According to our latest research, Australian sole traders spend an average of 6 hours a week and $319 a month managing their tax and financial admin.

That’s 312 hours and $3,828 a year that could have been better spent elsewhere!

Even worse, sole traders spend an average of 13 hours and $1,000 preparing their tax returns at the end of the financial year. That’s not just a lot of time and money, it’s also precious energy spent just to meet tax obligations.

To help you avoid losing so much time and money on admin in FY 2025/26, we’ve put together this guide on good financial practices that’ll take some of the stress out of sorting your taxes.

Whether you’re a tax veteran or just starting your self-employed journey, here are a few things you can do to save time and money each week, and make lodging your tax return as painless as possible. Here we go!

🙋 Hnry users spend just 2 hours a week on average managing their financial admin. Check out how we can save you time and money.

Know what you owe

As a sole trader, there’s a lot to think about when it comes to sorting your taxes.

Not only do you have to calculate and pay your own income tax, you also have to sort GST (if registered), the Medicare levy, and superannuation contributions (optional) – and ideally save enough for a rainy day. Phew!

Taking the time now to plan it all out could save you a huge headache down the line. Not to mention avoiding interest, fines, and penalties if you’re late paying the taxes and levies you owe. Yikes!

To help you get started, we’ve put together a handy list of all the things bits and bobs you’ll need to be across:

Income tax

Your income tax is calculated by adding up all your sources of income (including salary and wages, self-employed income, investment income etc), and applying your effective tax rate – that is to say, the actual percentage of income tax you owe.

(If you’re lost already, don’t panic – we explain how to calculate your effective tax rate in detail in our guide to tax rates and thresholds.)

At the end of the financial year, you’ll need to report all sources of income, as well as any tax deductions you’re claiming in your tax return. From there, the ATO will let you know how much income tax you owe. Pretty straightforward!

But, if you haven’t set aside enough funds to pay your income tax bill, it can get downright gnarly. That’s why it’s useful to calculate what you might owe from the get go, so you can save throughout the year instead of being hit all at once.

💡 You can get a rough estimate of your income tax bill using our sole trader tax calculator.

🙋♀️ … or you can use Hnry, and we sort it all for you. Learn more.

GST

If you earn over $75,000 from your self-employed income in any given 12-month period, then you are required to register for and charge GST.

GST is a tax you collect on behalf of the ATO – it’s not something you pay out of pocket. As soon as you’re registered, you’ll need to add an additional 10% on top of your prices, which you then forward on to the ATO at the end of every GST period.

💡 For more information on your potential GST obligations, check out our monster guide to GST.

Medicare levy

Alongside your other tax obligations, you also need to pay the Medicare levy, generally calculated at 2% of your taxable income income.

If you are either a low earner, you may be eligible to pay at a reduced rate. If you’re a high earner, and you don’t have private patient hospital insurance, you may also need to pay the Medicare levy surcharge.

💡 Need more information? We have a guide for the Medicare levy, and the Medicare levy surcharge. Tada!

💡 While Hnry will calculate and pay your Medicare levy on your behalf, we won’t be able to sort your Medicare levy surcharge. The surcharge calculation depends on things Hnry might not be aware of, like your level of Private Health Insurance cover, how much your spouse earns, and if you have any dependents. For more information, check out our guide to Medicare.

Student loan

Student Loan - If you have an outstanding study or training loan (HELP, VSL, SFSS, SSL, ABSTUDY SSL, or TSL), and you earn over the annual threshold of $56,156 for the 2025/26 financial year, then you’re required to make repayments on that loan.

💡 We break it all down in more detail in our guide to student loan repayments.

Superannuation contributions

Okay, it’s really not a tax, and it’s definitely not required – but while we’re talking about things you need to set money aside for, you may want to consider contributing to your Super fund. For starters, there are potentially some real tax benefits for making Super contributions, depending on your circumstances.

Another real benefit is the magic of compounding returns. Basically, when you invest in a Super fund, you’ll ideally earn returns on the money you invest (there are no guarantees!). The returns are then added to the capital to be reinvested, allowing both to generate further returns. Jackpot!

💡 We can’t get into it all here, but check out our comprehensive Superannuation guide for more!

How to plan ahead

Now you’re across what you need to set aside, here’s how to go about it.

Step One: Calculate your taxes

Use our income tax calculator to calculate your tax rate, Medicare levy, and student loan repayments.

If you know exactly how much you’ll make this year, our income tax calculator is a simple and accurate way to calculate the amount of money you’ll need to set aside.

If you don’t know how much you’ll earn, our calculator is a good starting point. Plug in your previous year’s income, and go from there. As your projections for the year change, keep revisiting the calculator to make sure you’re still on track to meet your obligations.

Step Two: Get to grips with GST

Like we said earlier, if you expect to earn $75k or more in self-employed income in any given 12-month period, you’re required to register for and charge GST. If you’re registered for GST, and you fail to collect it on the ATO’s behalf, you are still be required to pay GST owed – only it’ll be out of your own pocket (oof).

That’s why it’s so important to be across your obligations, to avoid any expensive mistakes. Remember, GST for your services is a tax paid by your customers, not by you!

💡 You can reduce your GST bill by claiming back the GST your business has paid when purchasing goods and services. For more information, check out our guide to GST.

Step Three: Make the most of Superannuation

If you make personal contributions to your super fund, you may be able to claim a tax deduction for superannuation contributions up to $30,000. Eligibility for this deduction varies according to personal circumstances however, so it’s best to check the ATO website.

If you’re a low or middle-income earner, and you make post-tax contributions to your super fund, the government may contribute up to $500 as well, depending on your eligibility.

That’s easy money being left on the table if you’re not taking advantage of it!

Step four: Optimise your Medicare levy

Did you know that you pay more in Medicare (the Medicare levy surcharge) if you don’t have private patient hospital cover and earn over $97k (or $194k as a family)?

If you meet this $97/194k threshold, taking out private patient hospital cover is a great option – it provides you with healthcare not covered by Medicare and reduces your Medicare levy!

🙋♀️ Looking for a way to automate all of the above? Hnry calculates and pays your tax, GST, student loan and Medicare levy every time you get paid.

While that’s a heck of a lot to be thinking about, our budgeting journey doesn’t stop there. Let’s look at what else you should be setting aside funds for: planned and unplanned time off work.

Step five: Factor in time spent not earning

The best-laid plans of mice and men, right? Despite our best efforts to reach our business goals, life will sometimes get in the way. We need to make sure we have a rainy day fund to cover both the expected and the unexpected.

Get the ball rolling on this fund by calculating the total number of days a year you might not be able to work. For example:

- Public Holidays: Australia celebrates 7 national public holidays, and a handful of regional ones to boot.

- Personal Holidays: Are you taking a vacation this year (you absolutely should)? Do you need some time off to refresh and recharge? Give yourself some ‘annual leave’ and factor ‘paid’ time off into your budget!

- Sick Leave: PAYG employees get 10 sick days a year. Even if you don’t need it, knowing you have 10 days worth of income stashed away can make falling ill less stressful.

- Slow Periods: Many industries have slumps in activity at certain points in the year. If you know when yours are, you can compensate by putting more aside during busy periods.

If possible, it’s always best to err on the side of caution and factor in one or two days extra, just in case of emergencies.

The next step is to estimate how much money you need to set aside in order to cover these potential days off. This amount may vary by type of ‘leave’ – you might want to save more to spend for a vacation than during a sick day, for example – but at the very least, the amount you set aside should cover all your expenses for the time you take off.

📖 For more tips on planning leave, check out our guide to taking time off!

Step six: Regularly set money aside

If you’ve calculated all of the above, and it turns out you have enough savings to cover your taxes and time-off, sweet! Our work here is done, and you can reward yourself with a nice hot/cool drink, depending on the weather.

But if you don’t yet have a fund in place, don’t worry. You can create one pretty quickly. All you need to do is set yourself a savings target based on how much you need, decide on a savings timeframe, and then put money aside each paycheck until you’ve reached your goal. How little or how much you put aside is entirely up to you.

Hnry makes this easy for sole traders by allowing users to automatically assign a percentage of their income to a savings account (or wherever they’d like to send it – investments, charities, friends and family, you name it). Our automatic allocation feature can send money almost anywhere.

📖 Looking for a way to automate tax calculations? Hnry calculates and pays your tax, GST, student loan and Medicare levy every time you get paid. See how it works.

Get savvy with expenses

Now we get to the fun stuff!

When you claim business expenses, you reduce your taxable income and thus your overall tax bill. But you have to be careful to only claim what you’re allowed to claim – otherwise, you risk playing the ATO lottery.

Find out what you can claim

To claim a business expense, the ATO has three golden rules you must meet:

- You must have spent the money yourself and weren’t reimbursed.

- The expenses must directly relate to earning your income.

- You must have a record to prove it (usually a receipt).

Along with their three golden rules, the ATO has industry-specific guides for what you can and can’t claim as a business expense. You can find these guides here.

💡If the expense was for both work and private purposes, you can only claim a deduction for work-related use.

Taking the time now to learn what you can claim as a business expense will set you up for the year ahead. As always, if you’re unsure about what you can claim as a business expense, always check with a tax specialist (or if you’re a Hnry customer, the friendly Hnry team!)

📖 For more information, check out our monster guide to tax deductions for Aussie sole traders!

Save your receipts

There’s nothing worse than putting hours of blood, sweat, and tears into your financial admin, only to realise at the end of the financial year that you lost the receipts!

Keeping clear, organised records of purchases and goods/products sold will help make tax time as stress-free as possible. It’s also good practice; the ATO requires you to save a record of your expenses (receipts) for five years after purchase, either physically or digitally.

Imagine five years of receipts strewn across your office floor, and you can see why a good filing system is super important!

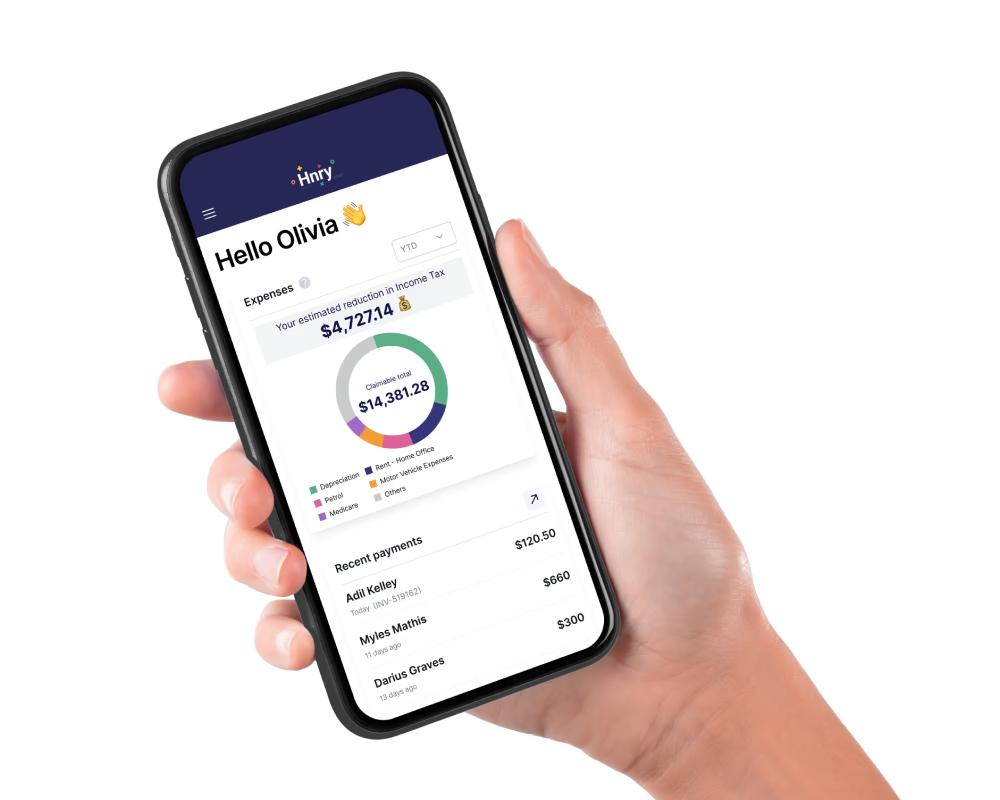

That’s where Hnry comes in. You can raise expenses in our app, and we’ll manage them for you. We calculate your tax savings from expenses as you go, giving you immediate tax relief. Plus, we store your receipt photos for you for the required five years – no shoebox required, ever again!

For bonus points, you could also use the Hnry Debit Card. Every time you use it to make a purchase, it automatically raises an expense in the Hnry app, so nothing slips through the cracks. From there, all you need to do is upload a pic of your receipt, confirm a few details, and you’re done. Expenses sorted!

Save time, money, and energy with Hnry

We may be biased, but we believe that the best way for sole traders to maximise their tax deductions (legally) is to use Hnry.

Hnry is an award-winning tax app and service that’s helping sole traders spend less time on financial admin, and more time doing what they love (unless what they love is financial admin).

For just 1% + GST of your self-employed income, capped at $1,500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

Easy! Simple! Done! You won’t even have to think about it!

So what are you waiting for? Join Hnry today!