Done with DIYing your own taxes? Out of patience with your out-of-touch accountant? Welcome to the end of the financial year (EOFY) with Hnry. We think you’re going to like it here.

For sole traders, the EOFY can be a stressful and confusing time. There’s a lot to do and keep track of, from claiming eligible business expenses, to lodging your tax return on time, to accurately calculating and paying your own taxes, Medicare levy, student loan, GST, and whatnot.

That’s why Hnry was created – to take the hassle out of sole trader admin. For just 1% +GST of your self-employed pay (capped at $1,500 +GST), we sort the EOFY for you. Yes, all of it.

We:

- Calculate and pay your taxes and Medicare levy as you earn throughout the financial year,

- Manage all your claimable business expenses, passing on the tax relief in real time,

- Manage and lodge all your income tax and GST returns – at no extra cost.

All you need to do on your end is:

- Start using Hnry (if you haven’t already) and get paid through your Hnry account before 30th June 2024

- You’ll also need to keep using Hnry for 90 days after you join, in order to be eligible for our tax-lodging service

- Raise all 2024/25 business expenses before our deadline (Sunday 13th July)

- Complete your Hnry Annual Review form (sent out around July/August)

- Wait for lodgment confirmation

- Don’t lodge your own tax return with the ATO (even if they ask you to)

That’s it! Simple, straightforward, easy.

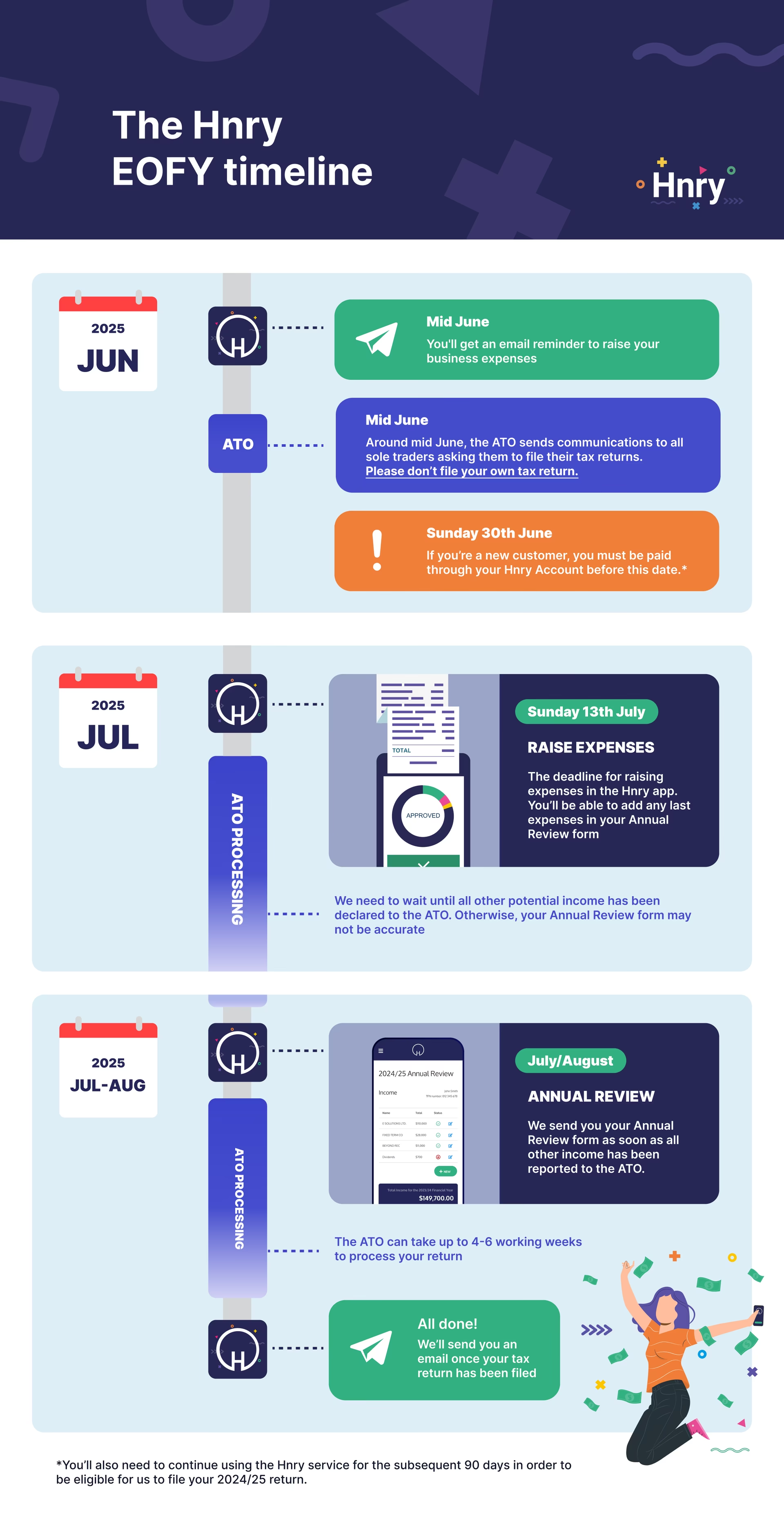

Tl;dr: the Hnry EOFY timeline.

1. Start using Hnry and get paid before 30 June

In order for us to lodge your tax return, you actually need to be a Hnry customer!

It takes time and effort for our tax team to lodge tax returns, which is why it’s not a “free” service – it’s actually covered by your 1% +GST Hnry fee.

To be eligible for us to lodge your return, you need to:

- Sign up for a Hnry Account

- Get paid through your Hnry Account before the 30th of June, and

- Continue using the Hnry service for a subsequent 90 days.

💡 Note: If you have any outstanding tax returns from previous financial years, we can sort and lodge them for you for an additional $300 +GST fee per return.

2. Raise all your business expenses

💡 The deadline for raising business expenses through the Hnry App is Sunday 13th July.

Claiming eligible business expenses is the easiest way to (legally!) lower your income tax bill. That being said, you can’t necessarily claim everything you buy on behalf of your business – the ATO has strict rules around what they will accept as a valid tax deduction.

As a general rule, you can claim a tax deduction for a business expense as long as they meet the ATO’s three golden rules:

- The expenses must directly be required to earn your income.

- You must have spent the money yourself and weren’t reimbursed.

- You must have a record to prove it (usually a receipt).

📖 For more information on eligible business expenses, check out our expenses guide for sole traders.

You can raise business expenses through the Hnry app. Simply head to the Expenses tab, snap a photo of your expense receipt, enter a few details, and you’re done! Once approved, you can even throw that receipt away – we’ll store it for you for the required five years.

Better yet, you can use a Hnry Debit Card to purchase business expenses, and we’ll automatically set up every card transaction as a claim. You just need to snap a pic of the receipt and confirm the details. The rest is managed by us.

As you raise expenses throughout the year, we automatically calculate and adjust your effective tax rate accordingly. What this means is that you don’t have to wait until the EOFY for tax relief – we pass it on in real time!

💡 An effective tax rate is exactly what it sounds like: the actual percentage of your income that you pay in income tax. For a more detailed explanation, check out our guide to tax rates.

Our deadline for raising expenses through the Hnry app is Sunday 13th July. After this date, any additional expenses can be raised in your Annual Review form.

📖 Confused about what you can and can’t claim? We have a guide for that.

3. Complete your Hnry Annual Review form

💡 Your Annual Review form will be sent out from July/August.

💡 If you plan to claim any voluntary personal Super contributions as a tax deduction, you’ll need to submit a Notice of Intent (NOI) form with your super fund before you complete your Annual Review form.

Your Hnry Annual Review form is a quick, final check that all the information we have for your tax return is accurate and up to date. It’s super straightforward, and shouldn’t take you longer than five minutes to complete.

We have to wait until other potential income has been declared to the ATO on your behalf. This includes things like:

- Your PAYG salary

- Interest and dividends

- Private Health Insurance details

There’s no action for you at this point; it’s a waiting game. All these sources have their own ATO reporting deadlines.

Once everything has been reported to the ATO, we can pull that information into your Annual Review form for you to confirm. If we didn’t wait for all this, the information we include in your tax return wouldn’t be accurate!

You’ll receive a link to your Annual Review form on your Hnry Dashboard once it’s ready, usually around July/August. To complete your Annual Review form, you’ll need:

- Your up-to-date contact details,

- Any additional income earned this financial year, and not received through Hnry,

- Any additional business expenses you haven’t already raised.

- Spouse income details (if you have a spouse)

That’s it! Make sure all your info is correct, review all your sources of income, and raise additional expenses if needed. You’re done!

4. Wait for lodgment confirmation

Now we’re picking up steam in the Australian market, we now have quite a few income tax returns to get through each year! Your best bet for being at the front of the queue is to complete your Annual Review form as soon as possible. We operate on a first-come-first-served basis, and the sooner you get back to us, the better.

Once we complete and lodge your tax return, you’ll get an email confirming we’ve sorted it. After we lodge, however, it’s all out of our hands. Your tax return will be with the ATO for processing, and that could take up to 4-6 business weeks. If you’re owed a refund, that’ll be paid to you directly by the ATO – it doesn’t come through Hnry.

Unfortunately there’s nothing we can do on our end to speed up the ATO processes. Please be patient!

5. Don’t lodge your own tax return

At some point, usually mid June, the ATO sends communications to all individuals asking them to lodge their tax returns. Please don’t lodge your own tax return.

We know it’s tempting to just do it yourself! But there are a few good reasons why you probably shouldn’t:

- Lodging your tax return is part of your 1% Hnry fee! We want you to get the full benefit you’re paying for. It’s a no-brainer.

- The pre-filled information in your tax return may not be accurate – your self-employed income, any interest, dividends, and health insurance details, and potentially part of your salary may not have been reported to the ATO yet.

- If you get any of your info wrong and need us to re-lodge, you may have to return some of your refund, or be required to pay additional tax. Plus, we charge an amendment fee for this service.

All in all, it’s much simpler to leave it to Hnry. We’re experts in sole trader tax, and our Annual Review form is much quicker for you to complete than a whole tax return.

Tl;dr: the Hnry EOFY timeline

- Mid June: You’ll get an email running you through our EOFY process

- Sunday 30th June: If you’re a new customer, you must be paid through your Hnry Account before this date. You’ll also need to continue using the Hnry service for the subsequent 90 days in order to be eligible for us to lodge your 2024/25 return.

- Sunday 13th July: The deadline for raising expenses in the Hnry app. You’ll be able to add any last expenses in your Annual Review form.

- July/August: We send you your Annual Review form, as soon as other income has been reported to the ATO.

- Once your return is lodged: We’ll send a confirmation email of the outcome. You’re done!

From there, the ATO can take up to 6 working weeks to process your tax return (although it’s usually much quicker), and notify you if you’re eligible for a refund. Phew!

Congratulations on another financial year, done and dusted! We know being a sole trader isn’t easy, which is why we work hard to make the EOFY as stress-free as possible. We take care of all the admin, so you can sit back, relax, and celebrate a job well done.

📖 Ready to hit the ground running in the New Financial Year? We have a guide for that.

📖 Thinking about changing up your pricing? We have a guide for that.

📖 What about putting aside money for time off? Saving for retirement? Growing your profit? You guessed it – guides guides guides!

Share on: