If you’ve been self-employed for a while now, you’re probably more than aware that sole traders are fully responsible for preparing, paying, and lodging their own taxes.

Unfortunately, it’s all part and puzzle of running your own business.

Even so, setting aside the right amount of tax can be complicated. If you’re off in your calculations, or accidentally overlook something, you could be hit with a pretty hefty bill at the end of the financial year.

So to help you accurately plan ahead, we’ve put together a quick explainer to take you through the different taxes you may owe, how they’re calculated, ways to reduce your tax bill, and how to get it right every time.

Let’s get started!

- Overview

- Income tax

- Tax offsets for sole traders

- Medicare levy

- GST

- Student loan repayments

- Superannuation contributions

- How Hnry sorts it all

An overview of sole trader taxes

There are three main kinds of taxes and levies that sole traders need to be aware of:

- Income tax

- Medicare levy

- Goods and Services Tax (GST)

As well as these main three, you might also need to factor in:

- Student loan repayments

- Superannuation contributions

How much you’ll eventually owe depends on your individual circumstances. For example, you may be eligible for the small business income tax offset, which could reduce your final tax bill by up to $1,000. You can also lower your taxable income by claiming business expenses – but we’ll talk through both of these, and more, in a bit.

Because of all this, preparing your taxes isn’t as straightforward as setting aside a set percentage of your income every time you get paid. Instead, you’ll need to understand which rules apply to you, so you can prepare accordingly and avoid expensive surprises.

Income tax

Australia operates using a progressive tax system, meaning that you don’t pay a set percentage of income tax across all your income. Instead, your income will be split across several bands, each with its own tax rate.

Australian Resident Income Tax Rates (2024/25)

| Income Bracket | Tax Rate % |

|---|---|

| 0 to $18,200 | Nil |

| $18,201 to $45,000 | 16% |

| $45,001 to $135,000 | 30% |

| $135,001 to $190,000 | 37% |

| $190,001 and over | 45% |

Source: ATO

Calculating progressive tax rates

Let’s say that you earn $30k as a part-time employee, and $50k as a sole trader. Your taxable income is the sum total of all income – so in this case, $80k.

Even though $80k falls into the 30% tax rate band, you won’t owe 30% across your entire income. Instead, you calculate your income tax by applying the bands progressively:

| Income band | $80k income in band | Tax Rate % | = Tax Owed |

|---|---|---|---|

| $0 - $18,200 | $18,200 | 0% | = $0 |

| $18,201 to $45,000 | $26,800 | 16% | = $4,288 |

| $45,001 to $135,000 | $35,000 | 30% | = $10,500 |

| $135,001 to $190,000 | $0 | 37% | = $0 |

| $190,001 and over | $0 | 45% | = $0 |

Total income tax bill: $14,788.

Only $35k of an $80k income is actually taxed at 30%!

You’ll also need to remember that your employer will be deducting and paying tax on your behalf. Through your PAYG income, you should have already paid around $1,888 in income tax, taking into account the tax-free threshold.

All you’re directly responsible for paying is your self-employed income tax – in this case, the remaining $12,900. Phew!

Tax offsets for sole traders

Depending on your circumstances, there are a few tax offsets.) you may be eligible for. The two main ones are:

Small business income tax offset

The small business income tax offset, also known as the unincorporated small business tax discount, can reduce your tax bill by up to $1,000 a year.

Despite having a mouthful of a name, it’s really quite simple: if you’re a sole trader earning a net income of less than $5 million (!!!), and you’re not subject to the Personal Services Income rules, you’re eligible for this tax offset. It’ll automatically be applied by the ATO once your tax return has been processed. Neat!

🙋 If you’re eligible for the small business income tax offset and you use Hnry, we’ll automatically include it in our tax calculations.

Low income tax offset (LITO)

This one’s available to everyone, not just sole traders! To be eligible for the full $700 offset, you’ll need to have earned less than $37,500 across the financial year (including from your PAYG salary, if applicable).

If you earn over this threshold, the offset amount you’re eligible for will gradually reduce until you hit the upper threshold of $66,667. At this point, you’re officially considered a middle-income earner (🎉).

Medicare levy

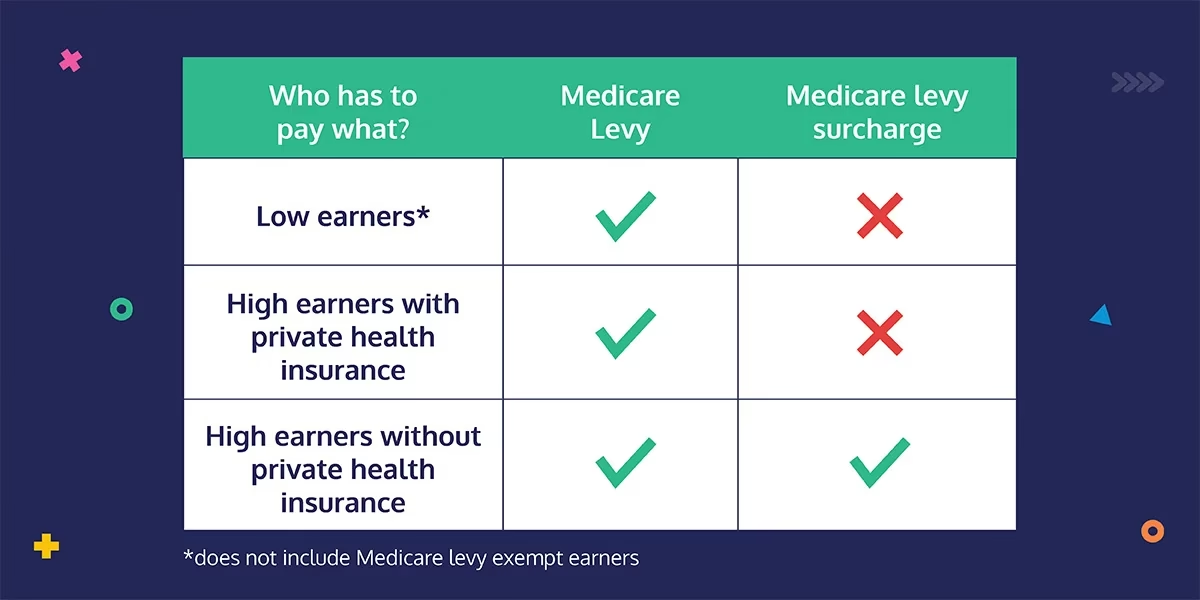

The Medicare levy is a mandatory fee paid by every working Australian in order to fund the public health system. While it’s automatically deducted from PAYG salaries each pay day, sole traders are responsible for calculating and paying their Medicare levy every financial year.

In an effort to reduce the load on the public health system, the government requires high-earning Aussies to pay a Medicare levy surcharge, in addition to the Medicare levy. This surcharge is waived if the person in question has a private health insurance policy.

💡 While Hnry will calculate and pay your Medicare levy on your behalf, we won’t be able to sort your Medicare levy surcharge. The surcharge calculation depends on things Hnry might not be aware of, like your level of Private Health Insurance cover, how much your spouse earns, and if you have any dependents. For more information, check out our guide to Medicare.

For average earners

The Medicare levy will be 2% of your taxable income. Easy!

For low earners

For the financial year 2023/24, you may be eligible to pay the Medicare levy at a reduced rate if:

- Your taxable income is between $26,000-$32,500, or

- $41,089-$51,361 if you’re entitled to the seniors and pensioners tax offset – SAPTO

You won’t have to pay the levy at all if:

- You earn $26,000 or less ($41,089 for those entitled to SAPTO)

You may also be eligible for a reduced rate depending on your family circumstances. For the 2023/24 financial year, you’d pay a reduced levy rate if:

- Your family taxable income is between $43,846 and $54,807, or

- Between $57,198 and $71,497 if you’re entitled to the SAPTO

- The lower family income threshold increases by $4,027 for each dependent child

- The upper threshold increases by $5,034 for each dependent child

The way the ATO calculates your family taxable income is based on either:

- The combined taxable income of you and your married or de facto spouse (including a spouse who died during the year)

Or:

- Your taxable income if you were the sole carer of one or more dependent children.

For high earners with private insurance:

If you:

- Earn over $97k as a sole trader (and you’re single),

- OR over $194k in combination with your spouse,

- AND you, your spouse, and any dependent children have an “appropriate level of private patient hospital care”

You will only be required to pay the 2% Medicare levy.

For high earners without private insurance:

If however, you:

- earn over $97k as a sole trader (and you’re single),

- OR over $194k in combination with your spouse, +$1,500 for each dependent child after the first one,

- AND you don’t have the appropriate level of private healthcare insurance for yourself, your spouse, and any dependent children,

you’re required to pay the Medicare levy surcharge (MLS). It’ll be either 1%, 1.25%, or 1.5% of your “income for MLS purposes”, depending on how much you earn. This is in addition to the 2% Medicare levy.

MLS rates 2024/25

| Threshold | Base tier | Tier 1 | Tier 2 | Tier 3 |

|---|---|---|---|---|

| Single income | $97,000 or less | $97,001 - $113,000 | $113,001 - $151,000 | $151,001 or more |

| Family income | $194,000 or less | $194,001 - $226,000 | $226,001 - $302,000 | $302,001 or more |

| Medicare levy surcharge | 0% | 1% | 1.25% | 1.5% |

📖 We have a whole guide on the Medicare levy and the Medicare levy surcharge that goes into way more detail!

GST

GST, short for “Goods and Services Tax”, is a flat-rate consumption tax levied at 10% on most goods and services sold in Australia.

If your business is set to make $75,000 or more in the next 12 months, you’re required to register for and charge GST. Luckily, this is fairly straightforward. You simply collect an additional GST charge of 10% from your clients, on top of your regular prices/fees – you don’t pay this out of pocket!

You can calculate the cost of your services +GST using our GST calculator.

If you’re GST registered, you’ll need to complete and submit a Business Activity Statement (BAS) at regular intervals. The good news is that if you happen to pay more GST than you collect in a GST period, you may be eligible for a refund for the difference.

📖 Want learn more about GST and how it works? Check out our monster guide to GST, written specifically for sole traders!

Student Loan

It’s not a tax, but if you have an outstanding HECS loan, it is something you’ll need to make payments on to the ATO.

Luckily it’s a straightforward calculation – student loan repayments are a set percentage of every $1 you earn over the repayment threshold. This percentage depends on your repayment income – the more you earn, the higher the percentage.

Hang on though, let’s break that all down.

Repayment income

Your repayment income includes:

- Taxable income

- Reportable fringe benefits

- Total net investment loss

- Reportable super contributions

- Any tax-exempt foreign employment income

Basically, it’s a bit more comprehensive than plain old taxable income.

Repayment threshold

For FY 2025/26, the repayment threshold is currently set at $56,156. But it tends to change year on year. You’ll need to make sure you’re across any and all threshold updates.

Repayment percentage

The ATO updates student loan repayment percentages regularly. You’ll need to check the ATO’s repayment calculation table every new financial year to make sure you’re using up-to-date rates.

Paying back your student loan

Student loans in Australia are technically interest free, but they do come with a few interesting quirks that make them slightly harder to deal with (sorry!).

HECS loan indexation

In order to make sure the initial value of the loan doesn’t decrease over time due to inflation, HECS loans used to be indexed to the Consumer Price Index (CPI) – basically, the inflation rate. Whatever the CPI for the financial year, all student loan balances would increase by the same percent.

In theory, the inflation rate tends to be lower than wage growth (Wage Price Index, WPI), meaning people earn more money faster than the value of that money deflates. But this theory hit a huge snag in practice during the pandemic years, when the inflation rate skyrocketed, increasing everyone’s student loan balance by an unprecedented 7.1%.

To counter this, the Albanese government announced that they would change the indexation rules, tying the value of student loans to either the CPI or WPI, whichever was lower.

This change would also be backdated to 1 June 2023, reducing the 7.1% increase.

📖 We explain these changes in more detail in this article about how HECS loans are changing.

Voluntary vs. compulsory repayments

Another weird quirk of student loans is the way voluntary and compulsory repayments work.

Compulsory repayments are due at the end of the financial year, as part of your tax payable once your tax return has been lodged. Like we mentioned earlier, compulsory repayments depend on your income level, and are calculated as a set percentage of every dollar earned. You can use our compulsory repayments calculator to see how much you may owe overall.

Compulsory repayments calculator

But it’s important to note that compulsory repayments go towards your loan balance after it’s been indexed. Meaning that, depending on your circumstances, it’s possible for your loan to grow year on year – even if you’ve been paying it off.

One way to avoid this is to pay voluntary repayments throughout the financial year. These go directly towards your loan balance, lowering it before it’s indexed. But bear in mind that voluntary repayments don’t count towards your compulsory repayments – you’ll still need to pay the full compulsory repayment amount for the financial year once it’s due.

We know – it’s confusing as heck. If you’re still paying off your student loan, you have our genuine sympathy.

📖 For more information, check out our guide to paying off your student loan as a sole trader.

Superannuation contributions

Finally, it’s definitely not a tax, but while we’re talking about things you need to set money aside for, you may want to consider voluntarily contributing to your Superannuation fund.

For starters, there are some pretty sweet potential tax benefits, depending on the type of contributions you make, the amount, your income level, and your age. But if you can wrangle it all, it could make a real difference!

Concessional contributions

Concessional contributions are generally made from your pre-tax income, and are tax deductible. These contributions are capped at a maximum of $30,000 per financial year (starting July 1st 2024).

Because concessional contributions come from your pre-tax income, they’re not taxed at your income tax rate. Instead, they’re taxed at a flat rate of 15% in your superannuation fund (score!).

💡 If you’re a high-income earner with a pre-tax income of over $250,000 per annum, your superannuation contributions may incur an additional tax (Division 293) of 15%, making the total rate 30%.

For PAYG employees, their employer’s Superannuation Guarantee (SG) contributions count towards this $30,000 cap. So if, say, your employer contributes $20k to your super fund, you can then only make $10k in additional concessional contributions.

On top of this, you can carry forward any unused contribution cap amounts for up to five years, which is handy if you’re playing catch up – just make sure that you’re eligible to do so.

Non-concessional contributions

Non-concessional contributions are made from your after-tax income – in case you prefer not to use your pre-tax income, or if you’ve maxed out your concessional contribution limit.

These contributions aren’t taxed in your superannuation fund, and are generally capped at $110,000 per financial year.

You can contribute more than the limit if you’re eligible for the bring-forward rule, which allows you to contribute up to two years of the annual cap amount.

The superannuation government co-contribution

For those on the lower end of the earnings scale, you may be able to get the government to boost your superannuation – for free!

If you meet the eligibility requirements, you could receive a bonus of $500 in your superannuation account from the government if you contribute $1,000 to your superfund this year. It’s the closest thing to free money that there is.

💡 Note: the government co-contribution will only be made based on non-concessional contributions (meaning you can’t claim a tax deduction for your contribution if you want to receive the government co-contribution).

Age-based restrictions

Different contribution rules may apply once you’re in your 60s and 70s. It’s a good idea to contact your accountant or financial advisor (or the friendly Hnry team!) for guidance.

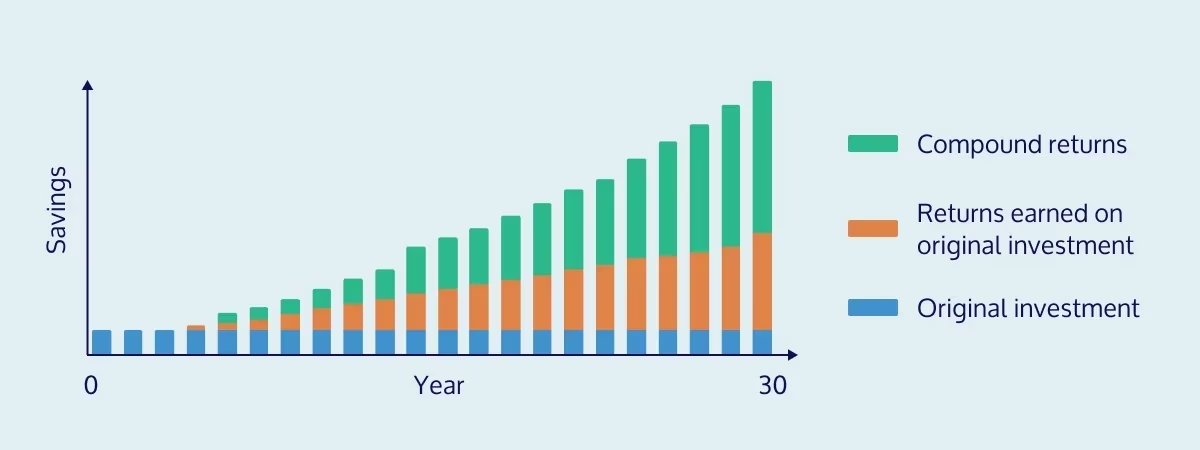

The magic of compounding interest

Another real benefit of investing in your Super fund as a sole trader, instead of putting it in the too-hard basket and letting things slide, is the magic of compounding returns.

Basically, when you invest in a Super fund, you’ll ideally earn returns on the money you invest (there are no guarantees!). The returns are then added to the capital to be reinvested, allowing both to generate further returns.

In theory, the more you invest now, the longer your investment has time to earn compounding returns, resulting in hopefully a bigger Superannuation balance down the track. Taking a break from investing in your Superannuation fund could mean a difference of hundreds of thousands of dollars when it comes time to retire.

How Hnry Helps

Hnry is an award-winning app and tax service designed to help sole traders with their financial admin.

For just 1% +GST of your self-employed income, capped at $1,500 +GST a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

We also complete and lodge your tax return for you, including claiming any tax relief you might be entitled to. It’s all part of the service!

More importantly, we free up thousands of hours for sole traders to focus more on what they do best – their jobs. Hnry is on a mission to make being a sole trader simple, affordable, and accessible for anyone.

Share on: