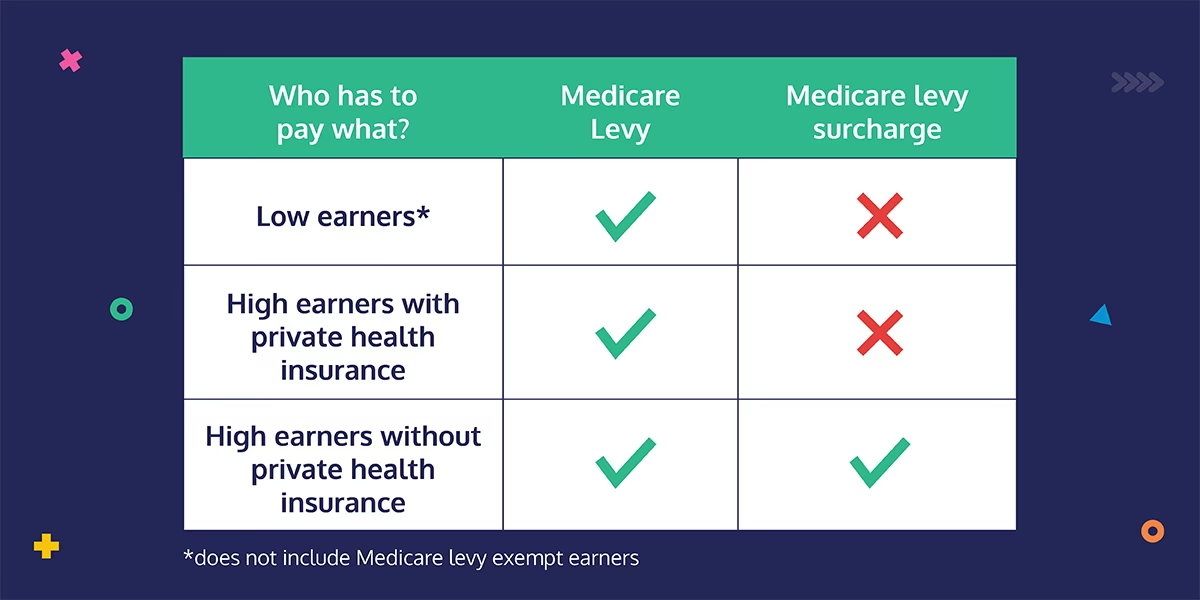

Health insurance

If you are a high earner, and you take out a certain level of health insurance for yourself and your family, you may be exempt from paying the Medicare levy surcharge (see below).

It’s important to note that this exemption only applies to the Medicare levy surcharge, NOT the Medicare levy.

How is the Medicare levy calculated?

Average earners

You pay 2% of your taxable income as a sole trader for the Medicare levy. The Australian Tax Office (ATO) calculates this fee when you lodge your tax return.

Low earners (2024/2025 financial year)

Reductions and exemptions

For the financial year 2024/25, you may be eligible to pay the Medicare levy at a reduced rate if:

- Your taxable income is between $27,222-$34,027, or

- $43,020-$53,775 if you’re entitled to the seniors and pensioners tax offset – SAPTO

You won’t have to pay the levy at all if:

- You earn $27,222 or less ($43,020 for those entitled to SAPTO)

Family income

You may also be eligible for a reduced levy rate depending on your family situation. The ATO takes into account family income, and whether you have dependents, when deciding if you’re eligible for a reduced Medicare levy rate.

For the 2024/25 financial year, you’d pay a reduced levy rate if:

- Your family taxable income is between $45,907 and $57,383, or

- Between $59,886 and $74,857 if you’re entitled to the SAPTO

- The lower family income threshold increases by $4,216 for each dependent child you have

- The upper threshold increases by $5,270 for each dependent child you have

The way the ATO calculates your family taxable income is based on either:

- The combined taxable income of you and your married or de facto spouse (including a spouse who died during the year)

Or:

- Your taxable income if you were the sole carer of one or more dependent children.

Nasrin has lived with her boyfriend Sean for four years, making him her de facto spouse. She runs a small vegan quiche business as a sole trader, selling her products at market stalls across Sydney.

The taxable income from her business is $47,600. Sean doesn’t bring in any money but he helps deliver the quiches to the market stalls and keeps their home in order.

Because Nasrin lives with Sean and their family income is within the threshold of $45,907 and $57,383, she may be eligible for a reduced Medicare levy rate.

Mark is a single dad with sole care of his two young sons. He works from home in Adelaide as a freelance graphic designer and logo specialist for small business owners throughout Australia.

His taxable income is $48,700 (below the maximum threshold of $57,383).

Because he has dependents, he may qualify for a reduced Medicare levy rate.

Other exemptions

Aside from the income threshold, you may also be exempt from paying the Medicare levy if:

- You’re not entitled to Medicare benefits

- You meet certain medical requirements

- You’re a foreign resident for tax purposes

Medicare Levy Surcharge vs. Health Insurance

The Medicare Levy Surcharge (MLS) was created to encourage high earners to take out private patient hospital cover, reducing the burden on the public health system – or pay a higher levy. Fair enough, eh?

The ATO uses a special definition of income called income for MLS purposes to figure out if you need to pay the MLS, and if so, at what rate you pay it. This is different from your taxable income alone, because it includes things like:

- Reportable fringe benefits

- Total net investment losses

- Reportable super contributions

- Income from a trust or partnership

- Dividends and property from a company, on which family trust distribution tax has been paid.

The MLS rates are charged at 1%, 1.25% or 1.5% on top of the standard 2% Medicare levy, depending on your MLS income total. If you have a spouse, your MLS income total will be calculated based on your joint (family) income.

MLS rates 2023/24

| Threshold | Base tier | Tier 1 | Tier 2 | Tier 3 |

|---|---|---|---|---|

| Single income | $97,000 or less | $97,001 - $113,000 | $113,001 - $151,000 | $151,001 or more |

| Family income | $194,000 or less | $194,001 - $226,000 | $226,001 - $302,000 | $302,001 or more |

| Medicare levy surcharge | 0% | 1% | 1.25% | 1.5% |

High earners with health insurance:

If you:

- Earn over $97k as a sole trader (and you’re single),

- OR over $194k in combination with your spouse,

- AND you, your spouse, and any dependent children have an “appropriate level of private patient hospital care”

You will only be required to pay the 2% Medicare levy.

High earners without health insurance:

If however, you:

- earn over $97k as a sole trader (and you’re single),

- OR over $194k in combination with your spouse, +$1,500 for each dependent child after the first one,

- AND you don’t have the appropriate level of private patient hospital cover for yourself, your spouse, and any dependent children,

you’re required to pay the Medicare levy surcharge (MLS).

Enrico separated from his partner 46 days into the financial year, meaning he was single for 314 days out of 360.

The income for MLS purposes from his plumbing business is $105,110 (more than the singles surcharge threshold of $97k).

Enrico may be liable to pay the MLS for the number of days he was single.

As you can see, the MLS can be complicated – and expensive if you earn above a certain threshold. Depending on your personal circumstances and your healthcare needs, you may be better off taking out health insurance that includes hospital cover. As well as reducing your Medicare Levy Surcharge, you get the additional benefits of faster treatment and more choices.

How Hnry can help

If you’re over the maths, you can simplify your tax and financial admin by signing up for Hnry – and we’ll do it all for you! Hnry is an award-winning tax and financial admin service designed solely for sole traders (mind the pun). Every time you get paid, we’ll calculate, deduct and pay your:

- Medicare levy

- Income tax

- GST (if applicable)

- Student loan repayments

- Superannuation contributions (optional)

… all for just 1% of your self-employed income. We’ll even lodge your income tax and BAS returns for you, at no extra cost!

All your tax and financial admin is checked over by our team of accountants, so you can relax and go about growing your business. Whew! [Join Hnry today].