For many sole traders, the end of the financial year (EOFY) can be stressful and confusing.

From sorting taxes, to claiming deductions, to completing and actually lodging your tax return, there’s a lot to be across.

How do you calculate how much you owe in income tax? Wait, which tax bracket are you in again? What about your student loan repayments? Old mate Gazza claimed his weed whacker as a business expense – should you be claiming yours?!

Well firstly, unless you and Gazza are landscapers or similar, it’s probably best to leave the weed whacker out of it.

Secondly, the end of the financial year can absolutely be complicated. That’s why we’ve created this EOFY survival guide. It contains a full walkthrough of the end-of-year tax form, as well as dates and deadlines, helpful tips, and real-life examples.

Basically, you’ll find everything you need to sprint through this EOFY. Or at the very least, jog confidently.

So lace up your running shoes, and let’s begin!

Intro to tax returns

Before we start getting into the tax trenches, let’s start with why we’re doing this in the first place. Don’t worry, it won’t take long.

Everyone who earns an income in Australia is subject to income tax. Income tax helps keep our government and public services running – basically, most of the common goods we enjoy (safe roads, sturdy bridges, Gruen Transfer) are funded in part by the taxes we pay.

Most PAYG (Pay As You Go) employees have a set salary, or work a set number of hours every week. This makes their income regular and predictable, meaning that the amount of tax they owe is also regular and predictable.

Because of this, paying tax as a PAYG employee is so straightforward that they usually don’t have to think about it all. All they have to do is fill in a Tax File Number declaration when they start working, and the rest is handled by their company’s payroll.

For sole traders, it’s a whole different ball game. To begin with, sole trader income can be quite variable, and the Australian Taxation Office (ATO) won’t know how much you earn until you tell them. Sole traders can also often claim more expenses than PAYG employees, lowering their taxable income and potentially their overall tax bill.

That’s where tax returns come in. At the end of every Financial Year (FY), the ATO will need to know:

- how much income you’ve made,

- the different sources of your income (self-employed income, government payments and allowances, capital gains etc), and

- the tax deductions you’re claiming.

Your tax return will tell them all these things. Think of it like a bar tab on the 31st of December – at the end of the night, you figure out who owes what, settle your account, and start the new year with a clean slate.

(Don’t think too hard about that analogy.)

Prepping for your tax return

Before you start filling in the actual form, it’s worth taking a few minutes to make sure you’ve tied up all your financial loose ends.

For starters, now is a good time to review your business expenses and triple check you’re claiming all the deductions you’re eligible for. In our most recent sole trader pulse, 36% of sole traders weren’t claiming everything they could claim – don’t let this be you! You could be missing out on some serious tax savings.

Secondly, your voluntary superannuation contributions could help lower your taxable income – and now’s your last chance to make the most of this tax benefit this year!

Claiming business expenses

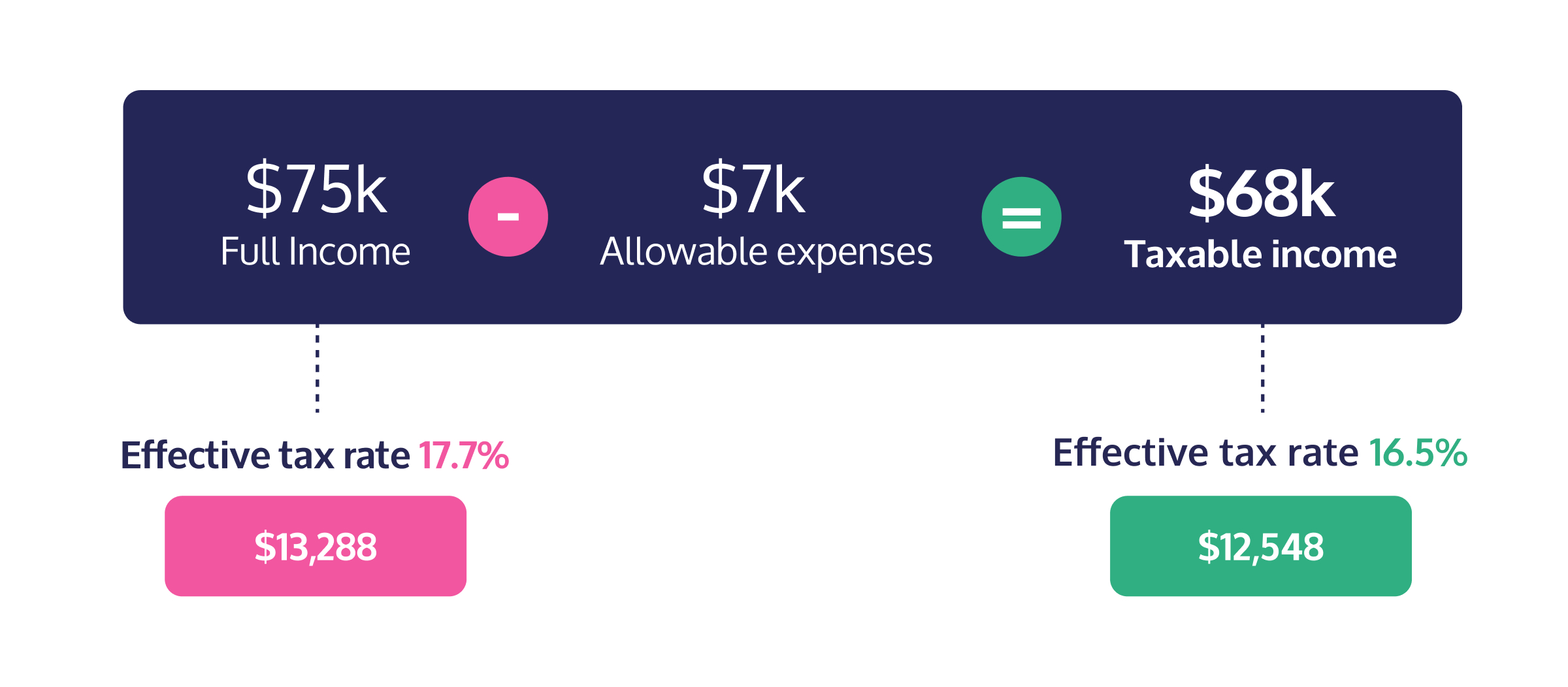

Claiming business expenses is a great way to lower your taxable income, and thereby reduce your overall tax bill. It’s a common misconception that you get refunded the value of your business expenses from the tax you pay, but this isn’t true – instead, they reduce the income you get taxed on.

Less taxable income means less tax owed. That’s why lowering your taxable income can result in lowering your effective tax rate.

To make a real difference to your final tax bill, you should aim to claim everything you (legally) can. This does come with a bit of admin, though – you’ll need to keep and store your receipts for five years (as required by the ATO), record expenses in your tax return, and only claim the depreciation of more expensive assets – the whole shebang.

For this reason, making sure your expense records are always up to date can save you a lot of time and hassle come the EOFY. And we’re probably biased, but we reckon the easiest way to do all this is by using Hnry.

- You take a picture of your receipt, and raise it as an expense in the Hnry app.

- Our team of experts will manage all your expense claims.

- We then factor your expense claim into the amount of tax we deduct from your future pay, for immediate tax relief.

- AND we store your digital expense receipts for the required 5 years.

📖 For more information on effective tax rates, check out our article on tax brackets and tax rates.

📖 Learn how to expense claim like a tax veteran with our sole trader guide to expenses.

📖 If you just want to skip to the good stuff, you can calculate your approximate tax rate using our self-employed tax calculator.

Superannuation contributions

Unlike PAYG employees, sole traders are (usually) on their own when it comes to saving for retirement, making it easy to ignore altogether. But the Australian government actually incentivises superannuation contributions through a few handy, beneficial initiatives.

📖 For a full rundown on how superannuation contributions work, check out our guide to superannuation for sole traders.

Concessional contributions

If you decide to make personal concessional super contributions, these are made from your pre-tax income, and are taxed in your super fund at 15% (potentially lower than your marginal tax rate).

💡 Your marginal tax rate is the rate of the highest tax bracket your income falls into. For example, if you make upwards of $200k a year (look at you go!), part of your income will fall into the tippy top tax bracket ($190k+) and be taxed at your marginal tax rate of 45%.

💡 Heads up though, if you’re a high-income earner with a pre-tax income of over $250,000 a year, your superannuation contributions may incur an additional tax (Division 293) of 15%, making the total rate 30%.

Concessional contributions are capped at $30,000 for the 2025/26 financial year, meaning you can only contribute and claim a deduction up to this amount. However, if you have any unused concessional contributions from the last few years, you may be eligible to bring forward the cap for the last 5 years.

💡 Important to note - if you have an employer who has made super contributions for you, these will count towards your concessional contribution cap.

In order for the personal super contributions you make to be classified as concessional contributions, you’ll need to fill in a ‘Notice of Intent to Claim a Tax Deduction’ form with your super fund before you lodge your tax return. On their end, they’ll confirm that you’re eligible to claim your contributions as a tax deductible concessional contribution, and forward the information to the ATO.

Non-concessional contributions

It’s worth noting that you can also contribute another $110,000 as non-concessional contributions, on top of your concessional contributions.

However, while these contributions aren’t taxed in your super fund, they do come out of your post-tax income and you can’t claim them as a deduction.

Superannuation co-contributions

If you’re an eligible low-income earner, the Australian government will match your non-concessional contributions by adding up to $0.50 for every $1, up to a maximum of $500. This amount is subject to earnings thresholds, and means you can’t claim a tax deduction for your contributions. The government co-contribution gets paid directly into your super fund after you’ve lodged your tax return.

You can calculate your potential super co-contribution on the ATO website.

Completing and lodging your tax return

With these last few bits figured out, it’s time to fill in your tax return.

In order to do this quickly and accurately, you’ll need a few important pieces of information to hand:

- Your bank account number (BSB and account number)

- Your income statement or payment summaries

- Payment summaries from Centrelink (Services Australia) (if applicable)

- Your business income and expenses

- Receipts for expenses you’re claiming

- Your spouse’s income (if applicable)

- Your private health insurance information (if applicable)

- Details for any other income sources for the year

Got all that? Excellent! Now we get to the actual form.

Filling out your tax return

There are three different ways you can fill out and lodge your tax return:

- You can lodge your tax return online with myTax

- Doing it this way means you’ll have to do it all yourself, but if you have the right information to hand, it shouldn’t take you too long.

- You can lodge your tax return through a registered tax agent.

- This method involves the least amount of work for you personally. Your tax agent will collect the information they need from you, before lodging your return on your behalf.

- Fun fact: Hnry is a registered tax agent. If you use our service, we automatically prepare your tax return for you at the end of the financial year.

- Even more fun fact: Most tax agents charge an additional fee for this service. Hnry doesn’t – it’s included as part of our 1% +GST fee (capped at a maximum of $1,500 +GST a year).

- You can go old school and lodge a paper tax return

- This includes filling out a hard copy, and sending it in via mail. Tax refunds are usually processed within 50 days.

- We’re not sure why anyone would do it this way, but hey, you do you.

You’ll have until October 31st to fill in and send off your income tax return (unless you have a tax agent or special dispensation, in which case you’ll have until 15th of May).

Once you’ve submitted all the information required, the ATO will send you a bill (Notice of Assessment) for the income tax, Medicare levy, and student loan repayments that you still owe. If you’ve been preparing for this bill throughout the year, the final amount shouldn’t be too difficult for you to manage.

If you’ve accidentally underpaid your tax, it’s a pretty straightforward fix – you’ll have until the due date on your Notice of Assessment from the ATO to square up.

But, if your tax bill is significant, you may also be required to pay “PAYG” income tax instalments for the next financial year. Basically, PAYG instalments are the ATO’s way of getting you to pay your potential tax bill ahead of time – kind of like a PAYG employee, except it’s less an exact science, and more estimation. Their calculations will be based on your earnings for the previous financial year, which may not be accurate for the year ahead, meaning you’ll potentially either overpay or underpay your taxes through these instalments.

It’s really not an ideal situation to be in – you’ll still have to pay the tax bill you owe for the previous financial year, while also paying taxes in instalments for the current financial year.

(Alternatively, you could just use Hnry – we get it pretty much bang on.)

Otherwise, that’s pretty much it! Tax return lodged. Pat yourself on the back, get yourself a drink, maybe a snack or two if you’re feeling peckish. And then make it easier on yourself for the next year by signing up for Hnry – we do it all for you, and you’ll never have to think about tax again.

Key Dates to Remember

Perhaps the most important thing to remember is that your tax obligations aren’t over at the end of June. There are a handful of dates scattered throughout the year, all of which are important to remember.

| Date | Deadline | Description |

|---|---|---|

| 1st July | New Financial Year begins | From 1st July onwards, you can lodge tax returns and apply for tax refunds from the financial year that just ended. 🙋 At Hnry, we start lodging your tax return in early August, after employers have finalised all their ATO submissions. This means when we lodge, we have the most accurate and up-to-date information on hand. |

| 31st October | Tax return due | If you don't have an extension, have any outstanding tax returns, or have an accountant or tax agent lodging on your behalf, you have until the 31st of October to lodge your tax return. |

| 15th of May (the following year) | Tax return due (lodging through a tax agent/accountant) | If you do have an accountant or tax agent lodging on your behalf (and no outstanding tax returns), your tax return is due on the 15th of May the following year. 🙋 Hnry is a registered tax agent, but we don't wait until the deadline to lodge your tax return! |

| 28th October 28th February 28th April 28th July | BAS lodgement/payment dates | Your quarterly BAS lodgements and payments are due on these dates. |

How Hnry makes the EOFY easy

Hnry is an award-winning service that helps sole traders spend less time on financial admin, and more time doing what they love (unless what they love is financial admin).

If you’re a Hnry customer, when the EOFY arrives:

- All of your taxes will have been already paid (we do it automatically for you throughout the year)

- You confirm your details are correct, and your expense claims are up to date

- We’ll prepare your tax return, and once it’s ready, lodge it for you

No huge, unexpected tax bill, no stack of paperwork, no tax calculations – Hnry does it all for you.

Get your tax ducks (and deductions!) in a row by joining Hnry today.